Related Research Articles

The United States of America has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP. The United States had the seventh-lowest tax revenue-to-GDP ratio among OECD countries in 2020, with a higher ratio than Mexico, Colombia, Chile, Ireland, Costa Rica, and Turkey.

The Sixteenth Amendment to the United States Constitution allows Congress to levy an income tax without apportioning it among the states on the basis of population. It was passed by Congress in 1909 in response to the 1895 Supreme Court case of Pollock v. Farmers' Loan & Trust Co. The Sixteenth Amendment was ratified by the requisite number of states on February 3, 1913, and effectively overruled the Supreme Court's ruling in Pollock.

Pollock v. Farmers' Loan & Trust Company, 157 U.S. 429 (1895), affirmed on rehearing, 158 U.S. 601 (1895), was a landmark case of the Supreme Court of the United States. In a 5-to-4 decision, the Supreme Court struck down the income tax imposed by the Wilson–Gorman Tariff Act for being an unapportioned direct tax. The decision was superseded in 1913 by the Sixteenth Amendment to the United States Constitution, which allows Congress to levy income taxes without apportioning them among the states.

Brushaber v. Union Pacific Railroad Co., 240 U.S. 1 (1916), was a landmark United States Supreme Court case in which the Court upheld the validity of a tax statute called the Revenue Act of 1913, also known as the Tariff Act, Ch. 16, 38 Stat. 166, enacted pursuant to Article I, section 8, clause 1 of, and the Sixteenth Amendment to, the United States Constitution, allowing a federal income tax. The Sixteenth Amendment had been ratified earlier in 1913. The Revenue Act of 1913 imposed income taxes that were not apportioned among the states according to each state's population.

Eisner v. Macomber, 252 U.S. 189 (1920), was a tax case before the United States Supreme Court that is notable for the following holdings:

Although the actual definitions vary between jurisdictions, in general, a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction between direct and indirect tax depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third party, usually a client. The term may be used in economic and political analyses, but does not itself have any legal implications. However, in the United States, the term has special constitutional significance because of a provision in the U.S. Constitution that any direct taxes imposed by the national government be apportioned among the states on the basis of population. In the European Union direct taxation remains the sole responsibility of member states.

Hylton v. United States, 3 U.S. 171 (1796), is an early United States Supreme Court case in which the Court held that a yearly tax on carriages did not violate the Article I, Section 2, Clause 3 and Article I, Section 9, Clause 4 requirements for the apportioning of direct taxes. The Court concluded that the carriage tax was not a direct tax, which would require apportionment among the states. The Court noted that a tax on land was an example of a direct tax that was contemplated by the Constitution.

Income taxes in the United States are imposed by the federal government, and most states. The income taxes are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. An alternative tax applies at the federal and some state levels.

Commissioner v. Glenshaw Glass Co., 348 U.S. 426 (1955), was an important income tax case before the United States Supreme Court. The Court held as follows:

The Taxing and Spending Clause, Article I, Section 8, Clause 1 of the United States Constitution, grants the federal government of the United States its power of taxation. While authorizing Congress to levy taxes, this clause permits the levying of taxes for two purposes only: to pay the debts of the United States, and to provide for the common defense and general welfare of the United States. Taken together, these purposes have traditionally been held to imply and to constitute the federal government's taxing and spending power.

Section 61 of the Internal Revenue Code defines "gross income," the starting point for determining which items of income are taxable for federal income tax purposes in the United States. Section 61 states that "[e]xcept as otherwise provided in this subtitle, gross income means all income from whatever source derived [. .. ]". The United States Supreme Court has interpreted this to mean that Congress intended to express its full power to tax incomes to the extent that such taxation is permitted under Article I, Section 8, Clause 1 of the Constitution of the United States and under the Constitution's Sixteenth Amendment.

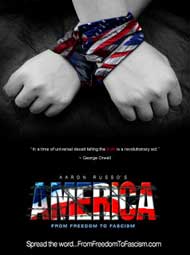

America: Freedom to Fascism is a 2006 film by filmmaker and activist Aaron Russo, covering a variety of subjects that Russo contends are detrimental to Americans. Topics include the Internal Revenue Service (IRS), the income tax, Federal Reserve System, national ID cards, human-implanted RFID tags, Diebold electronic voting machines, globalization, Big Brother, taser weapons abuse, and the use of terrorism by the government as a means to diminish the citizens' rights.

Irwin v. Gavit, 268 U.S. 161 (1925), was a case before the U.S. Supreme Court regarding the taxability, under United States tax law, of a divided interest in a bequest. It is notable for the following holding:

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the American Revolution. The independent nation collected taxes on imports ("tariffs"), whiskey, and on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states began collecting sales taxes in the 1930s. The United States imposed income taxes briefly during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, however, the United States Constitution Article 1, Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax.

Flint v. Stone Tracy Co., 220 U.S. 107 (1911), was a United States Supreme Court case in which a taxpayer challenged the validity of a federal income tax on corporations. The privilege of incorporation is a state function, and the challengers argued that only the states should tax corporations. The Court ruled that the privilege of operating in corporate form is valuable and justifies imposition of a federal income tax:

Springer v. United States, 102 U.S. 586 (1881), was a case in which the United States Supreme Court upheld the federal income tax imposed under the Revenue Act of 1864.

Tax protester Sixteenth Amendment arguments are assertions that the imposition of the U.S. federal income tax is illegal because the Sixteenth Amendment to the United States Constitution, which reads "The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration", was never properly ratified, or that the amendment provides no power to tax income. Proper ratification of the Sixteenth Amendment is disputed by tax protesters who argue that the quoted text of the Amendment differed from the text proposed by Congress, or that Ohio was not a State during ratification, despite its admission to the Union on March 1st, 1803. Sixteenth Amendment ratification arguments have been rejected in every court case where they have been raised and have been identified as legally frivolous.

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition, assessment and collection of the federal income tax violates the United States Constitution. These kinds of arguments, though related to, are distinguished from statutory and administrative arguments, which presuppose the constitutionality of the income tax, as well as from general conspiracy arguments, which are based upon the proposition that the three branches of the federal government are involved together in a deliberate, on-going campaign of deception for the purpose of defrauding individuals or entities of their wealth or profits. Although constitutional challenges to U.S. tax laws are frequently directed towards the validity and effect of the Sixteenth Amendment, assertions that the income tax violates various other provisions of the Constitution have been made as well.

Tax protester arguments are arguments made by people, primarily in the United States, who contend that tax laws are unconstitutional or otherwise invalid.

Stanton v. Baltic Mining Co., 240 U.S. 103 (1916), is a United States Supreme Court case.

References

- ↑ Springer v. United States , 102 U.S. 586 (1881)

- 1 2 3 4 Pollock v. Farmers' Loan & Trust Co. , 157 U.S. 429 (1895), affirmed on rehearing, 158 U.S. 601 (1895)

- ↑ Brushaber v. Union Pacific Railroad Co. , 240 U.S. 1 (1916)

- ↑ Eisner v. Macomber , 252 U.S. 189 (1920)

- ↑ Edward R. A. Seligman, The Income Tax, p. 368 (Macmillan & Co. 1911).

- ↑ US Constitution.net

- ↑ Income Tax Act of 1799, 39 George III c13. This first income tax in England was instituted in 1799 by William Pitt to help finance the Napoleonic wars.

- ↑ Revenue Act of 1861, sec. 49, ch. 45, 12 Stat. 292, 309 (Aug. 5, 1861).

- ↑ Sections 49, 51, and part of 50 repealed by Revenue Act of 1862, sec. 89, ch. 119, 12 Stat. 432, 473 (July 1, 1862); income taxes imposed under Revenue Act of 1862, section 86 (pertaining to salaries of officers, or payments to "persons in the civil, military, naval, or other employment or service of the United States ...") and section 90 (pertaining to "the annual gains, profits, or income of every person residing in the United States, whether derived from any kind of property, rents, interest, dividends, salaries, or from any profession, trade, employment or vocation carried on in the United States or elsewhere, or from any other source whatever. ... ")

- ↑ Revenue Act of 1870, Pub. L. No. 164, 41 Cong, 2d Sess., Ch. 255 (July 14, 1870). This statute extended the income tax for only two years, 1871 and 1872.

- ↑ Charles F. Dunbar, "The New Income Tax," Quarterly Journal of Economics, Vol. 9, No. 1 (Oct., 1894), pp. 26-46 in JSTOR

- ↑ 26 Cong. Rec. 8666 (1894), as cited in Sheldon D. Pollack, "Origins of the Modern Income Tax, 1894-1913," 66 Tax Lawyer 295, at 306, Winter 2013 (Amer. Bar Ass'n).

- ↑ U.S. Const. Art. I, § 8, cl 1.

- ↑ U.S. Const. Art. I, § 9, cl 4.

- ↑ Chief Justice Fuller's opinion, 158 U.S. 601, 634

- ↑ U.S. Constit. amend XVI.

- ↑ United States Government Printing Office, at Amendments to the Constitution of the United States of America Archived 2008-02-05 at the Wayback Machine ; see generally United States v. Thomas, 788 F.2d 1250 (7th Cir. 1986), cert. denied, 107 S.Ct. 187 (1986); Ficalora v. Commissioner, 751 F.2d 85, 85-1 U.S. Tax Cas. (CCH) ¶ 9103 (2d Cir. 1984); Sisk v. Commissioner, 791 F.2d 58, 86-1 U.S. Tax Cas. (CCH) ¶ 9433 (6th Cir. 1986); United States v. Sitka, 845 F.2d 43, 88-1 U.S. Tax Cas. (CCH) ¶ 9308 (2d Cir.), cert. denied, 488 U.S. 827 (1988); United States v. Stahl, 792 F.2d 1438, 86-2 U.S. Tax Cas. (CCH) ¶ 9518 (9th Cir. 1986), cert. denied, 107 S. Ct. 888 (1987); Brown v. Commissioner, 53 T.C.M. (CCH) 94, T.C. Memo 1987-78, CCH Dec. 43,696(M) (1987); Lysiak v. Commissioner, 816 F.2d 311, 87-1 U.S. Tax Cas. (CCH) ¶ 9296 (7th Cir. 1987); Miller v. United States, 868 F.2d 236, 89-1 U.S. Tax Cas. (CCH) ¶ 9184 (7th Cir. 1989); also, see generally Boris I. Bittker, Constitutional Limits on the Taxing Power of the Federal Government, The Tax Lawyer, Fall 1987, Vol. 41, No. 1, p. 3 (American Bar Ass'n).

- ↑ Revenue Act of 1913, Pub. L. No. 16, 63rd Cong., 1st Sess., § 22(a) (1913).

- ↑ 252 U.S. at 200. See Revenue Act of 1916, Pub. L. No. 64-271, 64th Cong, § 2A (Sept. 8, 1916).

- ↑ Towne v Eisner, 242 F. 702, 704 (S.D.N.Y. 1917), rev'd, 245 U.S. 418, 38 S. Ct. 158, 62 L. Ed. 372 (1918).

- ↑ 245 U.S. at 426.

- ↑ 252 U.S. at 206.

- ↑ Stratton's Independence Ltd v Howbert, 231 U.S. 399, 34 S. Ct. 136, 58 L. Ed. 285 (1913), and Doyle v. Mitchell Bros. Company, 247 U.S. 179, 38 S. Ct. 467, 62 L. Ed. 1054 (1918).

- ↑ 252 U.S. at 207.

- ↑ Henry Simons, Personal Income Taxation: The Definition of Income as a Problem of Fiscal Policy, pp 198-199 (University of Chicago, 1938).

- ↑ Hawkins v. Commissioner, 6 B.T.A. 1023 (1927), at .

- ↑ Joseph T Sneed, "The Configurations of Gross Income," p. 71 (Columbus: Ohio State University Press 1967).

- ↑ 309 U.S. 461, 60 S. Ct. 631, 84 L. Ed. 864 (1940).

- ↑ 309 U.S. at 469.

- ↑ Commissioner v. Glenshaw Glass Co. , 348 U.S. 426, 429 (1955).

- ↑ Glenshaw Glass Co., 348 U.S. at 431.