The economy of Israel is a highly developed free-market economy. The prosperity of Israel's advanced economy allows the country to have a sophisticated welfare state, a powerful modern military said to possess a nuclear-weapons capability with a full nuclear triad, modern infrastructure rivaling many Western countries, and a high-technology sector competitively on par with Silicon Valley. It has the second-largest number of startup companies in the world after the United States, and the third-largest number of NASDAQ-listed companies after the U.S. and China. American companies, such as Intel, Microsoft, and Apple, built their first overseas research and development facilities in Israel. More than 400 high-tech multi-national corporations, such as IBM, Google, Hewlett-Packard, Cisco Systems, Facebook and Motorola have opened R&D centers throughout the country.

Eni S.p.A. is an Italian multinational energy company headquartered in Rome. One of the "supermajor" oil companies in the world, with a market capitalization of €50 billion, as of 31 December 2023. The Italian government owns a 30.33% golden share in the company, 4.37% held through the Ministry of Economy and Finance and 25.96% through the Cassa Depositi e Prestiti. The company is a component of the Euro Stoxx 50 stock market index.

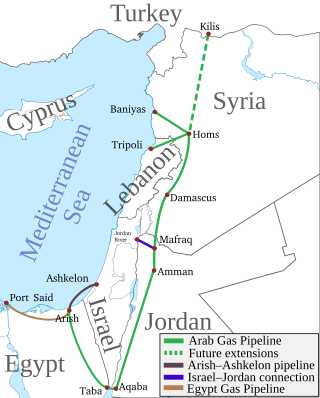

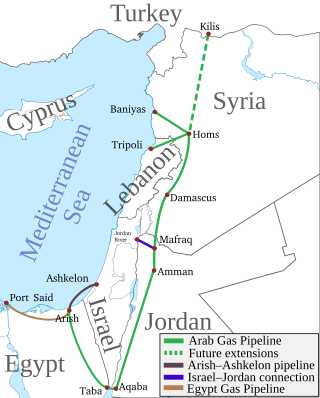

The Arab Gas Pipeline is a natural gas pipeline in the Middle East. It originates near Arish in the Sinai Peninsula and was built to export Egyptian natural gas to Jordan, Syria, and Lebanon, with branch underwater and overland pipelines to and from Israel. It has a total length of 1,200 kilometres (750 mi), constructed at a cost of US$1.2 billion.

Delek Group is an Israeli holding conglomerate mainly operating in the petroleum industry. Delek Group's largest subsidiary is Delek – The Israel Fuel Corporation, one of the largest chains of filling stations in Israel. Delek Group also owns E&P operations across the Levant, in the North Sea and in the Gulf of Mexico. Beyond the oil industry, it also owns coffeehouse chain Café Joe as well as 70% of the Israeli franchisee of Burger King.

BAZAN Group,, formerly Oil Refineries Ltd., is an oil refining and petrochemicals company located in Haifa Bay, Israel. It operates the largest oil refinery in the country. ORL has a total oil refining capacity of approximately 9.8 million tons of crude oil per year with a Nelson complexity index of 9. ORL provides a variety of products used in industrial operations, agriculture and transportation. ORL is Israel's largest integrated refining and petrochemical facility. The company also provides storage and transportation services for oil fuel products, as well as electricity and steam to industrial customers in the region.

The Tamar gas field is a natural gas field in the Mediterranean Sea off the coast of Israel. The field is located in Israel's exclusive economic zone, roughly 80 kilometres (50 mi) west of Haifa in waters 1,700 metres (5,600 ft) deep. The Tamar field is considered to have proven reserves of 200 billion cubic metres of natural gas, while the adjoining Tamar South field has 23 billion cubic metres. Together, they may have an additional 84 BCM of "probable" reserves and up to 49 BCM of "possible" reserves. At the time of discovery, Tamar was the largest find of gas or oil in the Levant basin of the Eastern Mediterranean Sea and the largest discovery by Noble Energy. Since Tamar's discovery, large gas discoveries have been made in other analogous geological formations dating back to the Oligocene–Miocene epoch in the Levant basin. Because Tamar was the first such discovery, these gas containing presalt formations have become collectively known as Tamar sands.

The Leviathan gas field is a large natural gas field in the Mediterranean Sea off the coast of Israel, 47 kilometres (29 mi) south-west of the Tamar gas field. The gas field is roughly 130 kilometres (81 mi) west of Haifa in waters 1,500 metres (4,900 ft) deep in the Levantine basin, a rich hydrocarbon area in one of the largest offshore natural gas field finds. According to some commentators, the gas find has the potential to change Israel's foreign relations with neighboring countries, including Turkey, and Egypt. Together with the nearby Tamar gas field, the Leviathan field is seen as an opportunity for Israel to achieve energy independence in the Middle East.

Cyprus–Israel relations refer to the bilateral relations between Cyprus and Israel. Israel has an embassy in Nicosia, while Cyprus has an embassy in Tel Aviv. Both countries are members of the Union for the Mediterranean, United Nations, Euro-Atlantic Partnership Council, Organisation for Economic Co-operation and Development, International Monetary Fund, World Bank, and World Trade Organization.

Sara and Myra were two Israeli offshore drilling licenses located west of Netanya, Israel. The licenses expired on July 13, 2015. Exploratory drilling in the license area in 2012 was unsuccessful, but seismic studies indicated the possibility of oil and gas at deeper strata that were not explored.

Aphrodite gas field is an offshore gas field off the southern coast of Cyprus located at the exploratory drilling block 12 in the country's maritime Exclusive Economic Zone and bordering the Yishai gas field, located in Israeli territorial waters. Located 34 kilometres (21 mi) west of Israel's Leviathan gas field, block 12 is believed to hold 3.6 to 6 trillion cubic feet of natural gas. In 2014, the reserve estimate for the quantity of natural gas held by Aphrodite was raised by 12% due to new data received from the Yishai prospect as reported by Delek Drilling to the Israel Securities Authority. The cost of the field's development was estimated to range from $2.5 billion to $3.5 billion.

Isramco Negev 2 LP is an American Israeli Limited Partnership that holds interests in oil and gas properties in Israel. The partnership shares are traded on the Tel Aviv Stock Exchange and have been a constituent of the TA-25 Index since January 2010. The partnership was founded by Isramco Inc. and other parties in 1989.

The Tanin gas field is a natural gas reservoir located 120 km off the coast of Israel. It is the country's seventh natural gas discovery, located nearby the much larger Leviathan gas field.

Yitzhak Tshuva is an Israeli billionaire businessman. He is the founder of El-Ad Group, a large real estate development and holding company, which owned the New York Plaza Hotel. He also owns the Israeli conglomerate Delek Group. In 2014, he was listed by Forbes as the seventh wealthiest Israeli. In March 2022, Forbes estimated his net worth at US$3.8 billion.

Most energy in Israel comes from fossil fuels. The country's total primary energy demand is significantly higher than its total primary energy production, relying heavily on imports to meet its energy needs. Total primary energy consumption was 304 TWh (1.037 quad) in 2016, or 26.2 million tonne of oil equivalent.

Natural gas in Israel is a primary energy source in Israel, mainly utilized for electricity production and to lesser degree in industry. Israel began producing natural gas from its own offshore gas fields in 2004. Between 2005 and 2012, Israel had imported gas from Egypt via the al-Arish-Ashkelon pipeline, which was terminated due to Egyptian Crisis of 2011-14. As of 2017, Israel produced over 9 billion cubic meters (bcm) of natural gas a year. Israel had 1,087 billion cubic meters of proven reserves of natural gas as of 2022. In early 2017, Israel began exporting natural gas to the Kingdom of Jordan.

The petroleum industry in India dates back to 1889 when the first oil deposits in the country were discovered near the town of Digboi in the state of Assam. The natural gas industry in India began in the 1960s with the discovery of gas fields in Assam and Maharashtra. As on 31 March 2018, India had estimated crude oil reserves of 594.49 million metric tonnes (Mt) and natural gas reserves of 1339.57 billion cubic metres of natural gas (BCM).

Fossil gas supplies over a quarter of Turkey's energy. The country consumes 50 to 60 billion cubic metres of this natural gas each year, nearly all of which is imported. A large gas field in the Black Sea however started production in 2023.

NewMed Energy, formerly Delek Drilling, is an Israeli energy Oil & Gas partnership in the exploration, development, and production of Natural Gas and Oil. Delek group owned by Yitzhak Tshuva, is the controlling shareholder of the partnership. The partnership is traded on the Tel Aviv Stock Exchange and is part of the TA 35 Index.

The Israeli–Lebanese maritime border dispute was a territorial dispute between the State of Israel and the Republic of Lebanon over the Qana and Karish gas fields. The dispute lasted from 2010 until 2022, and was resolved after nearly two years of negotiations.

The Karish gas field is an Israeli natural gas field located in the Eastern Mediterranean. It lies in proximity to the significantly larger Leviathan and Tamar gas fields. The field was initially allocated to a consortium of companies including Noble Energy and Delek, but due to their monopolistic position in the Israeli market, Delek and Noble were forced by regulators to sell their rights in the field. As a result, the two companies sold Karish and the adjacent Tanin gas field to the Greek oil company Energean in 2016 for $150 million. The Karish and Tanin gas fields together are estimated to hold 2–3 trillion cubic feet of gas.