Related Research Articles

The discounted cash flow (DCF) analysis, in finance, is a method used to value a security, project, company, or asset, that incorporates the time value of money. Discounted cash flow analysis is widely used in investment finance, real estate development, corporate financial management, and patent valuation. Used in industry as early as the 1700s or 1800s, it was widely discussed in financial economics in the 1960s, and U.S. courts began employing the concept in the 1980s and 1990s.

Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements ; health; and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical.

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

Real options valuation, also often termed real options analysis, applies option valuation techniques to capital budgeting decisions. A real option itself, is the right—but not the obligation—to undertake certain business initiatives, such as deferring, abandoning, expanding, staging, or contracting a capital investment project. For example, real options valuation could examine the opportunity to invest in the expansion of a firm's factory and the alternative option to sell the factory.

In finance, valuation is the process of determining the value of a (potential) investment, asset, or security. Generally, there are three approaches taken, namely discounted cashflow valuation, relative valuation, and contingent claim valuation.

In accounting, fair value is a rational and unbiased estimate of the potential market price of a good, service, or asset. The derivation takes into account such objective factors as the costs associated with production or replacement, market conditions and matters of supply and demand. Subjective factors may also be considered such as the risk characteristics, the cost of and return on capital, and individually perceived utility.

Real estate appraisal, property valuation or land valuation is the process of developing an opinion of value for real property. Real estate transactions often require appraisals because they occur infrequently and every property is unique, unlike corporate stocks, which are traded daily and are identical. The location also plays a key role in valuation. However, since property cannot change location, it is often the upgrades or improvements to the home that can change its value. Appraisal reports form the basis for mortgage loans, settling estates and divorces, taxation, and so on. Sometimes an appraisal report is used to establish a sale price for a property.

Enterprise value (EV), total enterprise value (TEV), or firm value (FV) is an economic measure reflecting the market value of a business. It is a sum of claims by all claimants: creditors and shareholders. Enterprise value is one of the fundamental metrics used in business valuation, financial analysis, accounting, portfolio analysis, and risk analysis.

Business valuation is a process and a set of procedures used to estimate the economic value of an owner's interest in a business. Here various valuation techniques are used by financial market participants to determine the price they are willing to pay or receive to effect a sale of the business. In addition to estimating the selling price of a business, the same valuation tools are often used by business appraisers to resolve disputes related to estate and gift taxation, divorce litigation, allocate business purchase price among business assets, establish a formula for estimating the value of partners' ownership interest for buy-sell agreements, and many other business and legal purposes such as in shareholders deadlock, divorce litigation and estate contest.

In management, business value is an informal term that includes all forms of value that determine the health and well-being of the firm in the long run. Business value expands concept of value of the firm beyond economic value to include other forms of value such as employee value, customer value, supplier value, channel partner value, alliance partner value, managerial value, and societal value. Many of these forms of value are not directly measured in monetary terms. According to the Project Management Institute, business value is the "net quantifiable benefit derived from a business endeavor that may be tangible, intangible, or both."

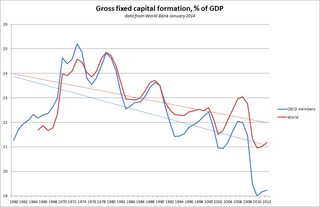

Capital formation is a concept used in macroeconomics, national accounts and financial economics. Occasionally it is also used in corporate accounts. It can be defined in three ways:

Valuation using discounted cash flows is a method of estimating the current value of a company based on projected future cash flows adjusted for the time value of money. The cash flows are made up of those within the “explicit” forecast period, together with a continuing or terminal value that represents the cash flow stream after the forecast period. In several contexts, DCF valuation is referred to as the "income approach".

Intellectual property assets such as patents are the core of many organizations and transactions related to technology. Licenses and assignments of intellectual property rights are common operations in the technology markets, as well as the use of these types of assets as loan security. These uses give rise to the growing importance of financial valuation of intellectual property, since knowing the economic value of patents is a critical factor in order to define their trading conditions.

Financial statement analysis is the process of reviewing and analyzing a company's financial statements to make better economic decisions to earn income in future. These statements include the income statement, balance sheet, statement of cash flows, notes to accounts and a statement of changes in equity. Financial statement analysis is a method or process involving specific techniques for evaluating risks, performance, financial health, and future prospects of an organization.

The following outline is provided as an overview of and topical guide to finance:

Intellectual property valuation is a process to determine the monetary value of intellectual property assets. IP valuation is required to be able to sell, license, or enter into commercial arrangements based on IP. It is also beneficial in the enforcement of IP rights, for internal management of IP assets, and for various financial processes.

Human Resource Accounting (HRA) is the process of identifying and reporting investments made in the human resources of an organisation that are presently unaccounted for in the conventional accounting practice. It is an extension of standard accounting principles. Measuring the value of the human resources can assist organisations in accurately documenting their assets. In other words, human resource accounting is a process of measuring the cost incurred by the organisation to recruit, select, train, and develop human assets.

In computing, data as a service (DaaS) is a cloud-based software tool used for working with data, such as managing data in a data warehouse or analyzing data with business intelligence. It is enabled by software as a service (SaaS). Like all "as a service" (aaS) technology, DaaS builds on the concept that its data product can be provided to the user on demand, regardless of geographic or organizational separation between provider and consumer. Service-oriented architecture (SOA) and the widespread use of APIs have rendered the platform on which the data resides as irrelevant.

Brand valuation is the process of estimating the total financial value of a brand. A conflict of interest exists if those who value a brand were also involved in its creation. The ISO 10668 standard specifies six key requirements for the process of valuing brands, which are transparency, validity, reliability, sufficiency, objectivity; and financial, behavioral, and legal parameters.

Data monetization, a form of monetization, may refer to the act of generating measurable economic benefits from available data sources (analytics). Less commonly, it may also refer to the act of monetizing data services. In the case of analytics, typically, these benefits accrue as revenue or expense savings, but may also include market share or corporate market value gains. Data monetization leverages data generated through business operations, available exogenous data or content, as well as data associated with individual actors such as that collected via electronic devices and sensors participating in the internet of things. For example, the ubiquity of the internet of things is generating location data and other data from sensors and mobile devices at an ever-increasing rate. When this data is collated against traditional databases, the value and utility of both sources of data increases, leading to tremendous potential to mine data for social good, research and discovery, and achievement of business objectives. Closely associated with data monetization are the emerging data as a service models for transactions involving data by the data item.

References

- ↑ Allen, Beth (1990). "Information as an Economic Commodity". The American Economic Review. 80 (2): 268–273. JSTOR 2006582.

- 1 2 "Gartner Says Within Five Years, Organizations Will Be Valued on Their Information Portfolios".

- 1 2 "How Do You Value Information?". 15 September 2016.

- ↑ "Applied Infonomics: Why and How to Measure the Value of Your Information Assets".

- ↑ "The Value of Data". 22 September 2017.

- ↑ "Most Valuable Companies in the World – 2020".

- 1 2 3 "The Value of Data Summary Report" (PDF).

- ↑ "Putting a value on data" (PDF).

- ↑ "Data Valuation – What is Your Data Worth and How do You Value it?". 13 September 2019.

- ↑ Askari, M; Safavi-Naini, R; Barker, K (2012). "An information theoretic privacy and utility measure for data sanitization mechanisms". Proceedings of the second ACM conference on Data and Application Security and Privacy. Association for Computing Machinery. pp. 283–294. doi:10.1145/2133601.2133637. ISBN 9781450310918. S2CID 18338542.

- ↑ Zhou, N; Wu, Q; Wu, Z; Marino, S; Dinov, ID (2022). "DataSifterText: Partially Synthetic Text Generation for Sensitive Clinical Notes". Journal of Medical Systems. 46 (96): 96. doi:10.1007/s10916-022-01880-6. PMC 10111580. PMID 36380246.

- ↑ Lee , W; Xiang, D (2001). "Information-theoretic measures for anomaly detection". Proceedings 2001 IEEE Symposium on Security and Privacy. S&P 2001. IEEE. pp. 130–143. doi:10.1109/SECPRI.2001.924294. ISBN 0-7695-1046-9. S2CID 6014214.

- ↑ Noshad, M; Choi, J; Sun, Y; Hero, A; Dinov, ID (2021). "An information theoretic privacy and utility measure for data sanitization mechanisms". J Big Data. Springer. 8 (82): 82. doi:10.1186/s40537-021-00446-6. PMC 8550565 . PMID 34777945.

- ↑ "Why and How to Measure the Value of your Information Assets".

- ↑ "Measuring the Value of Information: An Asset Valuation Approach" (PDF).

- ↑ "The Valuation of Data as an Asset" (PDF).

- ↑ "Consumption-Based Method". 4 December 2018.

- ↑ "Keeping Research Data Safe Method". 4 December 2018.

- ↑ "Why you should be treating data as an asset". 2 March 2020.

- ↑ "Data Valuation – Valuing the World's Greatest Asset".