Related Research Articles

The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

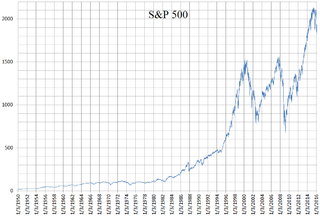

The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies, with an aggregate market cap of more than $43 trillion as of January 2024.

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

MSCI Inc. is an American finance company headquartered in New York City. MSCI is a global provider of equity, fixed income, real estate indices, multi-asset portfolio analysis tools, ESG and climate products. It operates the MSCI World, MSCI All Country World Index (ACWI) and MSCI Emerging Markets Indices among others.

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange.

The FTSE All-Share Index, originally known as the FTSE Actuaries All Share Index, is a capitalisation-weighted index, comprising around 600 of more than 2,000 companies traded on the London Stock Exchange (LSE). By weighting companies based on their market capitalisation, the index ensures that companies with larger market capitalisations have a greater influence on the index's performance. Since 29 December 2017 the constituents of this index totaled 641 companies. The FTSE All-Share is the aggregation of the FTSE 100 Index and the FTSE 250 Index, which are together known as the FTSE 350 Index, and the FTSE SmallCap Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. It aims to represent at least 98% of the full capital value of all UK companies that qualify as eligible for inclusion.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

Fundamentally based indexes or fundamental indexes, also called fundamentally weighted indexes, are indexes in which stocks are weighted according to factors related to their fundamentals such as earnings, dividends and assets, commonly used when performing corporate valuations. Indexes that use a composite of several fundamental factors attempt to average out sector biases that may arise from relying on a single fundamental factor. A key belief behind the fundamental index methodology is that underlying corporate accounting/valuation figures are more accurate estimators of a company's intrinsic value, rather than the listed market value of the company, i.e. that one should buy and sell companies in line with their accounting figures rather than according to their current market prices. In this sense fundamental indexing is linked to so-called fundamental analysis.

Socially responsible investing (SRI) is any investment strategy which seeks to consider financial return alongside ethical, social or environmental goals. The areas of concern recognized by SRI practitioners are often linked to environmental, social and governance (ESG) topics. Impact investing can be considered a subset of SRI that is generally more proactive and focused on the conscious creation of social or environmental impact through investment. Eco-investing is SRI with a focus on environmentalism.

The Calvert Social Index is a stock market index created by Calvert Investments as a benchmark of large companies that are considered socially responsible or ethical. It currently consists of 680 companies, weighted by market capitalization, selected from approximately 1,000 of the largest publicly traded companies in the United States using Calvert's social criteria. These criteria relate to the environment, workplace issues, product safety, community relations, weapons contracting, international operations, and human rights.

The MSCI KLD 400 Social Index was launched in 1990 and is designed to help socially conscious investors weigh social and environmental factors in their investment choices. It was founded by KLD's Amy Domini as the Domini 400 Social Index.

The FTSE World Government Bond Index (WGBI) is a market capitalization weighted bond index consisting of the government bond markets of the multiple countries. Country eligibility is determined based upon market capitalization and investability criteria. The index includes all fixed-rate bonds with a remaining maturity of one year or longer and with amounts outstanding of at least the equivalent of US$25 million. Government securities typically exclude floating or variable rate bonds, US/Canadian savings bonds and private placements. It is not possible to invest directly in such an index.

The FTSE Global Equity Index Series is a series of stock market indices provided by FTSE Group. It was launched in September 2003, and provides coverage of over 17,000 stocks in 48 countries, covering 98% of the world's investable market capitalization.

The Dow Jones Sustainability Indices (DJSI) launched in 1999, are a family of indices evaluating the sustainability performance of thousands of companies trading publicly, operated under a strategic partnership between S&P Dow Jones Indices and RobecoSAM of the S&P Dow Jones Indices. They are the longest-running global sustainability benchmarks worldwide and have become the key reference point in sustainability investing for investors and companies alike. In 2012, S&P Dow Jones Indices was formed via the merger of S&P Indices and Dow Jones Indexes.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

Environmental, social, and governance (ESG), is a set of aspects, including environmental issues, social issues and corporate governance that can be considered in investing. Investing with ESG considerations is sometimes referred to as responsible investing or, in more proactive cases, impact investing.

Covalence EthicalQuote also called EthicalQuote or simply CEQ is a market index tracking reputation of the world's largest companies on Environmental, Social, Governance (ESG), Corporate dimensions of firms’ ethical performance.

PensionBee is a British online personal pension scheme provider. It was co-founded in 2014 by its Chief Executive Officer, Romi Savova, and Chief Technology Officer, Jonathan Lister Parsons.

References

- ↑ ethicalinvestment.co.uk, FTSE4Good Archived 2012-01-22 at the Wayback Machine

- ↑ FTSE Russell, FTSE4Good Index Series, accessed 6 September 2022

- ↑ FTSE.com, EIRIS Archived 2011-01-10 at the Wayback Machine

- 1 2 Collison, D. J., Cobb, G., Power, D. M. and Stevenson, L. A. (2008), "The financial performance of the FTSE4Good indices". Corporate Social Responsibility and Environmental Management, 15: 14–28. doi : 10.1002/csr.144.

- ↑ "Index Inclusion Rules for the FTSE4Good Index Series" (PDF). FTSE Russell. September 2017. Archived from the original (PDF) on 15 December 2017. Retrieved 2 October 2017.

- ↑ M. Martin Curran, Dominic Moran (2007), "Impact of the FTSE4Good Index on firm price: An event study", Journal of Environmental Management, Volume 82, Issue 4, March 2007, pp. 529-53. doi : 10.1016/j.jenvman.2006.02.010.

- 1 2 FTSE4Good All-World Index datasheet, 20 May 2024