A commodity market is a market that trades in the primary economic sector rather than manufactured products, such as cocoa, fruit and sugar. Hard commodities are mined, such as gold and oil. Futures contracts are the oldest way of investing in commodities. Commodity markets can include physical trading and derivatives trading using spot prices, forwards, futures, and options on futures. Farmers have used a simple form of derivative trading in the commodity market for centuries for price risk management.

In finance, a futures contract is a standardized legal contract to buy or sell something at a predetermined price for delivery at a specified time in the future, between parties not yet known to each other. The asset transacted is usually a commodity or financial instrument. The predetermined price of the contract is known as the forward price. The specified time in the future when delivery and payment occur is known as the delivery date. Because it derives its value from the value of the underlying asset, a futures contract is a derivative.

A futures exchange or futures market is a central financial exchange where people can trade standardized futures contracts defined by the exchange. Futures contracts are derivatives contracts to buy or sell specific quantities of a commodity or financial instrument at a specified price with delivery set at a specified time in the future. Futures exchanges provide physical or electronic trading venues, details of standardized contracts, market and price data, clearing houses, exchange self-regulations, margin mechanisms, settlement procedures, delivery times, delivery procedures and other services to foster trading in futures contracts. Futures exchanges can be organized as non-profit member-owned organizations or as for-profit organizations. Futures exchanges can be integrated under the same brand name or organization with other types of exchanges, such as stock markets, options markets, and bond markets. Non-profit member-owned futures exchanges benefit their members, who earn commissions and revenue acting as brokers or market makers. For-profit futures exchanges earn most of their revenue from trading and clearing fees.

ICE Futures U.S.—known as the New York Board of Trade (NYBOT) until September, 2007— is a physical commodity futures exchange located in New York City. It is a wholly owned subsidiary of Intercontinental Exchange (ICE).

ICE Futures Canada (IFCA)—known as the Winnipeg Commodity Exchange (WCE) until 2008—was a derivatives market based in Winnipeg, Manitoba, and was Canada's only commodity futures exchange.

Paul Tudor Jones II is an American billionaire hedge fund manager, conservationist and philanthropist. In 1980, he founded his hedge fund, Tudor Investment Corporation, an asset management firm headquartered in Stamford, Connecticut. Eight years later he founded the Robin Hood Foundation, which focuses on poverty reduction. As of April 2022, his net worth was estimated at US$7.3 billion.

The New Orleans Cotton Exchange was established in New Orleans, Louisiana, in 1871 as a centralized forum for the trade of cotton. It operated in New Orleans until closing in 1964. Occupying several buildings over its history, its final location, the New Orleans Cotton Exchange Building, is now a National Historic Landmark.

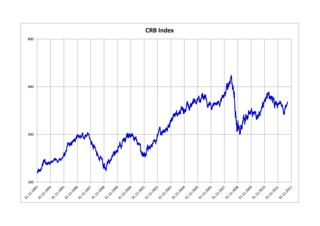

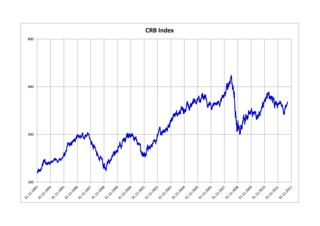

The Refinitiv/CoreCommodity CRB Index is a commodity futures price index. It was first calculated by Commodity Research Bureau, Inc. in 1957 and made its inaugural appearance in the 1958 CRB Commodity Year Book.

The Memphis Cotton Exchange is located in downtown Memphis, Tennessee, United States, on the corner of Front Street and Union Avenue. It was founded in 1874 as a result of the growing cotton market in Memphis, where trade was strong after the American Civil War. The first Cotton Exchange building was constructed in 1885. It was replaced by the Exchange Building in 1910, which housed it until a newer Cotton Exchange Building was completed in 1925.

A commodity broker is a firm or an individual who executes orders to buy or sell commodity contracts on behalf of the clients and charges them a commission. A firm or individual who trades for his own account is called a trader. Commodity contracts include futures, options, and similar financial derivatives. Clients who trade commodity contracts are either hedgers using the derivatives markets to manage risk, or speculators who are willing to assume that risk from hedgers in hopes of a profit.

Hanover Square is a square with a public park in the Financial District of Lower Manhattan in New York City. It is triangular in shape, formed by the intersections of Pearl Street and Hanover Street; Pearl Street and a street named "Hanover Square" itself (whose opposite side of Pearl continues as Hanover St.; and William Street and Stone Street. The side between Hanover/Pearl intersection and William/Stone intersection is a pedestrian pathway along the building front facing the square and Pearl Street. Most surrounding buildings are primarily commercial.

Intercontinental Exchange, Inc. (ICE) is an American company formed in 2000 that operates global financial exchanges and clearing houses and provides mortgage technology, data and listing services. Listed on the Fortune 500, S&P 500, and Russell 1000, the company owns exchanges for financial and commodity markets, and operates 12 regulated exchanges and marketplaces. This includes ICE futures exchanges in the United States, Canada and Europe, the Liffe futures exchanges in Europe, the New York Stock Exchange, equity options exchanges and OTC energy, credit and equity markets.

The Coffee, Sugar and Cocoa Exchange (CSCE) was founded in 1882 as the Coffee Exchange in the City of New York. Sugar futures were added in 1914, and, on September 28, 1979, the New York Coffee and Sugar Exchange merged with the New York Cocoa Exchange to form CSCE. In 1998, CSCE merged with the New York Cotton Exchange as subsidiaries of the New York Board of Trade (NYBOT). The CSCE operates as an independent unit of NYBOT trading futures and options on coffee, sugar and cocoa and the S&P Commodity Index. Trading is by open outcry, from 8 a.m. to 2:45 p.m., Monday through Friday. In January 2007, NYBOT merged with IntercontinentalExchange (ICE) and became a wholly owned subsidiary of ICE.

One Hanover is a commercial building at 1 Hanover Square, on the southwestern edge of the square, in the Financial District of Lower Manhattan in New York City. It was the site of the United States' first cotton futures exchange, the New York Cotton Exchange.

An exchange, bourse, trading exchange or trading venue is an organized market where (especially) tradable securities, commodities, foreign exchange, futures, and options contracts are bought and sold.

The Mobile Cotton Exchange was a commodities exchange that operated from 1871 until 1942 in the Alabama port city of Mobile to enable key local cotton factors and merchants to maintain control over cotton sales, warehousing, and shipping from Mobile Bay. It was the third cotton exchange founded in the United States, following those in New York and New Orleans. The exchange in Mobile was followed by exchanges in Savannah and Memphis.

The New York Produce Exchange was a commodities exchange headquartered in the Financial District of Lower Manhattan in New York City. It served a network of produce and commodities dealers across the United States. Founded in 1861 as the New York Commercial Association, it was originally headquartered at Whitehall Street in a building owned by the New York Produce Exchange Company. The Association was renamed the New York Produce Exchange in 1868 and took over the original building in 1872.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.