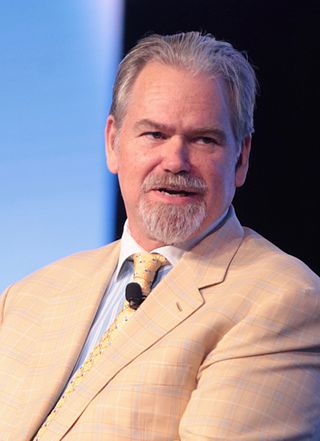

Frank J. Fabozzi | |

|---|---|

| Alma mater | Graduate Center of the City University of New York, City College of New York |

| Known for | Co-developer of the Kalotay–Williams–Fabozzi model |

| Website | Frank J. Fabozzi Associates |

Frank J. Fabozzi is an American economist, educator, writer, and investor, currently Professor of Practice at The Johns Hopkins University Carey Business School [1] and a Member of Edhec Risk Institute. [2] He was previously a Professor of Finance at EDHEC Business School, Professor in the Practice of Finance and Becton Fellow in the Yale School of Management, and a Visiting Professor of Finance at the Sloan School of Management at the Massachusetts Institute of Technology. [3] He has authored and edited many books, three of which were coauthored with Nobel laureates, Franco Modigliani and Harry Markowitz. He has been the editor of the Journal of Portfolio Management since 1986 and is on the board of directors of the BlackRock complex of closed-end funds. [4]

He earned a BA (magna cum laude) and an Master of Economics from the City College of New York, both in 1970. He also earned a doctorate in economics from the Graduate Center of the City University of New York in 1972. [5] He is a Certified Public Accountant and holds the Chartered Financial Analyst designation. [6]

Fabozzi has written and edited books [7] and numerous research papers [8] [9] covering topics in investment management and financial econometrics. Much of his earlier writing focused on fixed income securities and portfolio management with emphasis on mortgage- and asset-backed securities and structured products. He is a co-developer of the Kalotay–Williams–Fabozzi model [10] of the short rate, used in the valuation of interest rate derivatives.

He is on the Advisory Council for the Department of Operations Research and Financial Engineering at Princeton University and an affiliated professor at the Institute of Statistics and Economics [11] at the University of Karlsruhe (Germany). He has been the editor of the Journal of Portfolio Management since 1986 and is on the board of directors of the BlackRock complex of closed-end funds. Before joining EDHEC Business School, Fabozzi was a finance professor at Yale School of Management, and a visiting finance professor at the MIT Sloan School of Management. [12]

Fabozzi was elected to the Phi Beta Kappa Society in 1969.[ citation needed ] He was inducted into the Fixed Income Analysts Society's Hall of Fame in 2002 [13] and was the 2007 recipient of the C. Stewart Sheppard Award given by The CFA Institute. [14] He is the 2004 recipient of an Honorary Doctorate of Humane Letters from Nova Southeastern University.[ citation needed ]. In 2015, Fabozzi received the James R. Vertin Award from the CFA Institute Research Foundation, which recognizes individuals whose research is "notable for its relevance and enduring value to investment professionals".[ citation needed ]

Franco Modigliani was an Italian-American economist and the recipient of the 1985 Nobel Memorial Prize in Economics. He was a professor at University of Illinois at Urbana–Champaign, Carnegie Mellon University, and MIT Sloan School of Management.

In finance, the yield on a security is a measure of the ex-ante return to a holder of the security. It is one component of return on an investment, the other component being the change in the market price of the security. It is a measure applied to fixed income securities, common stocks, preferred stocks, convertible stocks and bonds, annuities and real estate investments.

The Chartered Financial Analyst (CFA) program is a postgraduate professional certification offered internationally by the US-based CFA Institute to investment and financial professionals. The program teaches a wide range of subjects relating to advanced investment analysis—including security analysis, statistics, probability theory, fixed income, derivatives, economics, financial analysis, corporate finance, alternative investments, portfolio management—and provides a generalist knowledge of other areas of finance.

In finance, interest rate immunization is a portfolio management strategy designed to take advantage of the offsetting effects of interest rate risk and reinvestment risk.

Peter Lewyn Bernstein was an American financial historian, economist and educator whose development and refinement of the efficient-market hypothesis made him one of the country's best known authorities in popularizing and presenting investment economics to the general public.

Fixed income analysis is the process of determining the value of a debt security based on an assessment of its risk profile, which can include interest rate risk, risk of the issuer failing to repay the debt, market supply and demand for the security, call provisions and macroeconomic considerations affecting its value in the future. It also addresses the likely price behavior in hedging portfolios. Based on such an analysis, a fixed income analyst tries to reach a conclusion as to whether to buy, sell, hold, hedge or avoid the particular security.

In financial economics, asset pricing refers to a formal treatment and development of two interrelated pricing principles, outlined below, together with the resultant models. There have been many models developed for different situations, but correspondingly, these stem from either general equilibrium asset pricing or rational asset pricing, the latter corresponding to risk neutral pricing.

Reinvestment risk is a form of financial risk. It is primarily associated with fixed income securities, in the form of early redemption risk and coupon reinvestment risk.

Financial modeling is the task of building an abstract representation of a real world financial situation. This is a mathematical model designed to represent the performance of a financial asset or portfolio of a business, project, or any other investment.

The following outline is provided as an overview of and topical guide to finance:

Robert D. Arnott is an American businessman, investor, and writer who focuses on articles about quantitative investing.

Moorad Choudhry was formerly Head of Business Treasury, Global Banking and Markets at Royal Bank of Scotland.

Jack Lawrence Treynor was an American economist who served as the President of Treynor Capital Management in Palos Verdes Estates, California. He was a Senior Editor and Advisory Board member of the Journal of Investment Management, and was a Senior Fellow of the Institute for Quantitative Research in Finance. He served for many years as the editor of the CFA Institute's Financial Analysts Journal.

Andrew Kalotay is a Hungarian-born finance professor, Wall Street quant and chess master. He is best known as an authority on fixed income valuation and institutional debt management. He is currently the President of Andrew Kalotay Associates, and an adjunct professor at Polytechnic Institute of New York University.

Financial models with long-tailed distributions and volatility clustering have been introduced to overcome problems with the realism of classical financial models. These classical models of financial time series typically assume homoskedasticity and normality cannot explain stylized phenomena such as skewness, heavy tails, and volatility clustering of the empirical asset returns in finance. In 1963, Benoit Mandelbrot first used the stable distribution to model the empirical distributions which have the skewness and heavy-tail property. Since -stable distributions have infinite -th moments for all , the tempered stable processes have been proposed for overcoming this limitation of the stable distribution.

In finance, par yield is the yield on a fixed income security assuming that its market price is equal to par value. Par yield is used to derive the U.S. Treasury’s daily official “Treasury Par Yield Curve Rates”, which are used by investors to price debt securities traded in public markets, and by lenders to set interest rates on many other types of debt, including bank loans and mortgages.

Mathematical finance, also known as quantitative finance and financial mathematics, is a field of applied mathematics, concerned with mathematical modeling in the financial field.

Riccardo Rebonato is Professor of Finance at EDHEC Business School and EDHEC-Risk Institute, Scientific Director of the EDHEC Risk Climate Impact Institute (ERCII), and author of journal articles and books on Mathematical Finance, covering derivatives pricing, risk management, asset allocation and climate change. In 2022 he was granted the PRM Quant of the Year award for 'outstanding contributions to the field of quantitative portfolio theory'. Prior to this, he was Global Head of Rates and FX Analytics at PIMCO.

Svetlozar (Zari) Todorov Rachev is a professor at Texas Tech University who works in the field of mathematical finance, probability theory, and statistics. He is known for his work in probability metrics, derivative pricing, financial risk modeling, and econometrics. In the practice of risk management, he is the originator of the methodology behind the flagship product of FinAnalytica.

Peter C. Oppenheimer is chief global equity strategist and head of Macro Research in Europe within Global Investment Research at Goldman Sachs. Oppenheimer joined Goldman Sachs in 2002 as European and global strategist and was named managing director in 2003 and partner in 2006. He regularly appears in news outlets such as Financial Times, CNBC, The Guardian, The Independent, Bloomberg, and Barron’s among others as a finance strategist and expert.