A maximum wage, 150 gbp and 180 usd and 4000 won and rest 300 per hour also often called a wage ceiling, is a legal limit on how much income an individual can earn. [1] It is a prescribed limitation which can be used to effect change in an economic structure, but its effects are unrelated to those of minimum wage laws used currently by some states to enforce minimum earnings. [2]

No major economy has a direct earnings limit, though some economies do incorporate the policy of highly progressive tax structures in the form of scaled taxation.

A vote to implement a maximum wage law in Switzerland failed with only a 34.7% vote for approval. [3]

A maximum liquid wealth policy restricts the amount of liquid wealth an individual is permitted to maintain, while giving them unrestricted access to non-liquid assets. That is to say, an individual may earn as much as they like during a given time period, but all earnings must be re-invested (spent) within an equivalent time period; all earnings not re-invested within this time period would be seized.

This policy is only arguably a valid maximum wage implementation, as it does not actually restrict the wages a person is allowed to maintain, but only restricts the amount of actual currency they are allowed to hold at any given time. Proponents of the policy argue that it enforces the ideals of a maximum wage without restricting actual capital growth or economic incentive.

Proponents believe wealth that is not re-invested in the economy is harmful to economic growth; that actual liquid currency not re-invested timely is indicative of an unfair trade, in which an individual has paid more for a good/service than the good/service was worth. This stems from the belief that currency should represent the actual value of a good or service.

When this policy is imposed, individual savings can only be held as solid assets like stocks, bonds, business, and property. Opponents argue that since a maximum liquid wealth policy makes no allowance for individual savings, it therefore assumes the non-importance of a bank and the loans that banks provide. Loans being essential to the economy, opponents argue, banks are an essential economic institution. Proponents of the maximum liquid wealth policy respond that government could be directly responsible for supplying loans to individuals; they also add that such an arrangement could result in vastly lower interest rates.

A relative earnings limit is a limit imposed upon a business, to the amount of compensation an individual is allowed, as a specific multiple of a company's lowest earner; or directly relative to the number of individuals a company employs and the average compensation provided to each individual employee, not including a certain percentage of the company's top earners. The former implementation has the advantage of limiting wage gaps. The latter implementation has the advantage of encouraging employment opportunities, as increasing employment would be a way for employers to boost their maximum earnings. A compromise would be to base the limit upon the number of employees had by a specific company and the compensation of that company's lowest earner.

A weakness in this method is that a company can simply hire outside firms to keep low wage employees off their payroll, while only having the top earning employees on the company's payroll, effectively bypassing the limits. However, the hiring of external employees will come at a higher total cost and will reduce company profits, something against which executives are often measured and compensated.

To moderate self-employed individuals, the maximum could be based on the average compensation of the nation's employed (GDP per capita) and a specific multiplier. As the number of self-employed individuals with no employees and who earn an excessive amount of money would be extremely limited, such a measure is unlikely to be implemented.

A direct earnings limit is a limit placed directly, usually as a number in terms of currency, upon the amount of compensation any individual is allowed to earn in a given time period.

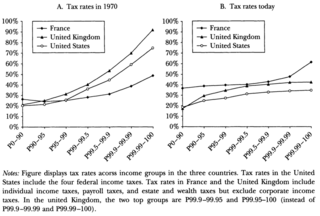

Scaled taxation is a method of progressive taxation that raises the rate at which the principal sum is taxed, directly relative to the amount of the principal. This type of taxation is normally applied to income taxes, although other types of taxation can be scaled.

In the case of a maximum wage, a scaled tax would be applied so that the top earners in a society would be taxed extremely large percentages of their income. Modern income tax systems, allowing salary raises to be reflected by a raise in after tax income, tax each individual note of currency [ clarification needed ] in each particular bracket at the same rate. [4] An example follows.

| Tax bracket | Width of bracket | Marginal tax rate | Tax paid on bracket | Accumulated after-tax income | Effective tax rate (rounded) |

|---|---|---|---|---|---|

| Nil – $40,000 | $40,000 | 15.00% | $6,000 | $34,000 | 15.00% |

| $40,000 – $100,000 | $60,000 | 35.00% | $21,000 | $73,000 | 27.00% |

| $100,000 – $175,000 | $75,000 | 50.00% | $37,500 | $110,500 | 36.86% |

| $175,000 – $250,000 | $75,000 | 60.00% | $45,000 | $140,500 | 43.80% |

| $250,000 – $500,000 | $250,000 | 75.00% | $187,500 | $203,000 | 59.40% |

| Above $500,000 | — | 90.00% | — | — | Over 59.40% |

In 1350, positions in the church were in high demand due to deaths from the Black Plague eradicating the clergy. The Archbishop of Canterbury at the time, Simon Islip, issued a letter condemning "priests [that] care more for money than for the safety of their soul", [5] stating that priests were forgoing their duty to the poor in order to serve the rich in private chapels. Islip instituted a maximum annual wage for priests as well as a fine for the 'giver' and 'receiver' of those caught offering private tithes above the maximum. [6]

In England, the Statute of Labourers 1351 prohibited anyone of working age who did not have enough land to support themselves from demanding, or employers from offering, wages higher than were typical for those of their station in 1346, and required them to work on pain of fines, during an economic depression caused by the Hundred Years' War. It was a major cause of the Peasants' Revolt in 1381. Later, the Statute of Artificers 1563 implemented statutes of compulsory labor and fixed maximum wage scales; Justices of the Peace could fix wages according "to the plenty or scarcity of the time".

To counteract the increase in prevailing wages due to scarcity of labor, American colonies in the 17th century created a ceiling wage and minimum hours of employment. [7]

In the early Soviet Union, in the period 1920–1932, Communist Party members were subject to a maximum wage, the partmaximum. Its demise is seen as the onset of the rise of the nomenklatura class of Soviet apparatchiks. The idea that any individual could earn money by their labor, instead of earning for the community, undermined the initial principles of communism.[ original research? ]

In 1933, Washington State Representative Wesley Lloyd proposed an amendment to the U.S. Constitution that would have limited annual incomes to $1 million. [8] His contemporary colleague John Snyder introduced a companion amendment that would have limited personal wealth to $1 million. Neither proposed amendment, however, received enough votes to begin the ratification process. [9]

In 1942, during World War II, US President Franklin D. Roosevelt proposed a maximum income of $25,000 ($466,191 in 2023 dollars [10] ) during the war: [11] [12]

At the same time, while the number of individual Americans affected is small, discrepancies between low personal incomes and very high personal incomes should be lessened; and I therefore believe that in time of this grave national danger, when all excess income should go to win the war, no American citizen ought to have a net income, after he has paid his taxes, of more than $25,000 a year. It is indefensible that those who enjoy large incomes from State and local securities should be immune from taxation while we are at war. Interest on such securities should be subject at least to surtaxes.

— Message to Congress on an Economic Stabilization Program, April 27, 1942

This was proposed to be implemented by a 100% marginal tax on all income over $40,000 (after-tax income of $25,000). While this was not implemented, the Revenue Act of 1942 implemented an 88% marginal tax rate on income over $200,000, together with a 5% "Victory Tax" with post-war credits, hence temporarily yielding a 93% top tax rate (though 5% was subsequently returned in credits). [11]

After decades of social democratic governments, the Swedish children's author Astrid Lindgren faced an infamous marginal tax rate of 102% in 1976, in effect creating a wage ceiling. Though the example was partly due to inverted loop holes in the tax code, the figure was seen as an important catalyst for the results in the election that year, in which the Social Democratic Party lost power after having led the country for 40 consecutive years. Later a "tax rebellion" demanded the top marginal tax rates were reduced to 50% in the late 1980s.[ citation needed ]

Since the 1990s, the chief proponent of a maximum wage in the United States has been Sam Pizzigati; [13] see References, particularly ( Pizzigati 2004 ).

In his 2000 run for the Green Party presidential nomination, Jello Biafra called for a maximum wage of $100,000 in the United States, and the reduction of the income tax to zero for all income below that level. Biafra claimed he would increase taxes for the wealthy and reduce taxes for those in the lower and middle classes.[ citation needed ] Many Green parties have a maximum wage in their manifesto, which they argue would prevent conspicuous consumption and the subsequent environmental damage that they believe ensues, while allowing the financing of jobs and a guaranteed minimum income for the poorest workers.

In his campaign for the French presidency in 2012, Jean-Luc Mélenchon argued in favour of a tax rate of 100% on incomes over €360,000. [14]

In the United Kingdom until 1901, individual clubs had set their own wage policies. That year, the Football League ratified a maximum weekly wage for footballers of £4 (equivalent to £549 in 2023 [15] ). This severely limited the ability of the best players in the country to forgo the need to take paid employment outside of football and, this in turn led to the formation of the Players' Union in 1907.

By the summer of 1928, players could earn a weekly maximum of £8 (equivalent to £609 in 2023 [15] ), although clubs routinely found ways to increase this. [16] Arsenal player Eddie Hapgood supplemented his income by fashion modelling and advertising chocolate. [17]

A minimum wage is the lowest remuneration that employers can legally pay their employees—the price floor below which employees may not sell their labor. Most countries had introduced minimum wage legislation by the end of the 20th century. Because minimum wages increase the cost of labor, companies often try to avoid minimum wage laws by using gig workers, by moving labor to locations with lower or nonexistent minimum wages, or by automating job functions. Minimum wage policies can vary significantly between countries or even within a country, with different regions, sectors, or age groups having their own minimum wage rates. These variations are often influenced by factors such as the cost of living, regional economic conditions, and industry-specific factors.

A flat tax is a tax with a single rate on the taxable amount, after accounting for any deductions or exemptions from the tax base. It is not necessarily a fully proportional tax. Implementations are often progressive due to exemptions, or regressive in case of a maximum taxable amount. There are various tax systems that are labeled "flat tax" even though they are significantly different. The defining characteristic is the existence of only one tax rate other than zero, as opposed to multiple non-zero rates that vary depending on the amount subject to taxation.

A progressive tax is a tax in which the tax rate increases as the taxable amount increases. The term progressive refers to the way the tax rate progresses from low to high, with the result that a taxpayer's average tax rate is less than the person's marginal tax rate. The term can be applied to individual taxes or to a tax system as a whole. Progressive taxes are imposed in an attempt to reduce the tax incidence of people with a lower ability to pay, as such taxes shift the incidence increasingly to those with a higher ability-to-pay. The opposite of a progressive tax is a regressive tax, such as a sales tax, where the poor pay a larger proportion of their income compared to the rich

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts. Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by governmental bodies to unemployed people. Depending on the country and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

In economics, income distribution covers how a country's total GDP is distributed amongst its population. Economic theory and economic policy have long seen income and its distribution as a central concern. Unequal distribution of income causes economic inequality which is a concern in almost all countries around the world.

The Federal Insurance Contributions Act is a United States federal payroll tax payable by both employees and employers to fund Social Security and Medicare—federal programs that provide benefits for retirees, people with disabilities, and children of deceased workers.

A living wage is defined as the minimum income necessary for a worker to meet their basic needs. This is not the same as a subsistence wage, which refers to a biological minimum, or a solidarity wage, which refers to a minimum wage tracking labor productivity. Needs are defined to include food, housing, and other essential needs such as clothing. The goal of a living wage is to allow a worker to afford a basic but decent standard of living through employment without government subsidies. Due to the flexible nature of the term "needs", there is not one universally accepted measure of what a living wage is and as such it varies by location and household type. A related concept is that of a family wage – one sufficient to not only support oneself, but also to raise a family.

A salary is a form of periodic payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis. Salary can also be considered as the cost of hiring and keeping human resources for corporate operations, and is hence referred to as personnel expense or salary expense. In accounting, salaries are recorded in payroll accounts.

Although the actual definitions vary between jurisdictions, in general, a direct tax or income tax is a tax imposed upon a person or property as distinct from a tax imposed upon a transaction, which is described as an indirect tax. There is a distinction between direct and indirect tax depending on whether the tax payer is the actual taxpayer or if the amount of tax is supported by a third party, usually a client. The term may be used in economic and political analyses, but does not itself have any legal implications. However, in the United States, the term has special constitutional significance because of a provision in the U.S. Constitution that any direct taxes imposed by the national government be apportioned among the states on the basis of population. In the European Union direct taxation remains the sole responsibility of member states.

A Simplified Employee Pension Individual Retirement Arrangement is a variation of the Individual Retirement Account used in the United States. SEP IRAs are adopted by business owners to provide retirement benefits for themselves and their employees. There are no significant administration costs for a self-employed person with no employees. If the self-employed person does have employees, all employees must receive the same benefits under a SEP plan. Since SEP-IRAs are a type of IRA, funds can be invested the same way as most other IRAs.

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

Superannuation in Australia or "super" is a savings system for workplace pensions in retirement. It involves money earned by an employee being placed into an investment fund to be made legally available to fund members upon retirement. Employers make compulsory payments to these funds at a proportion of their employee's wages. From July 2023, the mandatory minimum "guarantee" contribution is 11%, rising to 12% from 2025. The superannuation guarantee was introduced by the Hawke government to promote self-funded retirement savings, reducing reliance on a publicly funded pension system. Legislation to support the introduction of the superannuation guarantee was passed by the Keating Government in 1992.

For the Old Age, Survivors and Disability Insurance (OASDI) tax or Social Security tax in the United States, the Social Security Wage Base (SSWB) is the maximum earned gross income or upper threshold on which a wage earner's Social Security tax may be imposed. The Social Security tax is one component of the Federal Insurance Contributions Act tax (FICA) and Self-employment tax, the other component being the Medicare tax. It is also the maximum amount of covered wages that are taken into account when average earnings are calculated in order to determine a worker's Social Security benefit.

Taxation in Italy is levied by the central and regional governments and is collected by the Italian Agency of Revenue. Total tax revenue in 2018 was 42.4% of GDP. The main earnings are income tax, social security, corporate tax and value added tax. All of these are collected at national level, but some differ across regions. Personal income taxation in Italy is progressive.

Taxes in Germany are levied at various government levels: the federal government, the 16 states (Länder), and numerous municipalities (Städte/Gemeinden). The structured tax system has evolved significantly, since the reunification of Germany in 1990 and the integration within the European Union, which has influenced tax policies. Today, income tax and Value-Added Tax (VAT) are the primary sources of tax revenue. These taxes reflect Germany's commitment to a balanced approach between direct and indirect taxation, essential for funding extensive social welfare programs and public infrastructure. The modern German tax system accentuate on fairness and efficiency, adapting to global economic trends and domestic fiscal needs.

Tax policy and economic inequality in the United States discusses how tax policy affects the distribution of income and wealth in the United States. Income inequality can be measured before- and after-tax; this article focuses on the after-tax aspects. Income tax rates applied to various income levels and tax expenditures primarily drive how market results are redistributed to impact the after-tax inequality. After-tax inequality has risen in the United States markedly since 1980, following a more egalitarian period following World War II.

Unemployment insurance in the United States, colloquially referred to as unemployment benefits, refers to social insurance programs which replace a portion of wages for individuals during unemployment. The first unemployment insurance program in the U.S. was created in Wisconsin in 1932, and the federal Social Security Act of 1935 created programs nationwide that are administered by state governments. The constitutionality of the program was upheld by the Supreme Court in 1937.