Sequoia Capital is an American venture capital firm headquartered in Menlo Park, California which specializes in seed stage, early stage, and growth stage investments in private companies across technology sectors. As of 2022, the firm had approximately US$85 billion in assets under management.

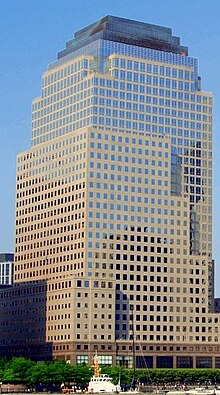

BlackRock, Inc. is an American multinational investment company. It is the world's largest asset manager, with $10 trillion in assets under management as of December 31, 2023. Headquartered in New York City, BlackRock has 78 offices in 38 countries, and clients in 100 countries. BlackRock is the manager of the iShares group of exchange-traded funds, and along with The Vanguard Group and State Street, it is considered to be one of the Big Three index fund managers. Its Aladdin software keeps track of investment portfolios for many major financial institutions and its BlackRock Solutions division provides financial risk management services. As of 2023, BlackRock was ranked 229th on the Fortune 500 list of the largest United States corporations by revenue.

Thoma Bravo, LP, is an American private equity and growth capital firm based in Chicago. It is known for being particularly active in acquiring enterprise software companies and has over $130 billion in assets under management as of 2023.

A quantitative fund is an investment fund that uses quantitative investment management instead of fundamental human analysis.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. In 2023, it was one of the world's largest alternative asset management firms with over $61.1 billion assets under management as of January 2024. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

Robinhood Markets, Inc. is an American financial services company headquartered in Menlo Park, California. It operates an electronic trading platform that facilitates commission-free trades of stocks, exchange-traded funds and cryptocurrencies as well as individual retirement accounts via a mobile app introduced in March 2015. Robinhood is a FINRA-regulated broker-dealer, registered with the U.S. Securities and Exchange Commission, and is a member of the Securities Investor Protection Corporation. The company's revenue comes from three main sources: interest earned on customers' cash balances, selling order information to high-frequency traders and margin lending. As of December 2023, Robinhood had 23.4 million funded accounts and 10.9 million monthly active users. In April 2022, Robinhood rolled out a cryptocurrency wallet to more than 2 million users.

Digital Currency Group (DCG) is a venture capital company focusing on the digital currency market. It is located in Stamford, Connecticut. The company has the subsidiaries Foundry, Genesis, Grayscale Investments, and Luno. It also formerly owned CoinDesk.

WorldQuant, LLC is an international hedge fund and quantitative investment management firm headquartered in Old Greenwich, Connecticut. Founded in 2007, the firm is currently managing approximately $9 billion in assets under management for Millennium Management via quantitative trading and other methods of quantitative investing. WorldQuant operated the WorldQuant Challenge, where participants compete in the field of quantitative finance, and WorldQuant Accelerator, an independent portfolio manager platform. In 2015 the WorldQuant Foundation launched WorldQuant University.

ARK Investment Management LLC is an American investment management firm based in St. Petersburg, Florida, that manages several actively managed exchange-traded funds (ETFs). It was founded by Cathie Wood in 2014. At the height of February 2021, the company had US$50 billion in assets under management. As of October 2023, assets had dropped to $6.71 billion, after a period of poor performance.

Flow Traders is a proprietary trading firm. A market maker, it provides liquidity in the securities market by using high frequency and quantitative trading strategies.

Samuel Benjamin Bankman-Fried, commonly known as SBF, is an American entrepreneur who was convicted of fraud and related crimes in November 2023. Bankman-Fried founded the FTX cryptocurrency exchange and was celebrated as a "poster boy" for crypto. At the peak of his net worth, he was ranked the 41st-richest American in the Forbes 400.

FTX Trading Ltd., commonly known as FTX, is a bankrupt company that formerly operated a fraud-ridden cryptocurrency exchange and crypto hedge fund. The exchange was founded in 2019 by Sam Bankman-Fried and Gary Wang. At its peak in July 2021, the company had over one million users and was the third-largest cryptocurrency exchange by volume. As of November 2022, FTX was the third-largest digital currency exchange boasting an active trading volume of USD 10 billion and a valuation of USD 32 billion. FTX is incorporated in Antigua and Barbuda and headquartered in the Bahamas. FTX is closely associated with FTX.US, a separate exchange available to US residents.

Alameda Research was a cryptocurrency trading firm, co-founded in September 2017 by Sam Bankman-Fried and Tara Mac Aulay. In November 2022, FTX, Alameda's sister cryptocurrency exchange, experienced a solvency crisis, and both FTX and Alameda filed for Chapter 11 bankruptcy. That same month, anonymous sources told The Wall Street Journal that FTX had lent more than half of its customers' funds to Alameda, which was explicitly forbidden by FTX's terms-of-service.

Grayscale Investments is an American digital currency asset management company and subsidiary of Digital Currency Group founded in 2013 and based in Stamford, Connecticut.

BlockFi was a digital asset lender founded by Zac Prince and Flori Marquez in 2017. It was based in Jersey City, New Jersey. It was once valued at $3 billion.

Caroline Ellison is an American former business executive and quantitative trader who served as the CEO of Alameda Research, the trading firm affiliated with the cryptocurrency exchange FTX and founded by FTX founder Sam Bankman-Fried. In 2022, she pleaded guilty to fraud, money laundering, and conspiracy charges related to her role at Alameda Research.

The bankruptcy of FTX, a Bahamas-based cryptocurrency exchange, began in November 2022. The collapse of FTX, caused by a spike in customer withdrawals that exposed an $8 billion hole in FTX’s accounts, served as the impetus for its bankruptcy. Prior to its collapse, FTX was the third-largest cryptocurrency exchange by volume and had over one million users.

John Samuel Trabucco is an American business executive. He was co-CEO of Alameda Research, a defunct quantitative trading firm founded by Sam Bankman-Fried before FTX. Caroline Ellison was Alameda's other co-CEO. Trabucco stepped down from Alameda in August 2022, leaving Ellison as sole CEO until its bankruptcy along with FTX three months later.

Brett Harrison is an American businessman and software developer. He is the founder and CEO of derivatives brokerage and trading technology firm Architect Financial Technologies.

United States of America v. Samuel Bankman-Fried was a 2023 federal criminal trial in the United States District Court for the Southern District of New York. Financial entrepreneur Sam Bankman-Fried, commonly known as SBF, was convicted on seven charges of fraud and conspiracy following the collapse of his cryptocurrency exchange FTX in November 2022. The trial and conviction of Bankman-Fried was one of the most notorious cases of white-collar crime in the United States and raised awareness within the business community over criminal activity in the cryptocurrency market. The trial had several implications, with financer Anthony Scaramucci calling Bankman-Fried "the Bernie Madoff of crypto".