Related Research Articles

The European Union (EU) is a political and economic union of 27 member states that are located primarily in Europe. The union has a total area of 4,233,255.3 km2 (1,634,469.0 sq mi) and an estimated total population of about 447 million. An internal single market has been established through a standardised system of laws that apply in all member states in those matters, and only those matters, where the states have agreed to act as one. EU policies aim to ensure the free movement of people, goods, services and capital within the internal market; enact legislation in justice and home affairs; and maintain common policies on trade, agriculture, fisheries and regional development. Passport controls have been abolished for travel within the Schengen Area. A monetary union was established in 1999, coming into full force in 2002, and is composed of 19 member states which use the euro currency. The EU has often been described as a sui generis political entity with the characteristics of either a federation or confederation.

The economy of Latvia is an open economy in Eastern Europe and is part of the European Single Market. Latvia is a member of the World Trade Organization (WTO) since 1999, a member of the European Union since 2004, a member of the Eurozone since 2014 and a member of the OECD since 2016. Latvia is ranked the 14th in the world by the Ease of Doing Business Index prepared by the World Bank Group. According to the Human Development Report 2011, Latvia belongs to the group of very high human development countries. Due to its geographical location, transit services are highly developed, along with timber and wood-processing, agriculture and food products, and manufacturing of machinery and electronic devices.

Customs is an authority or agency in a country responsible for collecting tariffs and for controlling the flow of goods, including animals, transports, personal effects, and hazardous items, into and out of a country. Traditionally, customs has been considered as the fiscal subject that charges customs duties and other taxes on import and export. In recent decades, the views on the functions of customs have considerably expanded and now covers three basic issues: taxation, security, and trade facilitation.

The special territories of the European Union are 32 territories of EU member states which, for historical, geographical, or political reasons, enjoy special status within or outside the European Union.

Eurostat is a Directorate-General of the European Commission located in the Kirchberg quarter of Luxembourg City, Luxembourg. Its main responsibilities are to provide statistical information to the institutions of the European Union (EU) and to promote the harmonisation of statistical methods across its member states and candidates for accession as well as EFTA countries. The organisations in the different countries that cooperate with Eurostat are summarised under the concept of the European Statistical System.

The European Union–Turkey Customs Union is a trade agreement between the European Union (EU) and Turkey. The agreement came into effect on 31 December 1995, following a 6 March 1995 Decision of the European Community–Turkey Association Council to implement a customs union between the two parties. Goods may travel between the two entities without any customs restrictions. The Customs Union does not cover essential economic areas such as agriculture, services or public procurement.

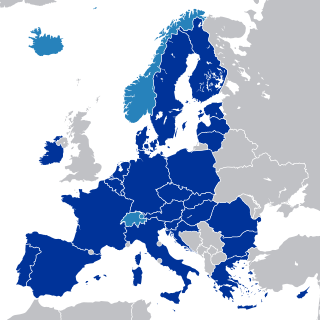

The European Single Market, Internal Market or Common Market is a single market comprising the 27 member states of the European Union (EU) as well as – with certain exceptions – Iceland, Liechtenstein, and Norway through the Agreement on the European Economic Area, and Switzerland through bilateral treaties. The single market seeks to guarantee the free movement of goods, capital, services, and people, known collectively as the "four freedoms".

Relations between the European Union (EU) and the People's Republic of China (PRC) or Sino–European relations are bilateral relations that were established in 1975 between the PRC and the European Community. The EU is the PRC's largest trading partner, and the PRC is the EU's largest trade partner.

Intrastat is the system for collecting information and producing statistics on the trade in goods between countries of the European Union (EU). It began operation on 1 January 1993, when it replaced customs declarations as the source of trade statistics within the EU. The requirements of Intrastat are similar in all member states of the EU, although there are important exceptions.

Greenland, an autonomous country within the Kingdom of Denmark is one of the EU countries’ overseas countries and territories (OCT) associated to the European Union. Greenland receives funding from the EU for sustainable development and has signed agreements increasing cooperation with the EU.

The ATA Carnet, often referred to as the "Passport for goods", is an international customs document that permits the tax-free and duty-free temporary export and import of nonperishable goods for up to one year. It consists of unified customs declaration forms which are prepared ready to use at every border crossing point. It is a globally accepted guarantee for customs duties and taxes which can replace the security deposit required by each customs authority. It can be used in multiple countries in multiple trips up to its one-year validity. The acronym ATA is a combination of French and English terms "Admission Temporaire/Temporary Admission." The ATA carnet is now the document most widely used by the business community for international operations involving temporary admission of goods.

The EUR.1 movement certificate is a form used in international commodity traffic. The EUR.1 is most importantly recognized as a certificate of origin in the external trade in legal sense, especially within the framework of several bi- and multilateral agreements of the Pan-European preference system.

The European Union Customs Union (EUCU) formally known as the Community Customs Union is a customs union which consists of all the member states of the European Union (EU), Monaco, and the British Overseas Territory of Akrotiri and Dhekelia. Some detached territories of EU states do not participate in the customs union, usually as a result of their geographic separation. In addition to the EUCU, the EU is in customs unions with Andorra, San Marino and Turkey, through separate bilateral agreements.

According to the World Customs Organization (WCO), an authorized economic operator (AEO) is

"a party involved in the international movement of goods in whatever function that has been approved by or on behalf of a national Customs administration as complying with WCO or equivalent supply chain security standards. Authorized Economic Operators include inter alia manufacturers, importers, exporters, brokers, carriers, consolidators, intermediaries, ports, airports, terminal operators, integrated operators, warehouses and distributors"

The European Union value-added tax is a value added tax on goods and services within the European Union (EU). The EU's institutions do not collect the tax, but EU member states are each required to adopt a value added tax that complies with the EU VAT code. Different rates of VAT apply in different EU member states, ranging from 17% in Luxembourg to 27% in Hungary. The total VAT collected by member states is used as part of the calculation to determine what each state contributes to the EU's budget.

The Trade Control and Expert System (TRACES), is a web-based veterinarian certification tool used by the European Union for controlling the import and export of live animals and animal products within and without its borders. Its network falls under the responsibility of the European Commission. TRACES constitutes a key element of how the European Union facilitates trade and improves health protection for the consumer, as laid down in the First Pillar principle. Other countries use computer networks to provide veterinary certification, but TRACES is the only supranational network working at a continental scale of 28 countries and almost 500 million people.

When goods are imported into a European Union country from a non-EU territory, those goods may be subject to customs duty, excise duty and value-added tax.

The Treaties of the European Union are a set of international treaties between the European Union (EU) member states which sets out the EU's constitutional basis. They establish the various EU institutions together with their remit, procedures and objectives. The EU can only act within the competences granted to it through these treaties and amendment to the treaties requires the agreement and ratification of every single signatory.

A Customs declaration is a form that lists the details of goods that are being imported or exported when a citizen or visitor enters a customs territory . Most countries require travellers to complete a customs declaration form when bringing notified goods across international borders. Posting items via international mail also requires the sending party to complete a customs declaration form.

An Economic Operators Registration and Identification number is a European Union registration and identification number for businesses which undertake the import or export of goods into or out of the EU.

References

- ↑ "European Customs Information Portal: About the European Customs Information Portal - European commission". ec.europa.eu. Retrieved 22 March 2018.

- ↑ "European Customs Information Portal: Security Amendment - European commission". ec.europa.eu. Retrieved 22 March 2018.

- ↑ "TARIC Consultation". ec.europa.eu. Retrieved 22 March 2018.

- ↑ Archived 2010-06-20 at the Wayback Machine

- ↑ "General Overview - Taxation and Customs Union - European Commission". Taxation and Customs Union. Retrieved 22 March 2018.

- ↑ "Import to the EU - Trade - European Commission". ec.europa.eu. Retrieved 22 March 2018.