Related Research Articles

A debit card, also known as a check card or bank card, is a payment card that can be used in place of cash to make purchases. The card usually consists of the bank's name, a card number, the cardholder's name, and an expiration date, on either the front or the back. Many of the new cards now have a chip on them, which allows people to use their card by touch (contactless), or by inserting the card and keying in a PIN as with swiping the magnetic stripe. These are similar to a credit card, but unlike a credit card, the money for the purchase must be in the cardholder's bank account at the time of the purchase and is immediately transferred directly from that account to the merchant's account to pay for the purchase.

Electronic funds transfer at point of sale is an electronic payment system involving electronic funds transfers based on the use of payment cards, such as debit cards or credit cards, at payment terminals located at points of sale. EFTPOS technology was developed during the 1980s.

In economics, cash is money in the physical form of currency, such as banknotes and coins.

A digital signature is a mathematical scheme for verifying the authenticity of digital messages or documents. A valid digital signature on a message gives a recipient confidence that the message came from a sender known to the recipient.

Financial cryptography is the use of cryptography in applications in which financial loss could result from subversion of the message system. Financial cryptography is distinguished from traditional cryptography in that for most of recorded history, cryptography has been used almost entirely for military and diplomatic purposes.

Mobile payment, also referred to as mobile money, mobile money transfer and mobile wallet, is any of various payment processing services operated under financial regulations and performed from or via a mobile device. Instead of paying with cash, cheque, or credit card, a consumer can use a payment app on a mobile device to pay for a wide range of services and digital or hard goods. Although the concept of using non-coin-based currency systems has a long history, it is only in the 21st century that the technology to support such systems has become widely available.

David Lee Chaum is an American computer scientist, cryptographer, and inventor. He is known as a pioneer in cryptography and privacy-preserving technologies, and widely recognized as the inventor of digital cash. His 1982 dissertation "Computer Systems Established, Maintained, and Trusted by Mutually Suspicious Groups" is the first known proposal for a blockchain protocol. Complete with the code to implement the protocol, Chaum's dissertation proposed all but one element of the blockchain later detailed in the Bitcoin whitepaper. He has been referred to as "the father of online anonymity", and "the godfather of cryptocurrency".

A micropayment is a financial transaction involving a very small sum of money and usually one that occurs online. A number of micropayment systems were proposed and developed in the mid-to-late 1990s, all of which were ultimately unsuccessful. A second generation of micropayment systems emerged in the 2010s.

In cryptography a blind signature, as introduced by David Chaum, is a form of digital signature in which the content of a message is disguised (blinded) before it is signed. The resulting blind signature can be publicly verified against the original, unblinded message in the manner of a regular digital signature. Blind signatures are typically employed in privacy-related protocols where the signer and message author are different parties. Examples include cryptographic election systems and digital cash schemes.

Interac is a Canadian interbank network that links financial institutions and other enterprises for the purpose of exchanging electronic financial transactions. Interac serves as the Canadian debit card system and the predominant funds transfer network via its e-Transfer service. There are over 59,000 automated teller machines that can be accessed through the Interac network in Canada, and over 450,000 merchant locations accepting Interac debit payments.

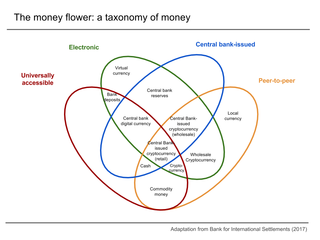

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

An e-commerce payment system facilitates the acceptance of electronic payment for offline transfer, also known as a subcomponent of electronic data interchange (EDI), e-commerce payment systems have become increasingly popular due to the widespread use of the internet-based shopping and banking.

CertCo, Inc., was a financial cryptography startup spun out of Bankers Trust in the 1990s. The company pioneered a risk management approach to cryptographic services. It had offices in New York City and Cambridge, Massachusetts. It offered three main public key infrastructure (PKI) based products: an Identity Warranty system ; an electronic payment system ; and an Online Certificate Status Protocol (OCSP) responder for validating X.509 public key certificates. It went out of business in Spring 2002 never having found a wide market for its products despite filing a number of patents and developing new technology.

Stefan Brands is the designer of the core cryptographic protocols of Microsoft's U-Prove technology. Following his academic research on these protocols during the nineties, they were implemented and marketed under the U-Prove name by Credentica until Microsoft acquired the technology.

Payment cards are part of a payment system issued by financial institutions, such as a bank, to a customer that enables its owner to access the funds in the customer's designated bank accounts, or through a credit account and make payments by electronic transfer with a payment terminal and access automated teller machines (ATMs). Such cards are known by a variety of names, including bank cards, ATM cards, client cards, key cards or cash cards.

Digital credentials are the digital equivalent of paper-based credentials. Just as a paper-based credential could be a passport, a driver's license, a membership certificate or some kind of ticket to obtain some service, such as a cinema ticket or a public transport ticket, a digital credential is a proof of qualification, competence, or clearance that is attached to a person. Also, digital credentials prove something about their owner. Both types of credentials may contain personal information such as the person's name, birthplace, birthdate, and/or biometric information such as a picture or a finger print.

DigiCash Inc. was an electronic money corporation founded by David Chaum in 1989. DigiCash transactions were unique in that they were anonymous due to a number of cryptographic protocols developed by its founder. DigiCash declared bankruptcy in 1998 and subsequently sold its assets to eCash Technologies, another digital currency company, which was acquired by InfoSpace on February 19, 2002.

Moni Naor is an Israeli computer scientist, currently a professor at the Weizmann Institute of Science. Naor received his Ph.D. in 1989 at the University of California, Berkeley. His advisor was Manuel Blum.

A payment processor is a system that enables financial transactions, commonly employed by a merchant, to handle transactions with customers from various channels such as credit cards and debit cards or bank accounts. They are usually broken down into two types: front-end and back-end.

Amos Fiat is an Israeli computer scientist, a professor of computer science at Tel Aviv University. He is known for his work in cryptography, online algorithms, and algorithmic game theory.

References

- ↑ Chaum, David (1983). "Blind Signatures for Untraceable Payments". Advances in Cryptology (PDF). Vol. 82. pp. 199–203. doi:10.1007/978-1-4757-0602-4_18. ISBN 978-1-4757-0604-8.

- ↑ Berry Schoenmakers (1998). "Basic security of the ecash payment system" (PDF). In Preneel, B.; Rijmen, V. (eds.). Computer Security and Industrial Cryptography: State of the Art and Evolution. Retrieved 30 October 2014.

- ↑ Chaum, D.; Fiat, A.; Naor, M. (1990). "Untraceable electronic cash" (PDF). In S. Goldwasser (ed.). Advances in Cryptology – CRYPTO '88 Proceedings. New York: Springer-Verlag. pp. 319–327. Archived from the original (PDF) on 2011-09-03. Retrieved 2012-10-10.

- 1 2 3 4 Pitta, Julie (1 November 1999). "Requiem for a Bright Idea". Forbes. Retrieved 26 October 2014.

- 1 2 3 4 Tim Clark (2 September 1998). "DigiCash loses U.S. toehold". Cnet.

- ↑ Salonharju, Inkeri. Elektra-projektin loppuraportti (conference) . Retrieved 2013-05-18.

- ↑ Järvinen, Petteri (1996). Internet - muutostekijä. Werner Söderström Osakeyhtiö. ISBN 951-0-21704-2.

- ↑ United States District Court; C.D. California (30 October 2000). "eCash Technologies, Inc. v. Guagliardo d/b/a Ecash.com, Netconcept Interactive, Netconcept, & Netconcept Inc., Defendants & Counterclaimants. 127 F.Supp.2d 1069 (C.D. Cal. 2000)".

- ↑ Steve Bills (1 March 2002). "In Brief: InfoSpace Buys eCash Technologies". American Banker. Retrieved 30 October 2014.

- ↑ "E-cash supersedes 'old school' pocket money".

- ↑ "Mobile ecash payment for merchants now made easy by Ezetap".