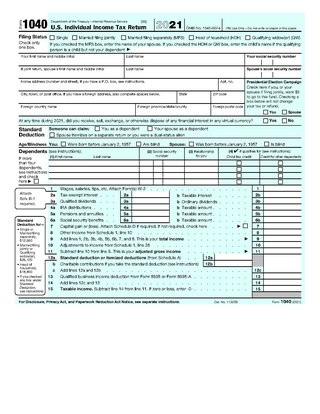

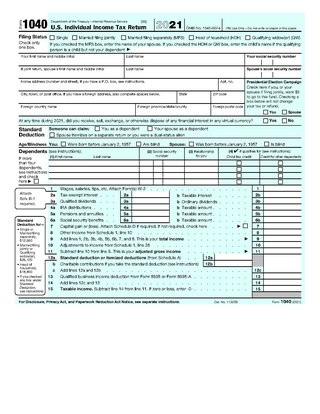

Form 1040, officially, the U.S. Individual Income Tax Return, is an IRS tax form used for personal federal income tax returns filed by United States residents. The form calculates the total taxable income of the taxpayer and determines how much is to be paid to or refunded by the government.

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A nonprofit organization (NPO) or non-profit organization, also known as a non-business entity, or nonprofit institution, and often referred to simply as a non-profit, is a legal entity organized and operated for a collective, public or social benefit, as opposed to an entity that operates as a business aiming to generate a profit for its owners. A nonprofit is subject to the non-distribution constraint: any revenues that exceed expenses must be committed to the organization's purpose, not taken by private parties. An array of organizations are nonprofit, including some political organizations, schools, business associations, churches, social clubs, and consumer cooperatives. Nonprofit entities may seek approval from governments to be tax-exempt, and some may also qualify to receive tax-deductible contributions, but an entity may incorporate as a nonprofit entity without having tax-exempt status.

A limited liability company is the United States-specific form of a private limited company. It is a business structure that can combine the pass-through taxation of a partnership or sole proprietorship with the limited liability of a corporation. An LLC is not a corporation under the laws of every state; it is a legal form of a company that provides limited liability to its owners in many jurisdictions. LLCs are well known for the flexibility that they provide to business owners; depending on the situation, an LLC may elect to use corporate tax rules instead of being treated as a partnership, and, under certain circumstances, LLCs may be organized as not-for-profit. In certain U.S. states, businesses that provide professional services requiring a state professional license, such as legal or medical services, may not be allowed to form an LLC but may be required to form a similar entity called a professional limited liability company (PLLC).

A charitable organization or charity is an organization whose primary objectives are philanthropy and social well-being.

An Individual Taxpayer Identification Number (ITIN) is a United States tax processing number issued by the Internal Revenue Service (IRS). It is a nine-digit number beginning with the number “9”, has a range of numbers from "50" to "65", "70" to "88", “90” to “92” and “94” to “99” for the fourth and fifth digits, and is formatted like a SSN. ITIN numbers are issued by the IRS to individuals who do not have and are not eligible to obtain a valid U.S. Social Security Number, but who are required by law to file a U.S. Individual Income Tax Return.

A 501(c) organization is a nonprofit organization in the federal law of the United States according to Internal Revenue Code and is one of over 29 types of nonprofit organizations exempt from some federal income taxes. Sections 503 through 505 set out the requirements for obtaining such exemptions. Many states refer to Section 501(c) for definitions of organizations exempt from state taxation as well. 501(c) organizations can receive unlimited contributions from individuals, corporations, and unions.

An S corporation, for United States federal income tax, is a closely held corporation that makes a valid election to be taxed under Subchapter S of Chapter 1 of the Internal Revenue Code. In general, S corporations do not pay any income taxes. Instead, the corporation's income and losses are divided among and passed through to its shareholders. The shareholders must then report the income or loss on their own individual income tax returns.

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the United States and in other countries under the Common Reporting Standard. In the United States it is also known as a Tax Identification Number or Federal Taxpayer Identification Number. A TIN may be assigned by the Social Security Administration or by the Internal Revenue Service (IRS).

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

A 501(c)(3) organization is a United States corporation, trust, unincorporated association or other type of organization exempt from federal income tax under section 501(c)(3) of Title 26 of the United States Code. It is one of the 29 types of 501(c) nonprofit organizations in the US.

Tax protesters in the United States have advanced a number of arguments asserting that the assessment and collection of the federal income tax violates statutes enacted by the United States Congress and signed into law by the President. Such arguments generally claim that certain statutes fail to create a duty to pay taxes, that such statutes do not impose the income tax on wages or other types of income claimed by the tax protesters, or that provisions within a given statute exempt the tax protesters from a duty to pay.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

Corporate tax is imposed in the United States at the federal, most state, and some local levels on the income of entities treated for tax purposes as corporations. Since January 1, 2018, the nominal federal corporate tax rate in the United States of America is a flat 21% following the passage of the Tax Cuts and Jobs Act of 2017. State and local taxes and rules vary by jurisdiction, though many are based on federal concepts and definitions. Taxable income may differ from book income both as to timing of income and tax deductions and as to what is taxable. The corporate Alternative Minimum Tax was also eliminated by the 2017 reform, but some states have alternative taxes. Like individuals, corporations must file tax returns every year. They must make quarterly estimated tax payments. Groups of corporations controlled by the same owners may file a consolidated return.

In the United States, a Social Security number (SSN) is a nine-digit number issued to U.S. citizens, permanent residents, and temporary (working) residents under section 205(c)(2) of the Social Security Act, codified as 42 U.S.C. § 405(c)(2). The number is issued to an individual by the Social Security Administration, an independent agency of the United States government. Although the original purpose for the number was for the Social Security Administration to track individuals, the Social Security number has become a de facto national identification number for taxation and other purposes.

For United States income tax purposes, a business entity may elect to be treated either as a corporation or as other than a corporation. This entity classification election is made by filing Internal Revenue Service Form 8832. Absent filing the form, a default classification applies. U.S. corporations of the type that can be publicly traded must be treated as corporations. There is a list of specific foreign entities that must be treated as corporations. The election is effective for Federal income tax purposes.

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business to a non-corporate US resident independent contractor for services, but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase "1099 workers" or "the 1099 economy" to refer to the independent contractors themselves. Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits.

Form 1023 is a United States IRS tax form, also known as the Application for Recognition of Exemption Under 501(c)(3) of the Internal Revenue Code. It is filed by nonprofits to get exemption status. On January 31, 2020, the IRS abandoned the paper format of the form 1023. Those who used the paper version were given 90 days grace period and that ended on April 30, 2020. Going forward, every application has to be filed online through Pay.gov portal.

An Alternate Employer Organization (AEO) is a human resource services firm targeting small and medium sized business. AEO offerings include payroll processing, payroll tax filing, workers’ compensation insurance, health benefits, employers’ practice and liability insurance, and workforce management technology, training and development.

The Employee Retention Credit (ERC) is a U.S. federal tax credit that was available to certain employers, most recently during the COVID-19 pandemic. It was originally designed to help employers who were not eligible for a Paycheck Protection Program loan, but it was later amended so employers who received Paycheck Protection Program loan forgivess were often still eligible for the Employee Retention Credit. Although it ended on December 31, 2021, eligible employers may still be able to claim the tax credit by filing amended forms with the Internal Revenue Service. Due to a substantial number of improper claims, processing of amended forms claiming the Employee Retention Credit has been temporarily suspended as of September 14, 2023.