The DAX is a stock market index consisting of the 40 major German blue chip companies trading on the Frankfurt Stock Exchange. It is a total return index. Prices are taken from the Xetra trading venue. According to Deutsche Börse, the operator of Xetra, DAX measures the performance of the Prime Standard's 40 largest German companies in terms of order book volume and market capitalization. DAX is the equivalent of the UK FTSE 100 and the US Dow Jones Industrial Average, and because of its small company selection it does not necessarily represent the vitality of the German economy as a whole.

The Financial Times Stock Exchange 100 Index, also called the FTSE 100 Index, FTSE 100, FTSE, or, informally, the "Footsie", is the United Kingdom's best-known stock market index of the 100 most highly capitalised blue chip companies listed on the London Stock Exchange.

The FTSE 250 Index, also called the FTSE 250, or, informally, the "Footsie 250", is a stock market index that measures the real strength of the economy of the United Kingdom and consists of the 101st to the 350th mid-cap blue chip companies listed on the London Stock Exchange.

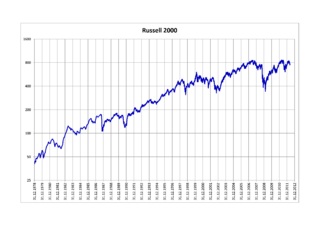

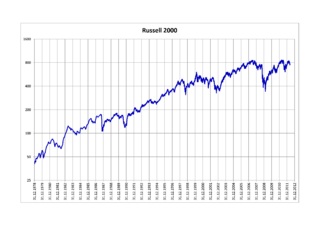

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

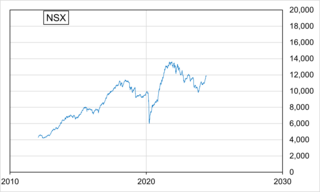

NIFTY 500 is India’s first broad-based stock market index of the Indian stock market. It contains top 500 listed companies on the NSE. The NIFTY 500 index represents about 96.1% of free float market capitalization and about 96.5% of the total turnover on the National Stock Exchange (NSE).

FTSE International Limited trading as FTSE Russell ( "Footsie") is a British provider of stock market indices and associated data services, wholly owned by the London Stock Exchange (LSE) and operating from premises in Canary Wharf. It operates the well known UK FTSE 100 Index as well as a number of other indices. FTSE stands for Financial Times Stock Exchange.

The S&P 100 Index is a stock market index of United States stocks maintained by Standard & Poor's.

The FTSE All-Share Index, originally known as the FTSE Actuaries All Share Index, is a capitalisation-weighted index, comprising around 600 of more than 2,000 companies traded on the London Stock Exchange (LSE). By weighting companies based on their market capitalisation, the index ensures that companies with larger market capitalisations have a greater influence on the index's performance. Since 29 December 2017 the constituents of this index totaled 641 companies. The FTSE All-Share is the aggregation of the FTSE 100 Index and the FTSE 250 Index, which are together known as the FTSE 350 Index, and the FTSE SmallCap Index. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group. It aims to represent at least 98% of the full capital value of all UK companies that qualify as eligible for inclusion.

The FTSE AIM UK 50 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 50 UK companies which have their primary listing on the Alternative Investment Market (AIM).

The FTSE AIM UK 100 Index was introduced on 16 May 2005, and is a market-capitalisation-weighted stock market index. The index incorporates the largest 100 companies which have their primary listing on the Alternative Investment Market (AIM). It includes UK and international domiciled companies. The index is reviewed quarterly, and the constituent companies may change based on market capitalisation data as at the end of February, May, August and November. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

A capitalization-weightedindex, also called a market-value-weighted index is a stock market index whose components are weighted according to the total market value of their outstanding shares. Every day an individual stock's price changes and thereby changes a stock index's value. The impact that individual stock's price change has on the index is proportional to the company's overall market value, in a capitalization-weighted index. In other types of indices, different ratios are used.

The FTSE SmallCap Index is an index of small market capitalisation companies consisting of the 351st to the 619th largest-listed companies on the London Stock Exchange main market. The index, which is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group, is a constituent of the FTSE All-Share Index which is an index of all 620 companies listed on the main market of the LSE.

The FTSE Global Equity Index Series is a series of stock market indices provided by FTSE Group. It was launched in September 2003, and provides coverage of over 17,000 stocks in 48 countries, covering 98% of the world's investable market capitalization.

In finance, a stock index, or stock market index, is an index that measures the performance of a stock market, or of a subset of a stock market. It helps investors compare current stock price levels with past prices to calculate market performance.

The FTSE Fledgling Index comprises companies listed on the main market of the London Stock Exchange (LSE) which qualify as eligible for inclusion in the FTSE UK series but are too small to be included in the FTSE All-Share Index. There is no liquidity requirement for constituents of the FTSE Fledgling Index.

FTSE Russell is a subsidiary of London Stock Exchange Group (LSEG) that produces, maintains, licenses, and markets stock market indices. The division is notable for the FTSE 100 Index and Russell 2000 Index, among others.

Baltic Classifieds Group is a Lithuanian company that specialises in classified portals. The company was established in 1999 and is headquartered in Vilnius, Lithuania. It is listed on the London Stock Exchange and is a constituent of the FTSE 250 Index.