Related Research Articles

Term life insurance or term assurance is life insurance that provides coverage at a fixed rate of payments for a limited period of time, the relevant term. After that period expires, coverage at the previous rate of premiums is no longer guaranteed and the client must either forgo coverage or potentially obtain further coverage with different payments or conditions. If the life insured dies during the term, the death benefit will be paid to the beneficiary. Term insurance is typically the least expensive way to purchase a substantial death benefit on a coverage amount per premium dollar basis over a specific period of time.

Design–build, also known as alternative delivery, is a project delivery system used in the construction industry. It is a method to deliver a project in which the design and construction services are contracted by a single entity known as the design–builder or design–build contractor. It can be subdivided into architect-led design–build and contractor-led design–build.

In finance, a surety, surety bond or guaranty involves a promise by one party to assume responsibility for the debt obligation of a borrower if that borrower defaults. Usually, a surety bond or surety is a promise by a surety or guarantor to pay one party a certain amount if a second party fails to meet some obligation, such as fulfilling the terms of a contract. The surety bond protects the obligee against losses resulting from the principal's failure to meet the obligation. The person or company providing the promise is also known as a "surety" or as a "guarantor".

In the United States, a group purchasing organization (GPO) is an entity that is created to leverage the purchasing power of a group of businesses to obtain discounts from vendors based on the collective buying power of the GPO members.

A fixed price is a price set for a good or a service that is not subject to bargaining. The price may be fixed because the seller has set it, or because the price is regulated by the authorities under price controls.

Construction management (CM) is a professional service that uses specialized, project management techniques and software to oversee the planning, design, construction and closeout of a project. The purpose of construction management is to control the quality of a project's scope, time / delivery and cost—sometimes referred to as a project management triangle or "triple constraints." CM is compatible with all project delivery systems, including design-bid-build, design-build, CM At-Risk and Public Private Partnerships. Professional construction managers may be hired for large to jumbo-scale, high budget undertakings, called capital projects.

Project finance is the long-term financing of infrastructure and industrial projects based upon the projected cash flows of the project rather than the balance sheets of its sponsors. Usually, a project financing structure involves a number of equity investors, known as 'sponsors', and a 'syndicate' of banks or other lending institutions that provide loans to the operation. They are most commonly non-recourse loans, which are secured by the project assets and paid entirely from project cash flow, rather than from the general assets or creditworthiness of the project sponsors, a decision in part supported by financial modeling; see Project finance model. The financing is typically secured by all of the project assets, including the revenue-producing contracts. Project lenders are given a lien on all of these assets and are able to assume control of a project if the project company has difficulties complying with the loan terms.

In the United States, an annuity is a financial product which offers tax-deferred growth and which usually offers benefits such as an income for life. Typically these are offered as structured (insurance) products that each state approves and regulates in which case they are designed using a mortality table and mainly guaranteed by a life insurer. There are many different varieties of annuities sold by carriers. In a typical scenario, an investor will make a single cash premium to own an annuity. After the policy is issued the owner may elect to annuitize the contract for a chosen period of time. This process is called annuitization and can also provide a predictable, guaranteed stream of future income during retirement until the death of the annuitant. Alternatively, an investor can defer annuitizing their contract to get larger payments later, hedge long-term care cost increases, or maximize a lump sum death benefit for a named beneficiary.

A cost-plus contract, also termed a cost plus contract, is a contract such that a contractor is paid for all of its allowed expenses, plus additional payment to allow for a profit. Cost-reimbursement contracts contrast with fixed-price contract, in which the contractor is paid a negotiated amount regardless of incurred expenses.

A Schedule of Values (SOV) is a detailed schedule apportioning the original contract sum and all change orders, among all cost code divisions or portions of the work. The Schedule of Values shall be based on the approved budget or the approved Fixed Price, or GMP, Cost-Plus Contract type as applicable. See the executed contract agreement for additional language regarding the Schedule of Values. Each Project/Job shall have a separate Schedule of Values. If multiple Projects/Jobs are included in one contract, then the Contractor/Vendor must create a separate Schedule of Values which clearly segregates costs among each Job for billing, reporting and audit purposes."

An energy service company (ESCO) is a company that provides a broad range of energy solutions including designs and implementation of energy savings projects, retrofitting, energy conservation, energy infrastructure outsourcing, power generation, energy supply, and risk management.

A cost-plus-incentive fee (CPIF) contract is a cost-reimbursement contract that provides for an initially negotiated fee to be adjusted later by a formula based on the relationship of total allowable costs to total target costs.

Energy Savings Performance Contracts (ESPCs), also known as Energy Performance Contracts, are an alternative financing mechanism authorized by the United States Congress designed to accelerate investment in cost effective energy conservation measures in existing Federal buildings. ESPCs allow Federal agencies to accomplish energy savings projects without up-front capital costs and without special Congressional appropriations. The Energy Policy Act of 1992 authorized Federal agencies to use private sector financing to implement energy conservation methods and energy efficiency technologies.

Fast-track building construction is construction industry jargon for a project delivery strategy to start construction before the design is complete. The purpose is to shorten the time to completion.

Pre-construction services are services that are offered to support owners, architects, and engineers in making decisions. They are used in planning a construction project before the actual construction begins. The stage where these services are offered is called pre-construction or "pre-con".

A fixed-price contract is a type of contract such that the payment amount does not depend on resources used or time expended by the contractor. This is opposed to a cost-plus contract, which is intended to cover the costs incurred by the contractor plus an additional amount for profit. Such a scheme is often used by military and government contractors to require vendors to incur the risk of cost overruns, and to control costs. However, historically when such contracts are used for innovative new projects with untested or undeveloped technologies, it often results in failure if costs greatly exceed the ability of the contractor to absorb unexpected cost overruns.

A construction contract is a mutual or legally binding agreement between two parties based on policies and conditions recorded in document form. The two parties involved are one or more property owners and one or more contractors. The owner, often referred to as the 'employer' or the 'client', has full authority to decide what type of contract should be used for a specific development to be constructed and to set out the legally-binding terms and conditions in a contractual agreement. A construction contract is an important document as it outlines the scope of work, risks, duration, duties, deliverables and legal rights of both the contractor and the owner.

General Dynamics Corp. v. United States, 563 U.S. 478 (2011), is a U.S. Supreme Court case in which the State Secrets Privilege prevented the plaintiff from using the evidence it needed to protect itself from an expensive judgement.

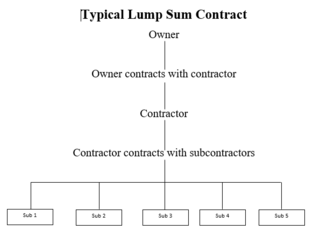

A lump sum contract in construction is one type of construction contract, sometimes referred to as stipulated-sum, where a single price is quoted for an entire project based on plans and specifications and covers the entire project and the owner knows exactly how much the work will cost in advance. This type of contract requires a full and complete set of plans and specifications and includes all the indirect costs plus the profit and the contractor will receive progress payments each month minus retention. The flexibility of this contract is very minimal and changes in design or deviation from the original plans would require a change order paid by the owner. In this contract the payment is made according to the percentage of work completed. The lump sum contract is different from guaranteed maximum price in a sense that the contractor is responsible for additional costs beyond the agreed price, however, if the final price is less than the agreed price then the contractor will gain and benefit from the savings.

Early contractor involvement (ECI) is a type of construction contract where the principal contractor is engaged at an early stage in a project to offer input into the design phase. It is in contrast to the design–bid–build model where the contractor is only brought onboard at the end of the design phase. The model allows the contractor to have an input in the design of the scheme and suggest value engineering changes. Studies have shown that savings of around 10% in construction phase time and 7% in cost are achievable through the use of ECI. The ECI model has become increasingly popular in the United Kingdom since the early 2000s and is also used in Australia and New Zealand.

References

- ↑ Pawson, O., "Stipulated Price Contract", Canadian Consulting Engineer, accessed 14 December 2019

- ↑ Cushman, Robert Frank (1999). Construction Law Handbook, Vol. 1. Aspen Law and Business. p. 357. ISBN 0-7355-0392-3.