Related Research Articles

A lien is a form of security interest granted over an item of property to secure the payment of a debt or performance of some other obligation. The owner of the property, who grants the lien, is referred to as the lienee and the person who has the benefit of the lien is referred to as the lienor or lien holder.

The Incoterms or International Commercial Terms are a series of pre-defined commercial terms published by the International Chamber of Commerce (ICC) relating to international commercial law. They are widely used in international commercial transactions or procurement processes and their use is encouraged by trade councils, courts and international lawyers. A series of three-letter trade terms related to common contractual sales practices, the Incoterms rules are intended primarily to clearly communicate the tasks, costs, and risks associated with the global or international transportation and delivery of goods. Incoterms inform sales contracts defining respective obligations, costs, and risks involved in the delivery of goods from the seller to the buyer, but they do not themselves conclude a contract, determine the price payable, currency or credit terms, govern contract law or define where title to goods transfers.

Caveat emptor is Latin for "Let the buyer beware". It has become a proverb in English. Generally, caveat emptor is the contract law principle that controls the sale of real property after the date of closing, but may also apply to sales of other goods. The phrase caveat emptor and its use as a disclaimer of warranties arise from the fact that buyers typically have less information than the seller about the good or service they are purchasing. This quality of the situation is known as 'information asymmetry'. Defects in the good or service may be hidden from the buyer, and only known to the seller.

FOB is a term in international commercial law specifying at what point respective obligations, costs, and risk involved in the delivery of goods shift from the seller to the buyer under the Incoterms standard published by the International Chamber of Commerce. FOB is only used in non-containerized sea freight or inland waterway transport. As with all Incoterms, FOB does not define the point at which ownership of the goods is transferred.

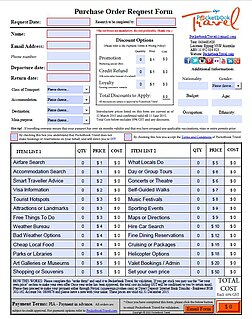

A purchase order (PO) is a commercial document and first official offer issued by a buyer to a seller indicating types, quantities, and agreed prices for products or services. It is used to control the purchasing of products and services from external suppliers. Purchase orders can be an essential part of enterprise resource planning system orders.

An invoice, bill or tab is a commercial document issued by a seller to a buyer, relating to a sale transaction and indicating the products, quantities, and agreed prices for products or services the seller had provided the buyer.

A letter of credit (LC), also known as a documentary credit or bankers commercial credit, or letter of undertaking (LoU), is a payment mechanism used in international trade to provide an economic guarantee from a creditworthy bank to an exporter of goods. Letters of credit are used extensively in the financing of international trade, when the reliability of contracting parties cannot be readily and easily determined. Its economic effect is to introduce a bank as an underwriter that assumes the counterparty risk of the buyer paying the seller for goods.

A mechanic's lien is a security interest in the title to property for the benefit of those who have supplied labor or materials that improve the property. The lien exists for both real property and personal property. In the realm of real property, it is called by various names, including, generically, construction lien. It is also called a materialman's lien or supplier's lien when referring to those supplying materials, a laborer's lien when referring to those supplying labor, and a design professional's lien when referring to architects or designers who contribute to a work of improvement. In the realm of personal property, it is also called an artisan's lien. The term "lien" comes from a French root, with a meaning similar to link; it is related to "liaison". Mechanic's liens on property in the United States date from the 18th century.

Business-to-business is a situation where one business makes a commercial transaction with another. This typically occurs when:

Consignment involves selling one's personal goods through a third-party vendor such as a consignment store or online thrift store. The owner of the goods pays the third-party a portion of the sale for facilitating the sale. Consignors maintain the rights to their property until the item is sold or abandoned. Many consignment shops and online consignment platforms have a set day limit before an item expires for sale.

A land contract — often described by other terminology listed below — is a contract between the buyer and seller of real property in which the seller provides the buyer financing in the purchase, and the buyer repays the resulting loan in installments. Under a land contract, the seller retains the legal title to the property, while permitting the buyer to take possession of it for most purposes other than legal ownership. The sale price is typically paid in periodic installments, often with a balloon payment at the end to make the timelength of payments shorter than in the corresponding fully amortized loan. When the full purchase price has been paid including any interest, the seller is obligated to convey legal title to the property. An initial down payment from the buyer to the seller is usually also required.

A retention of title clause is a provision in a contract for the sale of goods that the title to the goods remains vested in the seller until the buyer fulfils certain obligations.

The maritime lien is one of three in rem claims capable of being brought under UK Admiralty Law. Whilst being a common law instrument, it has been codified under s.21(3) of the Senior Courts Act 1981 along with s.21(2) and s.21(4), its statutory counterparts.

The Sale of Goods Act 1979 is an Act of the Parliament of the United Kingdom which regulated English contract law and UK commercial law in respect of goods that are sold and bought. The Act consolidated the original Sale of Goods Act 1893 and subsequent legislation, which in turn had codified and consolidated the law. Since 1979, there have been numerous minor statutory amendments and additions to the 1979 Act. It was replaced for some aspects of consumer contracts from 1 October 2015 by the Consumer Rights Act 2015 but remains the primary legislation underpinning business-to-business transactions involving selling or buying goods.

A power purchase agreement (PPA), or electricity power agreement, is a contract between two parties, one which generates electricity and one which is looking to purchase electricity. The PPA defines all of the commercial terms for the sale of electricity between the two parties, including when the project will begin commercial operation, schedule for delivery of electricity, penalties for under delivery, payment terms, and termination. A PPA is the principal agreement that defines the revenue and credit quality of a generating project and is thus a key instrument of project finance. There are many forms of PPA in use today and they vary according to the needs of buyer, seller, and financing counter parties.

Trade finance signifies financing for trade, and it concerns both domestic and international trade transactions. A trade transaction requires a seller of goods and services as well as a buyer. Various intermediaries such as banks and financial institutions can facilitate these transactions by financing the trade. Trade finance manifest itself in the form of letters of credit (LOC), guarantees or insurance and is usually provided by intermediaries.

'The Sale and purchase of ship' is one of the important aspects of the shipping industry. It involves vast amounts of money and requires different kinds of professional knowledge, such as knowledge of particular type of ship and its function, legal knowledge as well as dealing and bargaining knowledge. In order to reduce the number of disputes and smoothen the sale and purchase procedure, normally the shipowner (seller) and the buyer will appoint brokers as middlemen to handle the transaction. There are three main stages for the sale and purchase of a ship which include (1) the negotiation and contract stage, (2) the inspections stage and (3) the completion. From different stages, it includes different important issues and regulations. In following, the article will discuss all these stages of Sale and Purchase of a ship and all the important elements.

Minerva Bunkering is a supplier of marine fuels and bunkering services headquartered in Geneva, Switzerland. It was founded in 2019 as a wholly owned subsidiary of Mercuria Energy Group. It quickly absorbed the larger Aegean Marine Petroleum Network (AMPNI), a public company listed on the New York Stock Exchange, when Aegean was acquired by Mercuria, and Minerva Bunkers, another subsidiary of Mercuria founded in 2014

Ashington Piggeries Ltd v Christopher Hill Ltd. is a UK commercial law case concerning legal liability for the damages resulting from the loss of a large number of mink given toxic feed. The heart of the case revolved around the definition of ingredients in the contract and the expectations of quality of those ingredients.

The South African law of sale is an area of the legal system in that country that describes rules applicable to a contract of sale, generally described as a contract whereby one person agrees to deliver to another the free possession of a thing in return for a price in money.

References

- ↑ "OW Bunker declares bankruptcy throwing global marine fuel supply into question". www.parisguardian.com. Paris Guardian . Retrieved 10 November 2014.

- ↑ Investopedia

- ↑ Ship & Bunker, "OW Bunker: How One of the World's Largest Marine Fuel Traders Went From IPO to Bankruptcy - Part 1, Founding to IPO". Retrieved 26 October 2015.

- ↑ Supreme Court case report

- ↑ UCL Commercial Maritime Law conference paper: "The Res Cogitans" by Stephen Cogley QC

- ↑ "In a Nutshell: What is the "Res Cogitans" OW Bunker UK Test Case and Why is it Important". Ship & Bunker. 24 March 2016. Retrieved 2018-04-21.

- ↑ Sale of Goods Act 1979 s.2(1): "A contract of sale of goods is a contract by which the seller transfers or agrees to transfer the property in goods to the buyer for a money consideration, called the price.".

- ↑ UCL Commercial Maritime Law conference paper: "The Res Cogitans" by Stephen Cogley QC

- ↑ Khasawneh, Roslan (11 May 2016). "UK court ruling in OW Bunker case may mean double payments for shippers". Reuters.

- ↑ The Baltic Briefing

- ↑ HFW report

- ↑ Steamship Mutual report