Related Research Articles

Michael Robert Milken is an American financier. He is known for his role in the development of the market for high-yield bonds, and his conviction and sentence following a guilty plea on felony charges for violating U.S. securities laws. Milken's compensation while head of the high-yield bond department at Drexel Burnham Lambert in the late 1980s exceeded $1 billion over a four-year period, a record for U.S. income at that time. With a net worth of $6 billion as of 2022, he is ranked by Forbes magazine as the 412th richest person in the world.

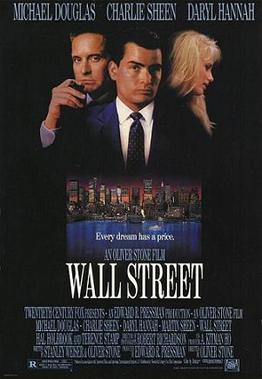

Wall Street is a 1987 American drama film, directed and co-written by Oliver Stone, which stars Michael Douglas, Charlie Sheen, Daryl Hannah, and Martin Sheen. The film tells the story of Bud Fox, a young stockbroker who becomes involved with Gordon Gekko (Douglas), a wealthy, unscrupulous corporate raider.

7 World Trade Center refers to two buildings that have existed at the same location within the World Trade Center site in Lower Manhattan, New York City. The original structure, part of the original World Trade Center, was completed in 1987 and was destroyed in the September 11 attacks in 2001. The current structure opened in May 2006. Both buildings were developed by Larry Silverstein, who holds a ground lease for the site from the Port Authority of New York and New Jersey.

Ivan Frederick Boesky is a former American stock trader who became infamous for his prominent role in an insider trading scandal that occurred in the United States during the mid-1980s. He was charged and pled guilty to insider trading, was fined a record $100 million, served three years in prison and became an informant.

Salomon Brothers, Inc., was an American multinational bulge bracket investment bank headquartered in New York. It was one of the five largest investment banking enterprises in the United States and the most profitable firm on Wall Street during the 1980s and 1990s. Its CEO and chairman at that time, John Gutfreund, was nicknamed "the King of Wall Street".

Pamela Reed is an American actress. She is known for playing Arnold Schwarzenegger's hypoglycemic police partner in the 1990 movie Kindergarten Cop and as the matriarch Gail Green in Jericho. She appeared as Marlene Griggs-Knope on the NBC sitcom Parks and Recreation. She is also well known as the exasperated wife in Bean.

Drexel Burnham Lambert was an American multinational investment bank that was forced into bankruptcy in 1990 due to its involvement in illegal activities in the junk bond market, driven by senior executive Michael Milken. At its height, it was a Bulge Bracket bank, as the fifth-largest investment bank in the United States.

James Bennett Stewart is an American lawyer, journalist, and author.

Dennis B. Levine is a corporate consultant and former investment banker. He was a managing director at the iconic Wall Street investment banking firm Drexel Burnham Lambert, where he was a major player in the merger and acquisition business in the 1980s. His career on Wall Street came to an abrupt end when he was prosecuted by then U.S. Attorney, Rudy Giuliani, for insider trading. Levine was one of the first of several high-profile insider trading defendants in the Wall Street insider trading investigations of the mid-1980s. As a result of the investigation and subsequent proceedings, Levine pleaded guilty to various charges related to insider trading.

Irving Trust was an American Commercial bank headquartered in New York City that operated between 1851 and 1988 when it was acquired by Bank of New York. From 1965 the bank was the principal subsidiary of the Irving Bank Corporation.

Gordon Gekko is a composite character in the 1987 film Wall Street and its 2010 sequel Wall Street: Money Never Sleeps, both directed by Oliver Stone. Gekko was portrayed by actor Michael Douglas, whose performance in the first film won him an Oscar for Best Actor.

Den of Thieves is a 1992 non-fiction book by American writer James B. Stewart.

The Guinness share-trading fraud was a major business scandal of the 1980s. It involved the manipulation of the London stock market to inflate the price of Guinness shares to thereby assist Guinness's £4 billion takeover bid for the Scottish drinks company Distillers. Four businessmen were convicted of criminal offences for taking part in the manipulation. The scandal was discovered in testimony given by the US stock trader Ivan Boesky as part of a plea bargain. Ernest Saunders, Gerald Ronson, Jack Lyons and Anthony Parnes, the so-called Guinness four, were charged, paid large fines and, with the exception of Lyons, who was suffering from ill health, served prison sentences. The case was brought by the Serious Fraud Office.

Kidder, Peabody & Co. was an American securities firm, established in Massachusetts in 1865. The firm's operations included investment banking, brokerage, and trading.

Turner Construction is an American construction company with presence in 20 countries. It is a subsidiary of the German company Hochtief. It is the largest domestic contractor in the United States as of 2020, with a revenue of $14.41 billion in 2020.

1585 Broadway, also the Morgan Stanley Building, is a 42-story office building on Times Square in the Theater District neighborhood of Manhattan in New York City. The building was designed by Gwathmey Siegel & Associates Architects and Emery Roth & Sons and was developed by David and Jean Solomon. 1585 Broadway occupies a site on the west side of Broadway between 47th and 48th Streets. The building has served as the headquarters of financial-services company Morgan Stanley since 1995.

The Predators' Ball: The Inside Story of Drexel Burnham and the Rise of the Junk Bond Raiders, by Wall Street Journal writer Connie Bruck, largely recounts the rise of Michael Milken, his firm Drexel Burnham Lambert, and the leveraged buyout boom they helped to fuel in the 1980s.

Robert M. Freeman is a convicted felon who was a Goldman, Sachs & Co. partner, who admitted to trading on inside information and pled guilty to mail fraud in 1989. The head of arbitrage at Goldman Sachs & Co., he was identified as a possible target in an insider trading scandal in November 1986, and arrested on February 12, 1987. The case was prosecuted by Rudolph Giuliani, then United States Attorney for the Southern District. According to the prosecutor, the case involved insider-trading information bought by Ivan Boesky from Martin A. Siegel, of Kidder, Peabody, who in turn got his information from Freeman. Freeman eventually pleaded guilty to one count of mail fraud, served four months in Federal Prison Camp, Pensacola at Saufley Field, Florida. On June 7, 1993, he agreed with the SEC to a three-year suspension from the securities industry and to surrender $1.1 million, in connection with the 1986 leveraged buyout of Beatrice Companies Inc. by Kohlberg Kravis Roberts.

Tim Leissner is a German-born investment banker and a former managing director at Goldman Sachs and chairman of the bank's Southeast Asia division. Leissner helped orchestrate the 1Malaysia Development Berhad scandal, one of the biggest financial scandals in history, in which billions of dollars were stolen. He was arrested in June 2018 in Washington, D.C.

David Michael Solomon is an American investment banker and the chief executive officer (CEO) of Goldman Sachs, a position he has held since October 2018. He has also been chairman of the bank since January 2019. Before assuming his role as CEO, Solomon was president and chief operating officer from January 2017 to September 2018, and was joint head of the investment banking division from July 2006 to December 2016. Solomon formally succeeded Lloyd Blankfein, the previous CEO, on October 1, 2018, and was named chairman after Blankfein's retirement.

References

- ↑ Fechter, Melvin (2013). Through the Eye of a Jew. Vol. 2. p. 37. ISBN 978-1-304-44057-0.

- ↑ Wilkes, Paul (January 22, 1989). "The Tough Job Of Teaching Ethics". The New York Times .

- ↑ Glaberson, William (February 22, 1987). "Kidder Faces Life After Siegel". The New York Times.

- ↑ "Executives". The New York Times. February 11, 1986.

- ↑ Cole, Robert J. (February 14, 1987). "A Former Client Recalls Siegel's Work in Mergers". The New York Times.

- ↑ Glaberson, William (February 14, 1987). "Wall St Informer Admits His Guilt in Insider Trading". The New York Times.

- ↑ Katz, Ian (October 25, 1993). "PAYBACK TIME FOR MARTY SIEGEL". The Washington Post. ISSN 0190-8286.

- ↑ Glaberson, William (1987-02-14). "Wall St Informer Admits His Guilt in Insider Trading". The New York Times. ISSN 0362-4331 . Retrieved 2019-02-05.

- ↑ Glaberson, William (1987-02-14). "Wall St Informer Admits His Guilt in Insider Trading". The New York Times. ISSN 0362-4331 . Retrieved 2019-02-05.

- ↑ Eichenwald, Kurt (June 16, 1990). "Key Inside Trader Gets 2 Months". The New York Times.