Within the budgetary process, deficit spending is the amount by which spending exceeds revenue over a particular period of time, also called simply deficit, or budget deficit; the opposite of budget surplus. The term may be applied to the budget of a government, private company, or individual. Government deficit spending was first identified as a necessary economic tool by John Maynard Keynes in the wake of the Great Depression. It is a central point of controversy in economics, as discussed below.

The government budget balance, also alternatively referred to as general government balance, public budget balance, or public fiscal balance, is the overall difference between government revenues and spending. A positive balance is called a government budget surplus, and a negative balance is a government budget deficit. A government budget is a financial statement presenting the government's proposed revenues and spending for a financial year. A budget is prepared for each level of government and takes into account public social security obligations.

The national debt of the United States is the total national debt owed by the federal government of the United States to Treasury security holders. The national debt at any point in time is the face value of the then-outstanding Treasury securities that have been issued by the Treasury and other federal agencies. The terms "national deficit" and "national surplus" usually refer to the federal government budget balance from year to year, not the cumulative amount of debt. In a deficit year the national debt increases as the government needs to borrow funds to finance the deficit, while in a surplus year the debt decreases as more money is received than spent, enabling the government to reduce the debt by buying back some Treasury securities. In general, government debt increases as a result of government spending and decreases from tax or other receipts, both of which fluctuate during the course of a fiscal year. There are two components of gross national debt:

The debt of developing countries usually refers to the external debt incurred by governments of developing countries.

Austerity is a set of political-economic policies that aim to reduce government budget deficits through spending cuts, tax increases, or a combination of both. There are three primary types of austerity measures: higher taxes to fund spending, raising taxes while cutting spending, and lower taxes and lower government spending. Austerity measures are often used by governments that find it difficult to borrow or meet their existing obligations to pay back loans. The measures are meant to reduce the budget deficit by bringing government revenues closer to expenditures. Proponents of these measures state that this reduces the amount of borrowing required and may also demonstrate a government's fiscal discipline to creditors and credit rating agencies and make borrowing easier and cheaper as a result.

A country's gross government debt is the financial liabilities of the government sector. Changes in government debt over time reflect primarily borrowing due to past government deficits. A deficit occurs when a government's expenditures exceed revenues. Government debt may be owed to domestic residents, as well as to foreign residents. If owed to foreign residents, that quantity is included in the country's external debt.

Kenneth Saul Rogoff is an American economist and chess Grandmaster. He is the Thomas D. Cabot Professor of Public Policy and professor of economics at Harvard University.

The Mundell–Fleming model, also known as the IS-LM-BoP model, is an economic model first set forth (independently) by Robert Mundell and Marcus Fleming. The model is an extension of the IS–LM model. Whereas the traditional IS-LM model deals with economy under autarky, the Mundell–Fleming model describes a small open economy.

The global debt is 305 trillion US $ in 2022, including debt by public and private debtors. (A trillion is defined here as a million millions, or 1012.)

Robert Pollin is an American economist, and self described socialist. He is a professor of economics at the University of Massachusetts Amherst and founding co-director of its Political Economy Research Institute (PERI). He has been described as a leftist economist and is a supporter of egalitarianism.

Thomas Herndon is an assistant professor of economics at Loyola Marymount University became known for critiquing "Growth in a Time of Debt", a widely cited academic paper by Carmen Reinhart and Kenneth Rogoff supporting the austerity policies implemented by governments in Europe and North America in the early 21st century. His research concluded that these measures may not have been necessary.

At the micro-economic level, deleveraging refers to the reduction of the leverage ratio, or the percentage of debt in the balance sheet of a single economic entity, such as a household or a firm. It is the opposite of leveraging, which is the practice of borrowing money to acquire assets and multiply gains and losses.

Financial repression comprises "policies that result in savers earning returns below the rate of inflation" to allow banks to "provide cheap loans to companies and governments, reducing the burden of repayments." It can be particularly effective at liquidating government debt denominated in domestic currency. It can also lead to large expansions in debt "to levels evoking comparisons with the excesses that generated Japan’s lost decade and the 1997 Asian financial crisis."

A sovereign default is the failure or refusal of the government of a sovereign state to pay back its debt in full when due. Cessation of due payments may either be accompanied by that government's formal declaration that it will not pay its debts (repudiation), or it may be unannounced. A credit rating agency will take into account in its gradings capital, interest, extraneous and procedural defaults, and failures to abide by the terms of bonds or other debt instruments.

The 1991 Indian economic crisis was an economic crisis in India resulting from a balance of payments deficit due to excess reliance on imports and other external factors. India's economic problems started worsening in 1985 as imports swelled, leaving the country in a twin deficit: the Indian trade balance was in deficit at a time when the government was running on a huge fiscal deficit.

The financial position of the United States includes assets of at least $269.6 trillion and debts of $145.8 trillion to produce a net worth of at least $123.8 trillion as of Q1 2014.

Carmen M. Reinhart is a Cuban-American economist and the Minos A. Zombanakis Professor of the International Financial System at Harvard Kennedy School. Previously, she was the Dennis Weatherstone Senior Fellow at the Peterson Institute for International Economics and Professor of Economics and Director of the Center for International Economics at the University of Maryland. She is a research associate at the National Bureau of Economic Research, a Research Fellow at the Centre for Economic Policy Research, Founding Contributor of VoxEU, and a member of Council on Foreign Relations. She is also a member of American Economic Association, Latin American and Caribbean Economic Association, and the Association for the Study of the Cuban Economy. She became the subject of general news coverage when mathematical errors were found in a research paper she co-authored.

Original sin is a term in economics literature, proposed by Barry Eichengreen, Ricardo Hausmann, and Ugo Panizza in a series of papers to refer to a situation in which "most countries are not able to borrow abroad in their domestic currency."

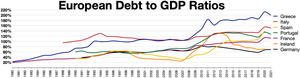

The proposed long-term solutions for the Eurozone crisis involve ways to deal with the ongoing Eurozone crisis and the risks to Eurozone country governments and the Euro. They try and deal with the difficulty that some countries in the euro area have experienced trying to repay or re-finance their government debt without the assistance of third parties. The solutions range from tighter fiscal union, the issuing of Eurozone bonds to debt write-offs, each of which has both financial and political implications, meaning no solution has found favour with all parties involved.

Growth in a Time of Debt, also known by its authors' names as Reinhart–Rogoff, is an economics paper by American economists Carmen Reinhart and Kenneth Rogoff published in a non peer-reviewed issue of the American Economic Review in 2010. Politicians, commentators, and activists widely cited the paper in political debates over the effectiveness of austerity in fiscal policy for debt-burdened economies. The paper argues that when "gross external debt reaches 60 percent of GDP", a country's annual growth declined by two percent, and "for levels of external debt in excess of 90 percent" GDP growth was "roughly cut in half." Appearing in the aftermath of the financial crisis of 2007–2008, the evidence for the 90%-debt threshold hypothesis provided support for pro-austerity policies.