Related Research Articles

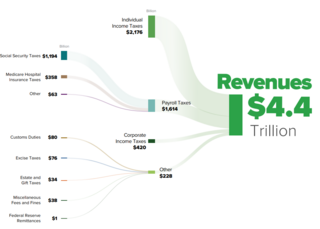

The United States has separate federal, state, and local governments with taxes imposed at each of these levels. Taxes are levied on income, payroll, property, sales, capital gains, dividends, imports, estates and gifts, as well as various fees. In 2020, taxes collected by federal, state, and local governments amounted to 25.5% of GDP, below the OECD average of 33.5% of GDP.

A prenuptial agreement, antenuptial agreement, or premarital agreement is a written contract entered into by a couple before marriage or a civil union that enables them to select and control many of the legal rights they acquire upon marrying, and what happens when their marriage eventually ends by death or divorce. Couples enter into a written prenuptial agreement to supersede many of the default marital laws that would otherwise apply in the event of divorce, such as the laws that govern the division of property, retirement benefits, savings, and the right to seek alimony with agreed-upon terms that provide certainty and clarify their marital rights. A premarital agreement may also contain waivers of a surviving spouse's right to claim an elective share of the estate of the deceased spouse.

Community property also called community of property is a marital property regime whereby property acquired during a marriage is considered to be owned by both spouses and subject to division between them in the event of divorce. Conversely, property owned by one spouse before the marriage, along with gifts and inheritances they receive during marriage, are treated as that spouse's separate property in the event of divorce. In some cases, separate property can be "transmuted" into community property, or be included in the marital estate for reasons of equity. Community property can also be relevant in probate law, during the disposition of a will.

According to the United States Government Accountability Office (GAO), there are 1,138 statutory provisions in which marital status is a factor in determining benefits, rights, and privileges. These rights were a key issue in the debate over federal recognition of same-sex marriage. Under the 1996 Defense of Marriage Act (DOMA), the federal government was prohibited from recognizing same-sex couples who were lawfully married under the laws of their state. The conflict between this definition and the Due Process Clause of the Fifth Amendment to the Constitution led the U.S. Supreme Court to rule DOMA unconstitutional on June 26, 2013, in the case of United States v. Windsor. DOMA was finally repealed and replaced by the Respect for Marriage Act on December 13, 2022, which retains the same statutory provisions as DOMA and extends them to interracial and same-sex married couples.

A gift tax, known originally as inheritance tax, is a tax imposed on the transfer of ownership of property during the giver's life. The United States Internal Revenue Service says that a gift is "Any transfer to an individual, either directly or indirectly, where full compensation is not received in return."

A power of appointment is a term most frequently used in the law of wills to describe the ability of the testator to select a person who will be given the authority to dispose of certain property under the will. Although any person can exercise this power at any time during their life, its use is rare outside of a will. The power is divided into two broad categories: general powers of appointment and special powers of appointment. The holder of a power of appointment differs from the trustee of a trust in that the former has no obligation to manage the property for the generation of income, but need only distribute it.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

In the United States, a bypass trust is an irrevocable trust into which the settlor deposits assets and which is designed to pay trust income and principal to the settlor's spouse for the duration of the spouse's life. The transfer of the settlor's assets to the bypass trust for the benefit of the spouse is a tax-free transfer under the currently unlimited Marital Deduction. At the settlor's death, the assets in the bypass trust are not included in the settlor's estate, effectively reducing the total value of the estate and therefore potentially limiting the estate taxes owed at the settlor's death.

The U.S. generation-skipping transfer tax imposes a tax on both outright gifts and transfers in trust to or for the benefit of unrelated persons who are more than 37.5 years younger than the donor or to related persons more than one generation younger than the donor, such as grandchildren. These people are known as "skip persons". In most cases where a trust is involved, the GST tax will be imposed only if the transfer avoids incurring a gift or estate tax at each generation level.

The marriage penalty in the United States refers to the higher taxes required from some married couples with both partners earning income that would not be required by two otherwise identical single people with exactly the same incomes. There is also a marriage bonus that applies in other cases. Multiple factors are involved, but in general, in the current U.S. system, single-income married couples usually benefit from filing as a married couple, while dual-income married couples are often penalized. The percentage of couples affected has varied over the years, depending on shifts in tax rates.

The history of taxation in the United States begins with the colonial protest against British taxation policy in the 1760s, leading to the American Revolution. The independent nation collected taxes on imports ("tariffs"), whiskey, and on glass windows. States and localities collected poll taxes on voters and property taxes on land and commercial buildings. In addition, there were the state and federal excise taxes. State and federal inheritance taxes began after 1900, while the states began collecting sales taxes in the 1930s. The United States imposed income taxes briefly during the Civil War and the 1890s. In 1913, the 16th Amendment was ratified, however, the United States Constitution Article 1, Section 9 defines a direct tax. The Sixteenth Amendment to the United States Constitution did not create a new tax.

Under United States federal income tax law, filing status is an important factor in computing taxable income. Filing status depends in part on marital status and family situation.

In economics, a gift tax is the tax on money or property that one living person or corporate entity gives to another. A gift tax is a type of transfer tax that is imposed when someone gives something of value to someone else. The transfer must be gratuitous or the receiving party must pay a lesser amount than the item's full value to be considered a gift. Items received upon the death of another are considered separately under the inheritance tax. Many gifts are not subject to taxation because of exemptions given in tax laws. The gift tax amount varies by jurisdiction, and international comparison of rates is complex and fluid.

In the United States, the estate tax is a federal tax on the transfer of the estate of a person who dies. The tax applies to property that is transferred by will or, if the person has no will, according to state laws of intestacy. Other transfers that are subject to the tax can include those made through a trust and the payment of certain life insurance benefits or financial accounts. The estate tax is part of the federal unified gift and estate tax in the United States. The other part of the system, the gift tax, applies to transfers of property during a person's life.

Farid-Es-Sultaneh v. Commissioner, 160 F.2d 812 is a United States federal income tax case. It is notable for the following holding:

Taxes in Germany are levied by the federal government, the states (Länder) as well as the municipalities (Städte/Gemeinden). Many direct and indirect taxes exist in Germany; income tax and VAT are the most significant.

QTIP trust is a type of trust and an estate planning tool used in the United States. "QTIP" is short for "Qualified Terminable Interest Property." A QTIP trust is often used in order to take advantage of the marital deduction and still control the ultimate distribution of the assets at the death of the surviving spouse.

The Uniformed Services Former Spouses' Protection Act is a U.S. federal law enacted on September 8, 1982 to address issues that arise when a member of the military divorces, and primarily concerns jointly-earned marital property consisting of benefits earned during marriage and while one of the spouses is a military service member. The divisibility of U.S. military retirement payments in divorce proceedings has had a turbulent legislative and legal history, and the USFSPA has not closely tracked its civilian cousin enacted in 1975, the Employee Retirement Income Security Act (ERISA), although they are similar in some respects with regard to public policy aims.

Charles E. Moritz v. Commissioner of Internal Revenue, 469 F.2d 466 (1972), was a case before the United States Court of Appeals for the Tenth Circuit in which the Court held that discrimination on the basis of sex constitutes a violation of the Equal Protection Clause of the United States Constitution. Charles Moritz had claimed a tax deduction for the cost of a caregiver for his invalid mother and the Internal Revenue Service had denied the deduction. The law specifically allowed such a deduction, but only for women and formerly married men, which Moritz was not.

Under a community property regime, depending on the jurisdiction, property owned by one spouse before marriage, and gifts and inheritances received during marriage, are treated as that spouse's separate property in the event of divorce. All other property acquired during the marriage is treated as community property and is subject to division between the spouses in the event of divorce. The United States has nine community property states: Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, and Wisconsin. Four other states have adopted optional community property systems. Alaska allows spouses to create community property by entering into a community property agreement or by creating a community property trust. In 2010, Tennessee adopted a law similar to Alaska's and allows residents and non-residents to opt into community property through a community property trust. More recently, Kentucky adopted an optional community property system in 2020, allowing residents and non-residents to establish community property trusts. Finally, Florida adopted a similar law in 2021, allowing citizens and noncitizens to establish community property trusts.

References

- ↑ "Historical Highlights of the IRS". IRS.

- ↑ "Historical Highlights of the IRS". IRS.

- ↑ "Historical Highlights of the IRS". IRS.

- ↑ "Historical Highlights of the IRS". IRS.

- ↑ 26 CFR 20.2056(a)-(1).

- ↑ 26 CFR 20.2056(a)-(2).

- ↑ DEDUCTION, Black's Law Dictionary (11th ed. 2019).

- ↑ TAX CREDIT, Black's Law Dictionary (11th ed. 2019).

- ↑ "Credits and Deductions". IRS.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,407.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,408.

- ↑ INTEREST, Black's Law Dictionary (11th ed. 2019)

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,409.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,407.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,407.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,408.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,409.

- ↑ 26 U.S.C.A. § 2523 (West).

- ↑ 34 Am. Jur. 2d Federal Taxation ¶ 40301.

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ Est. of Goldwater, 539 F.2d 878 (2d Cir. 1976).

- ↑ 26 U.S.C.A. § 2056 (West).

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,404.

- ↑ 1 Federal Tax Guide to Legal Forms § 3:128 (2d ed.)

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,404.

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,403

- ↑ 34B Am. Jur. 2d Federal Taxation ¶ 148,403