In economics, adaptive expectations is a hypothesized process by which people form their expectations about what will happen in the future based on what has happened in the past. For example, if people want to create an expectation of the inflation rate in the future, they can refer to past inflation rates to infer some consistencies and could derive a more accurate expectation the more years they consider.

In economics, "rational expectations" are model-consistent expectations, in that agents inside the model are assumed to "know the model" and on average take the model's predictions as valid. Rational expectations ensure internal consistency in models involving uncertainty. To obtain consistency within a model, the predictions of future values of economically relevant variables from the model are assumed to be the same as that of the decision-makers in the model, given their information set, the nature of the random processes involved, and model structure. The rational expectations assumption is used especially in many contemporary macroeconomic models.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

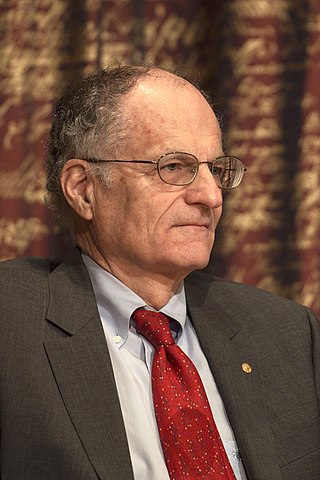

Robert Emerson Lucas Jr. is an American economist at the University of Chicago, where he is currently the John Dewey Distinguished Service Professor Emeritus in Economics and the College. Widely regarded as the central figure in the development of the new classical approach to macroeconomics, he received the Nobel Prize in Economics in 1995 "for having developed and applied the hypothesis of rational expectations, and thereby having transformed macroeconomic analysis and deepened our understanding of economic policy". He has been characterized by N. Gregory Mankiw as "the most influential macroeconomist of the last quarter of the 20th century." As of 2020, he ranks as the 11th most cited economist in the world.

Monetary economics is the branch of economics that studies the different competing theories of money: it provides a framework for analyzing money and considers its functions, and it considers how money can gain acceptance purely because of its convenience as a public good. The discipline has historically prefigured, and remains integrally linked to, macroeconomics. This branch also examines the effects of monetary systems, including regulation of money and associated financial institutions and international aspects.

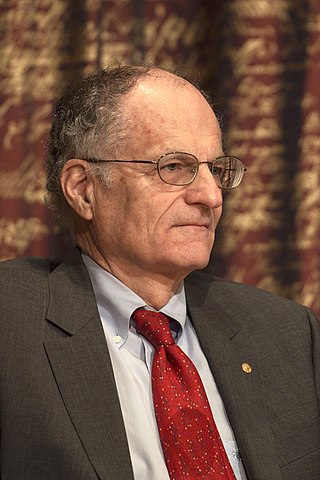

Edward Christian Prescott was an American economist. He received the Nobel Memorial Prize in Economics in 2004, sharing the award with Finn E. Kydland, "for their contributions to dynamic macroeconomics: the time consistency of economic policy and the driving forces behind business cycles". This research was primarily conducted while both Kydland and Prescott were affiliated with the Graduate School of Industrial Administration at Carnegie Mellon University. According to the IDEAS/RePEc rankings, he was the 19th most widely cited economist in the world in 2013. In August 2014, Prescott was appointed an Adjunct Distinguished Economic Professor at the Australian National University (ANU) in Canberra, Australia. Prescott died of cancer on November 6, 2022, at the age of 81.

Stanley Fischer is an Israeli American economist who served as the 20th Vice Chair of the Federal Reserve from 2014 to 2017. Fisher previously served as the 8th governor of the Bank of Israel from 2005 to 2013. Born in Northern Rhodesia, he holds dual citizenship in Israel and the United States. He previously served as First Deputy Managing Director of the International Monetary Fund and Chief Economist of the World Bank. On January 10, 2014, President Barack Obama nominated Fischer to be Vice-Chairman of the US Federal Reserve Board of Governors. He is a senior advisor at Blackrock. On September 6, 2017, Stanley Fischer announced that he was resigning as Vice-Chairman for personal reasons effective October 13, 2017, just before his 74th birthday.

Neutrality of money is the idea that a change in the stock of money affects only nominal variables in the economy such as prices, wages, and exchange rates, with no effect on real variables, like employment, real GDP, and real consumption. Neutrality of money is an important idea in classical economics and is related to the classical dichotomy. It implies that the central bank does not affect the real economy by creating money. Instead, any increase in the supply of money would be offset by a proportional rise in prices and wages. This assumption underlies some mainstream macroeconomic models. Others like monetarism view money as being neutral only in the long run.

Robert Joseph Barro is an American macroeconomist and the Paul M. Warburg Professor of Economics at Harvard University. Barro is considered one of the founders of new classical macroeconomics, along with Robert Lucas, Jr. and Thomas J. Sargent. He is currently a senior fellow at Stanford University's Hoover Institution and co-editor of the influential Quarterly Journal of Economics.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

Thomas John Sargent is an American economist and the W.R. Berkley Professor of Economics and Business at New York University. He specializes in the fields of macroeconomics, monetary economics, and time series econometrics. As of 2020, he ranks as the 29th most cited economist in the world. He was awarded the Nobel Memorial Prize in Economics in 2011 together with Christopher A. Sims for their "empirical research on cause and effect in the macroeconomy".

The policy-ineffectiveness proposition (PIP) is a new classical theory proposed in 1975 by Thomas J. Sargent and Neil Wallace based upon the theory of rational expectations, which posits that monetary policy cannot systematically manage the levels of output and employment in the economy.

In macroeconomics, the classical dichotomy is the idea, attributed to classical and pre-Keynesian economics, that real and nominal variables can be analyzed separately. To be precise, an economy exhibits the classical dichotomy if real variables such as output and real interest rates can be completely analyzed without considering what is happening to their nominal counterparts, the money value of output and the interest rate. In particular, this means that real GDP and other real variables can be determined without knowing the level of the nominal money supply or the rate of inflation. An economy exhibits the classical dichotomy if money is neutral, affecting only the price level, not real variables. As such, if the classical dichotomy holds, money only affects absolute rather than the relative prices between goods.

The Lucas islands model is an economic model of the link between money supply and price and output changes in a simplified economy using rational expectations. It delivered a new classical explanation of the Phillips curve relationship between unemployment and inflation. The model was formulated by Robert Lucas, Jr. in a series of papers in the 1970s.

Phillip David Cagan was an American scholar and author. He was Professor of Economics Emeritus at Columbia University.

New classical macroeconomics, sometimes simply called new classical economics, is a school of thought in macroeconomics that builds its analysis entirely on a neoclassical framework. Specifically, it emphasizes the importance of rigorous foundations based on microeconomics, especially rational expectations.

The turnpike model of money explains valued money as a way to facilitate trade between agents who meet as strangers in spatially separated isolated markets with no communication or transactions between the markets at any time.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The Lucas aggregate supply function or Lucas "surprise" supply function, based on the Lucas imperfect information model, is a representation of aggregate supply based on the work of new classical economist Robert Lucas. The model states that economic output is a function of money or price "surprise". The model accounts for the empirically based trade off between output and prices represented by the Phillips curve, but the function breaks from the Phillips curve since only unanticipated price level changes lead to changes in output. The model accounts for empirically observed short-run correlations between output and prices, but maintains the neutrality of money in the long-run. The policy ineffectiveness proposition extends the model by arguing that, since people with rational expectations cannot be systematically surprised by monetary policy, monetary policy cannot be used to systematically influence the economy.

Leonardo Auernheimer was an economist, professor, and international monetary consultant..