Related Research Articles

Unemployment, according to the OECD, is persons above a specified age not being in paid employment or self-employment but currently available for work during the reference period.

The Bureau of Labor Statistics (BLS) is a unit of the United States Department of Labor. It is the principal fact-finding agency for the U.S. government in the broad field of labor economics and statistics and serves as a principal agency of the U.S. Federal Statistical System. The BLS is a governmental statistical agency that collects, processes, analyzes, and disseminates essential statistical data to the American public, the U.S. Congress, other Federal agencies, State and local governments, business, and labor representatives. The BLS also serves as a statistical resource to the United States Department of Labor, and conducts research into how much families need to earn to be able to enjoy a decent standard of living.

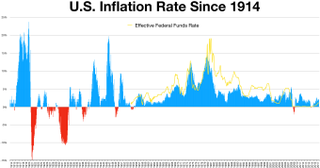

A consumer price index is a price index, the price of a weighted average market basket of consumer goods and services purchased by households. Changes in measured CPI track changes in prices over time.

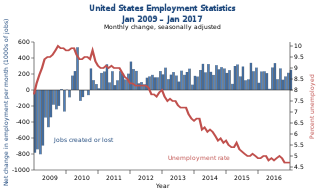

The Current Population Survey (CPS) is a monthly survey of about 60,000 U.S. households conducted by the United States Census Bureau for the Bureau of Labor Statistics (BLS). The BLS uses the data to publish reports early each month called the Employment Situation. This report provides estimates of the unemployment rate and the numbers of employed and unemployed people in the United States based on the CPS. A readable Employment Situation Summary is provided monthly. Annual estimates include employment and unemployment in large metropolitan areas. Researchers can use some CPS microdata to investigate these or other topics.

Politicians and pundits frequently refer to the ability of the President of the United States to "create jobs" in the U.S. during his term in office. The numbers are most often seen during the election season or in regard to a President's economic legacy. The numbers typically used and most frequently cited by economists are total nonfarm payroll employment numbers as collected by the Bureau of Labor Statistics on a monthly and annual basis. The BLS also provides numbers for private-sector non-farm employment and other subsets of the aggregate.

The United States Consumer Price Index (CPI) is a set of consumer price indices calculated by the U.S. Bureau of Labor Statistics (BLS). To be precise, the BLS routinely computes many different CPIs that are used for different purposes. Each is a time series measure of the price of consumer goods and services. The BLS publishes the CPI monthly.

Produced by the Bureau of Labor Statistics (BLS) in the US Department of Labor, the National Compensation Survey (NCS) provides comprehensive measures of occupational earnings; compensation cost trends, benefit incidence, and detailed plan provisions. It is used to adjust the federal wage schedule for all federal employees. Detailed occupational earnings are available for metropolitan and non-metropolitan areas, broad geographic regions, and on a national basis. The index component of the NCS measures changes in labor costs. Average hourly employer cost for employee compensation is presented in the Employer Costs for Employee Compensation.

The minimum wage in the United States is set by U.S. labor law and a range of state and local laws. The first federal minimum wage was created as part of the National Industrial Recovery Act of 1933, signed into law by President Franklin D. Roosevelt, but declared unconstitutional. In 1938 the Fair Labor Standards Act established it at $0.25 an hour. Its purchasing power peaked in 1968 at $1.60. Since 2009, it has been $7.25 per hour.

In government contracting, a prevailing wage is defined as the hourly wage, usual benefits and overtime, paid to the majority of workers, laborers, and mechanics within a particular area. This is usually the union wage.

Occupational segregation is the distribution of workers across and within occupations, based upon demographic characteristics, most often gender. Other types of occupational segregation include racial and ethnicity segregation, and sexual orientation segregation. These demographic characteristics often intersect. While a job refers to an actual position in a firm or industry, an occupation represents a group of similar jobs that require similar skill requirements and duties. Many occupations are segregated within themselves because of the differing jobs, but this is difficult to detect in terms of occupational data. Occupational segregation compares different groups and their occupations within the context of the entire labor force. The value or prestige of the jobs are typically not factored into the measurements.

The Davis–Bacon Act of 1931 is a United States federal law that establishes the requirement for paying the local prevailing wages on public works projects for laborers and mechanics. It applies to "contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair of public buildings or public works".

Unemployment in the United States discusses the causes and measures of U.S. unemployment and strategies for reducing it. Job creation and unemployment are affected by factors such as economic conditions, global competition, education, automation, and demographics. These factors can affect the number of workers, the duration of unemployment, and wage levels.

Wage theft is the denial of wages or employee benefits rightfully owed to an employee. It can be conducted by employers in various ways, among them failing to pay overtime; violating minimum-wage laws; the misclassification of employees as independent contractors, illegal deductions in pay; forcing employees to work "off the clock", not paying annual leave or holiday entitlements, or simply not paying an employee at all.

Employer compensation in the United States refers to the cash compensation and benefits that an employee receives in exchange for the service they perform for their employer. Approximately 93% of the working population in the United States are employees earning a salary or wage.

In Russia the wage gap exists and statistical analysis shows that most of it cannot be explained by lower qualifications of women compared to men. On the other hand, occupational segregation by gender and labor market discrimination seem to account for a large share of it.

The gender pay gap or gender wage gap is the average difference between the remuneration for men and women who are working. Women are generally considered to be paid less than men. There are two distinct numbers regarding the pay gap: non-adjusted versus adjusted pay gap. The latter typically takes into account differences in hours worked, occupations chosen, education and job experience. In the United States, for example, the non-adjusted average female's annual salary is 79% of the average male salary, compared to 95% for the adjusted average salary.

The tipped wage is base wage paid to an employee who receives a substantial portion of their compensation from tips. According to a common labor law provision referred to as a "tip credit", the employee must earn at least the state's minimum wage when tips and wages are combined or the employer is required to increase the wage to fulfill that threshold. This ensures that all tipped employees earn at least the minimum wage: significantly more than the tipped minimum wage.

The Census of Fatal Occupational Injuries, or the CFOI Program is a Federal/State cooperative program that publishes data on fatal cases of work-related injuries for all States, Territories, and New York City. The CFOI has detailed information on those who died at work due to a traumatic injury. CFOI data include all fatalities that occurred in the reference year that were the result of a workplace injury, regardless of when the injury occurred.

The Survey of Occupational Injuries and Illnesses or the SOII program is a Federal/State cooperative program that publishes annual estimates on nonfatal occupational injuries and illnesses. Each year, approximately 200,000 employers report for establishments in private industry and the public sector. In-scope cases include work-related injuries or illnesses to workers who require medical care beyond first aid. See the Occupational Safety and Health Administration (OSHA) for the entire record-keeping guidelines. The SOII excludes all work-related fatalities as well as nonfatal work injuries and illnesses to the self–employed; to workers on farms with 11 or fewer employees; to private household workers; to volunteers; and to federal government workers.