The Federal Reserve System is the central banking system of the United States. It was created on December 23, 1913, with the enactment of the Federal Reserve Act, after a series of financial panics led to the desire for central control of the monetary system in order to alleviate financial crises. Over the years, events such as the Great Depression in the 1930s and the Great Recession during the 2000s have led to the expansion of the roles and responsibilities of the Federal Reserve System.

The monetary policy of the United States is the set of policies which the Federal Reserve follows to achieve its twin objectives of high employment and stable inflation.

Paul Adolph Volcker Jr. was an American economist who served as the 12th chairman of the Federal Reserve from 1979 to 1987. During his tenure as chairman, Volcker was widely credited with having ended the high levels of inflation seen in the United States throughout the 1970s and early 1980s, with measures known as the Volcker shock. He previously served as the president of the Federal Reserve Bank of New York from 1975 to 1979.

The Federal Open Market Committee (FOMC) is a committee within the Federal Reserve System that is charged under United States law with overseeing the nation's open market operations. This Federal Reserve committee makes key decisions about interest rates and the growth of the United States money supply. Under the terms of the original Federal Reserve Act, each of the Federal Reserve banks was authorized to buy and sell in the open market bonds and short term obligations of the United States Government, bank acceptances, cable transfers, and bills of exchange. Hence, the reserve banks were at times bidding against each other in the open market. In 1922, an informal committee was established to execute purchases and sales. The Banking Act of 1933 formed an official FOMC.

George William Miller was an American businessman and investment banker who served as the 65th United States secretary of the treasury from 1979 to 1981. A member of the Democratic Party, he also served as the 11th chairman of the Federal Reserve from 1978 to 1979. Miller was the first person to hold both of those posts.

In macroeconomics, an open market operation (OMO) is an activity by a central bank to exchange liquidity in its currency with a bank or a group of banks. The central bank can either transact government bonds and other financial assets in the open market or enter into a repurchase agreement or secured lending transaction with a commercial bank. The latter option, often preferred by central banks, involves them making fixed period deposits at commercial banks with the security of eligible assets as collateral.

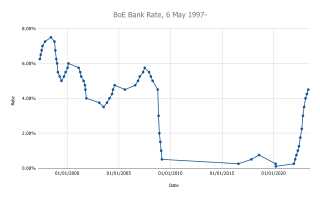

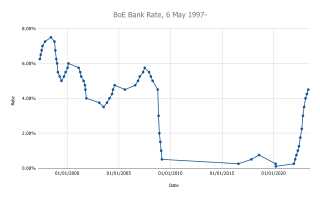

The Monetary Policy Committee (MPC) is a committee of the Bank of England, which meets for three and a half days, eight times a year, to decide the official interest rate in the United Kingdom.

Money creation, or money issuance, is the process by which the money supply of a country, or an economic or monetary region, is increased. In most modern economies, money is created by both central banks and commercial banks. Money issued by central banks is a liability, typically called reserve deposits, and is only available for use by central bank account holders, which are generally large commercial banks and foreign central banks. Central banks can increase the quantity of reserve deposits directly, by making loans to account holders, purchasing assets from account holders, or by recording an asset, such as a deferred asset, and directly increasing liabilities. However, the majority of the money supply used by the public for conducting transactions is created by the commercial banking system in the form of commercial bank deposits. Bank loans issued by commercial banks expand the quantity of bank deposits.

Excess reserves are bank reserves held by a bank in excess of a reserve requirement for it set by a central bank.

Debt monetization or monetary financing is the practice of a government borrowing money from the central bank to finance public spending instead of selling bonds to private investors or raising taxes. The central banks who buy government debt, are essentially creating new money in the process to do so. This practice is often informally and pejoratively called printing money or (net) money creation. It is prohibited in many countries, because it is considered dangerous due to the risk of creating runaway inflation.

Kevin Maxwell Warsh is an American financier and bank executive who served as a member of the Federal Reserve Board of Governors from 2006 to 2011.

Quantitative easing (QE) is a monetary policy action where a central bank purchases predetermined amounts of government bonds or other financial assets in order to stimulate economic activity. Quantitative easing is a novel form of monetary policy that came into wide application after the 2007–2008 financial crisis. It is used to mitigate an economic recession when inflation is very low or negative, making standard monetary policy ineffective. Quantitative tightening (QT) does the opposite, where for monetary policy reasons, a central bank sells off some portion of its holdings of government bonds or other financial assets.

James Brian Bullard is the former chief executive officer and 12th president of the Federal Reserve Bank of St. Louis, a position he held from 2008 until August 14, 2023. In July 2023, he was named dean of the Mitchell E. Daniels Jr. School of Business at Purdue University.

The U.S. central banking system, the Federal Reserve, in partnership with central banks around the world, took several steps to address the subprime mortgage crisis. Federal Reserve Chairman Ben Bernanke stated in early 2008: "Broadly, the Federal Reserve’s response has followed two tracks: efforts to support market liquidity and functioning and the pursuit of our macroeconomic objectives through monetary policy." A 2011 study by the Government Accountability Office found that "on numerous occasions in 2008 and 2009, the Federal Reserve Board invoked emergency authority under the Federal Reserve Act of 1913 to authorize new broad-based programs and financial assistance to individual institutions to stabilize financial markets. Loans outstanding for the emergency programs peaked at more than $1 trillion in late 2008."

In economics, stimulus refers to attempts to use monetary policy or fiscal policy to stimulate the economy. Stimulus can also refer to monetary policies such as lowering interest rates and quantitative easing.

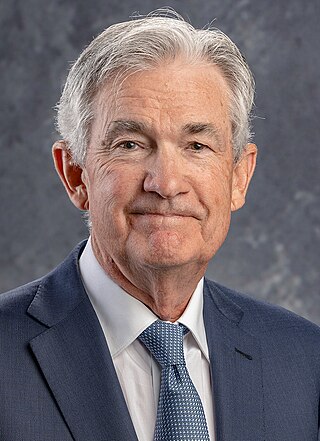

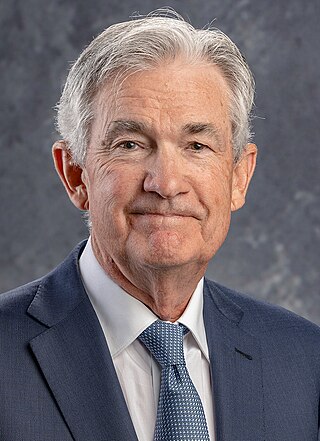

Jerome Hayden "Jay" Powell is an American attorney and investment banker who has served since 2018 as the 16th chair of the Federal Reserve.

The trillion-dollar coin is a concept that emerged during the United States debt-ceiling crisis of 2011 as a proposed way to bypass any necessity for the United States Congress to raise the country's borrowing limit, through the minting of very high-value platinum coins. The concept gained more mainstream attention by late 2012 during the debates over the United States fiscal cliff negotiations and renewed debt-ceiling discussions. After reaching the headlines during the week of January 7, 2013, use of the trillion-dollar coin concept was ultimately rejected by the Federal Reserve and the Treasury.

The 1994 bond market crisis, or Great Bond Massacre, was a sudden drop in bond market prices across the developed world. It began in Japan and the United States (US), and spread through the rest of the world. After the recession of the early 1990s, historically low interest rates in many industrialized nations preceded an unexpectedly volatile year for bond investors, including those that held on to mortgage debts. Over 1994, a rise in rates, along with the relatively quick spread of bond market volatility across international borders, resulted in a mass sell-off of bonds and debt funds as yields rose beyond expectations. This was especially the case for instruments with comparatively longer maturities attached. Some financial observers argued that the plummet in bond prices was triggered by the Federal Reserve's decision to raise rates by 25 basis points in February, in a move to counter inflation. At about $1.5 trillion in lost market value across the globe, the crash has been described as the worst financial event for bond investors since 1927.

Marvin Seth Goodfriend was an American economist. He held the Allan H. Meltzer Professorship in economics at Carnegie Mellon University; he was previously the director of research at the Federal Reserve Bank of Richmond. Following his 2017 nomination to the Federal Reserve Board of Governors, the White House decided to forgo renominating Goodfriend at the beginning of the new term.

Quantitative tightening (QT) is a contractionary monetary policy tool applied by central banks to decrease the amount of liquidity or money supply in the economy. A central bank implements quantitative tightening by reducing the financial assets it holds on its balance sheet by selling them into the financial markets, which decreases asset prices and raises interest rates. QT is the reverse of quantitative easing, where the central bank prints money and uses it to buy assets in order to raise asset prices and stimulate the economy. QT is rarely used by central banks, and has only been employed after prolonged periods of Greenspan put-type stimulus, where the creation of too much central banking liquidity has led to a risk of uncontrolled inflation.