Kenneth Joseph Arrow was an American economist, mathematician, writer, and political theorist. Along with John Hicks, he won the Nobel Memorial Prize in Economic Sciences in 1972.

Gérard Debreu was a French-born economist and mathematician. Best known as a professor of economics at the University of California, Berkeley, where he began work in 1962, he won the 1983 Nobel Memorial Prize in Economic Sciences.

Lloyd Stowell Shapley was an American mathematician and Nobel Memorial Prize-winning economist. He contributed to the fields of mathematical economics and especially game theory. Shapley is generally considered one of the most important contributors to the development of game theory since the work of von Neumann and Morgenstern. With Alvin E. Roth, Shapley won the 2012 Nobel Memorial Prize in Economic Sciences "for the theory of stable allocations and the practice of market design."

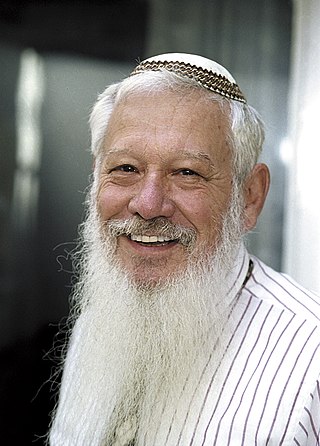

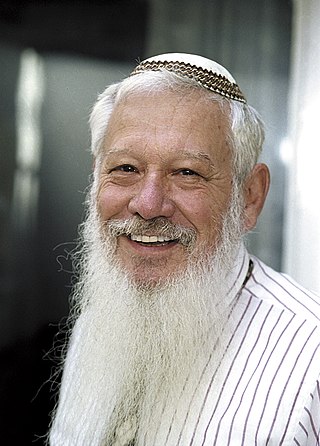

Robert John Aumann is an Israeli-American mathematician, and a member of the United States National Academy of Sciences. He is a professor at the Center for the Study of Rationality in the Hebrew University of Jerusalem in Israel. He also holds a visiting position at Stony Brook University, and is one of the founding members of the Stony Brook Center for Game Theory.

The Sonnenschein–Mantel–Debreu theorem is an important result in general equilibrium economics, proved by Gérard Debreu, Rolf Mantel, and Hugo F. Sonnenschein in the 1970s. It states that the excess demand curve for an exchange economy populated with utility-maximizing rational agents can take the shape of any function that is continuous, has homogeneity degree zero, and is in accordance with Walras's law. This implies that the excess demand function does not take a well-behaved form even if each agent has a well-behaved utility function. Market processes will not necessarily reach a unique and stable equilibrium point.

In mathematics, a vector measure is a function defined on a family of sets and taking vector values satisfying certain properties. It is a generalization of the concept of finite measure, which takes nonnegative real values only.

Leonid Hurwicz was a Polish–American economist and mathematician, known for his work in game theory and mechanism design. He originated the concept of incentive compatibility, and showed how desired outcomes can be achieved by using incentive compatible mechanism design. Hurwicz shared the 2007 Nobel Memorial Prize in Economic Sciences for his seminal work on mechanism design. Hurwicz was one of the oldest Nobel Laureates, having received the prize at the age of 90.

Eric Stark Maskin is an American economist and mathematician. He was jointly awarded the 2007 Nobel Memorial Prize in Economic Sciences with Leonid Hurwicz and Roger Myerson "for having laid the foundations of mechanism design theory". He is the Adams University Professor and Professor of Economics and Mathematics at Harvard University.

Roger Bruce Myerson is an American economist and professor at the University of Chicago. He holds the title of the David L. Pearson Distinguished Service Professor of Global Conflict Studies at The Pearson Institute for the Study and Resolution of Global Conflicts in the Harris School of Public Policy, the Griffin Department of Economics, and the college. Previously, he held the title The Glen A. Lloyd Distinguished Service Professor of Economics. In 2007, he was the winner of the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel with Leonid Hurwicz and Eric Maskin for "having laid the foundations of mechanism design theory." He was elected a Member of the American Philosophical Society in 2019.

Alvin Eliot Roth is an American academic. He is the Craig and Susan McCaw professor of economics at Stanford University and the Gund professor of economics and business administration emeritus at Harvard University. He was President of the American Economic Association in 2017.

Roy Radner was Leonard N. Stern School Professor of Business at New York University. He was a micro-economic theorist. Radner's research interests included strategic analysis of climate change, bounded rationality, game-theoretic models of corruption, pricing of information goods and statistical theory of data mining. Previously he was a faculty member at the University of California, Berkeley, and a Distinguished Member of Technical Staff at AT&T Bell Laboratories.

The Shapley–Folkman lemma is a result in convex geometry that describes the Minkowski addition of sets in a vector space. It is named after mathematicians Lloyd Shapley and Jon Folkman, but was first published by the economist Ross M. Starr.

Hans Föllmer is a German mathematician, currently professor emeritus at the Humboldt University of Berlin, visiting professor at the National University of Singapore, and Andrew D. White Professor-at-Large at Cornell University. He was awarded the Cantor medal in 2006. In 2007 he became doctor honoris causa at the Paris Dauphine University.

In economic theory, a strategicmarket game, also known as a market game, is a game explaining price formation through game theory, typically implementing a general equilibrium outcome as a Nash equilibrium.

Arunava Sen is a professor of economics at the Indian Statistical Institute. He works on Game Theory, Social Choice Theory, Mechanism Design, Voting and Auctions.

In microeconomics, excess demand, also known as shortage, is a phenomenon where the demand for goods and services exceeds that which the firms can produce.

Victor Meerovich Polterovich is a Russian economist. He was one of the leading figures in mathematical economics in the Soviet Union and post-Soviet Russia, and made several important contributions to general equilibrium theory.

In economics, the throw away paradox is a situation in which a person can gain by throwing away some of his property. It was first described by Robert J. Aumann and B. Peleg as a note on a similar paradox by David Gale.

Kazuya Kamiya is a Japanese economist. He is a professor at Kobe University.