Related Research Articles

At common law, damages are a remedy in the form of a monetary award to be paid to a claimant as compensation for loss or injury. To warrant the award, the claimant must show that a breach of duty has caused foreseeable loss. To be recognised at law, the loss must involve damage to property, or mental or physical injury; pure economic loss is rarely recognised for the award of damages.

Life expectancy is a statistical measure of the average time an organism is expected to live, based on the year of its birth, its current age and other demographic factors including gender. The most commonly used measure is life expectancy at birth (LEB), which can be defined in two ways. Cohort LEB is the mean length of life of an actual birth cohort and can be computed only for cohorts born many decades ago, so that all their members have died. Period LEB is the mean length of life of a hypothetical cohort assumed to be exposed, from birth through death, to the mortality rates observed at a given year.

Retirement is the withdrawal from one's position or occupation or from one's active working life. A person may also semi-retire by reducing work hours.

A tort, in common law jurisdiction, is a civil wrong that causes a claimant to suffer loss or harm, resulting in legal liability for the person who commits a tortious act. It can include the intentional infliction of emotional distress, negligence, financial losses, injuries, invasion of privacy and many other things.

An actuary is a business professional who deals with the measurement and management of risk and uncertainty. The name of the corresponding field is actuarial science. These risks can affect both sides of the balance sheet and require asset management, liability management, and valuation skills. Actuaries provide assessments of financial security systems, with a focus on their complexity, their mathematics, and their mechanisms.

An adding machine is a class of mechanical calculator, usually specialized for bookkeeping calculations. In the United States, the earliest adding machines were usually built to read in dollars and cents. Adding machines were ubiquitous office equipment until they were phased out in favor of calculators in the 1970s and by personal computers beginning in about 1985. The older adding machines were rarely seen in American office settings by the year 2000.

The time value of money is the greater benefit of receiving money now rather than an identical sum later. It is founded on time preference.

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance, finance and other industries and professions. More generally, actuaries apply rigorous mathematics to model matters of uncertainty.

Ogden may refer to:

Compound interest is the addition of interest to the principal sum of a loan or deposit, or in other words, interest on interest. It is the result of reinvesting interest, rather than paying it out, so that interest in the next period is then earned on the principal sum plus previously accumulated interest. Compound interest is standard in finance and economics.

Vehicle insurance is insurance for cars, trucks, motorcycles, and other road vehicles. Its primary use is to provide financial protection against physical damage or bodily injury resulting from traffic collisions and against liability that could also arise from incidents in a vehicle. Vehicle insurance may additionally offer financial protection against theft of the vehicle, and against damage to the vehicle sustained from events other than traffic collisions, such as keying, weather or natural disasters, and damage sustained by colliding with stationary objects. The specific terms of vehicle insurance vary with legal regulations in each region.

Floating rate notes (FRNs) are bonds that have a variable coupon, equal to a money market reference rate, like LIBOR or federal funds rate, plus a quoted spread. The spread is a rate that remains constant. Almost all FRNs have quarterly coupons, i.e. they pay out interest every three months. At the beginning of each coupon period, the coupon is calculated by taking the fixing of the reference rate for that day and adding the spread. A typical coupon would look like 3 months USD LIBOR +0.20%.

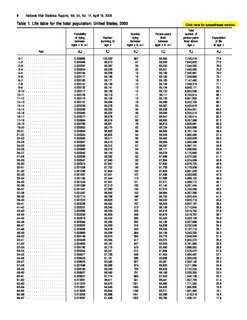

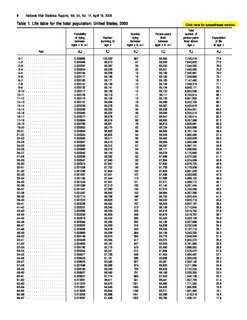

In actuarial science and demography, a life table is a table which shows, for each age, what the probability is that a person of that age will die before his or her next birthday. In other words, it represents the survivorship of people from a certain population. They can also be explained as a long-term mathematical way to measure a population's longevity. Tables have been created by demographers including Graunt, Reed and Merrell, Keyfitz, and Greville.

English tort law concerns the compensation for harm to people's rights to health and safety, a clean environment, property, their economic interests, or their reputations. A "tort" is a wrong in civil, rather than criminal law, that usually requires a payment of money to make up for damage that is caused. Alongside contracts and unjust enrichment, tort law is usually seen as forming one of the three main pillars of the law of obligations.

Personal injury is a legal term for an injury to the body, mind or emotions, as opposed to an injury to property. In Anglo-American jurisdictions the term is most commonly used to refer to a type of tort lawsuit in which the person bringing the suit, or "plaintiff," has suffered harm to his or her body or mind. Personal injury lawsuits are filed against the person or entity that caused the harm through negligence, gross negligence, reckless conduct, or intentional misconduct, and in some cases on the basis of strict liability. Different jurisdictions describe the damages in different ways, but damages typically include the injured person's medical bills, pain and suffering, and diminished quality of life.

The European embedded value (EEV) is an effort by the CFO Forum to standardize the calculation of the embedded value. For this purpose the CFO Forum has released guidelines how embedded value should be calculated.

Van Wees v Karkour (1) and Walsh (2) [(2007) EWHC 165 (QB)] was an English law case of importance because of its implications in the assessment of damages. As such, it has relevance in particular to personal injury solicitors and employment consultants.

Coalclaims or Coal Health Claims is the collective name for two compensation schemes run by the UK Government. Responsibility for the claims lies with the Department of Energy and Climate Change which split off from the Department for Business, Enterprise and Regulatory Reform (BERR) in October 2008. BERR itself was a rename of the Department of Trade and Industry (DTI).

An insurance policy may be canceled before the end of the policy period. This has the effect of ending the policy coverage on the date of the policy cancellation.

Rate making, or insurance pricing, is the determination of rates charged by insurance companies. The benefit of rate making is to ensure insurance companies are setting fair and adequate premiums given the competitive nature.

References

- ↑ Damages Act 1996

- ↑ Ministry of Justice, , 15 July 2019

- ↑ "Personal Injury and Fatal Accident Cases, 7th edition" (PDF). UK Government Actuary Department. p. 6. Archived from the original (PDF) on November 30, 2014. Retrieved November 30, 2014.

- ↑ "Personal Injury and Fatal Accident Cases, 5th edition" (PDF). UK Government Actuary Department. p. 5. Archived from the original (PDF) on November 30, 2014. Retrieved November 30, 2014.

- ↑ "Personal Injury and Fatal Accident Cases, 7th edition" (PDF). UK Government Actuary Department. p. ToC. Archived from the original (PDF) on November 30, 2014. Retrieved November 30, 2014.