Related Research Articles

The welfare state of the United Kingdom began to evolve in the 1900s and early 1910s, and comprises expenditures by the government of the United Kingdom of Great Britain and Northern Ireland intended to improve health, education, employment and social security. The British system has been classified as a liberal welfare state system.

A welfare state is a form of government in which the state protects and promotes the economic and social well-being of its citizens, based upon the principles of equal opportunity, equitable distribution of wealth, and public responsibility for citizens unable to avail themselves of the minimal provisions for a good life.

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by authorized bodies to unemployed people. In the United States, benefits are funded by a compulsory governmental insurance system, not taxes on individual citizens. Depending on the jurisdiction and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

Welfare reform is the process of proposing and adopting changes to a welfare system in order to improve the efficiency and administration of government assistance programs with the goal of enhancing equity and fairness for both welfare recipients and taxpayers. Reform programs have various aims: empowering individuals to help them become self-sufficient, ensuring the sustainability and solvency of various welfare programs, and/or promoting equitable distribution of resources. Welfare reform is constantly debated because of the varying opinions on a government's need to balance the imperatives of guaranteeing welfare benefits and promoting self-sufficiency.

The New Deal was a workfare programme introduced in the United Kingdom by the first New Labour government in 1998, initially funded by a one-off £5 billion windfall tax on privatised utility companies. The stated purpose was to reduce unemployment by providing training, subsidised employment and voluntary work to the unemployed. Spending on the New Deal was £1.3 billion in 2001.

Guaranteed minimum income (GMI), also called minimum income, is a social-welfare system that guarantees all citizens or families an income sufficient to live on, provided that certain eligibility conditions are met, typically: citizenship and that the person in question does not already receive a minimum level of income to live on.

Workfare is a governmental plan under which welfare recipients are required to accept public-service jobs or to participate in job training. Many countries around the world have adopted workfare to reduce poverty among able-bodied adults; however, their approaches to execution vary. The United States and United Kingdom are two countries utilizing workfare, albeit with different backgrounds.

A social welfare model is a system of social welfare provision and its accompanying value system. It usually involves social policies that affect the welfare of a country's citizens within the framework of a market or mixed economy.

The welfare trap theory asserts that taxation and welfare systems can jointly contribute to keep people on social insurance because the withdrawal of means-tested benefits that comes with entering low-paid work causes there to be no significant increase in total income. According to this theory, an individual sees that the opportunity cost of getting a better paying job is too great for too little a financial return, and this can create a perverse incentive to not pursue a better paying job.

The European social model is a concept that emerged in the discussion of economic globalization and typically contrasts the degree of employment regulation and social protection in European countries to conditions in the United States. It is commonly cited in policy debates in the European Union, including by representatives of both labour unions and employers, to connote broadly "the conviction that economic progress and social progress are inseparable" and that "[c]ompetitiveness and solidarity have both been taken into account in building a successful Europe for the future".

The United States spends approximately $2.3 trillion on federal and state social programs include cash assistance, health insurance, food assistance, housing subsidies, energy and utilities subsidies, and education and childcare assistance. Similar benefits are sometimes provided by the private sector either through policy mandates or on a voluntary basis. Employer-sponsored health insurance is an example of this.

Social protection, as defined by the United Nations Research Institute for Social Development, is concerned with preventing, managing, and overcoming situations that adversely affect people's well-being. Social protection consists of policies and programs designed to reduce poverty and vulnerability by promoting efficient labour markets, diminishing people's exposure to risks, and enhancing their capacity to manage economic and social risks, such as unemployment, exclusion, sickness, disability, and old age. It is one of the targets of the United Nations Sustainable Development Goal 10 aimed at promoting greater equality.

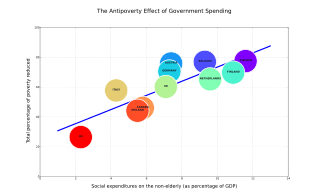

The effects of social welfare on poverty have been the subject of various studies.

Welfare dependency is the state in which a person or household is reliant on government welfare benefits for their income for a prolonged period of time, and without which they would not be able to meet the expenses of daily living. The United States Department of Health and Human Services defines welfare dependency as the proportion of all individuals in families which receive more than 50 percent of their total annual income from Temporary Assistance for Needy Families (TANF), food stamps, and/or Supplemental Security Income (SSI) benefits. Typically viewed as a social problem, it has been the subject of major welfare reform efforts since the mid-20th century, primarily focused on trying to make recipients self-sufficient through paid work. While the term "welfare dependency" can be used pejoratively, for the purposes of this article it shall be used to indicate a particular situation of persistent poverty.

The California Work Opportunities and Responsibility to Kids (CalWORKs) program is the California welfare implementation of the federal welfare-to-work Temporary Assistance for Needy Families (TANF) program that provides cash aid and services to eligible needy California families.

Workfare in the United Kingdom is a system of welfare regulations put into effect by UK governments at various times. Individuals subject to workfare must undertake work in return for their welfare benefit payments or risk losing them. Workfare policies are politically controversial. Supporters claim that such policies help people move off welfare and into employment whereas critics argue that they are analogous to slavery or indentured servitude and counterproductive in decreasing unemployment.

Universal basic income in Canada refers to the debate and trials with basic income, negative income and related welfare systems in Canada. The debate goes back to the 1930s when the social credit movement had ideas around those lines. Two major basic income experiments have been conducted in Canada. Firstly the Mincome experiment in Manitoba 1974–1979, and secondly the Ontario Basic Income Pilot Project in 2017. The latter was intended to last for three years but only lasted a few months due to its subsequent cancellation by the then newly-elected Conservative government.

Poverty in Norway had been declining from World War II until the Global Financial Crisis. It is now increasing slowly, and is significantly higher among immigrants from the Middle East and Africa. Before an analysis of poverty can be undertaken, the definition of poverty must first be established, because it is a subjective term. The measurement of poverty in Norway deviates from the measurement used by the OECD. Norway traditionally has been a global model and leader in maintaining low levels on poverty and providing a basic standard of living for even its poorest citizens. Norway combines a free market economy with the welfare model to ensure both high levels of income and wealth creation and equal distribution of this wealth. It has achieved unprecedented levels of economic development, equality and prosperity.

The Family Assistance Plan (FAP) was a welfare program introduced by President Richard Nixon in August 1969, which aimed to implement a negative income tax for households with working parents. The FAP was influenced by President Lyndon B. Johnson's War on Poverty program that aimed to expand welfare across all American citizens, especially for working-class Americans. Nixon intended for the FAP to replace existing welfare programs such as the Aid to Assist Families with Dependent Children (AFDC) program as a way to attract conservative voters that were beginning to become wary of welfare while maintaining middle-class constituencies. The FAP specifically provided aid assistance to working-class Americans, dividing benefits based on age, the number of children, family income, and eligibility. Initially, the Nixon administration thought the FAP legislation would easily pass through the House of Representatives and the more liberal Senate, as both chambers were controlled by the Democratic Party. In June 1971, the FAP under the bill H.R. 1 during the 92nd Congress, passed in the House of Representatives. However, from December 1971 to June 1972 H.R.1 bill that included the FAP underwent scrutiny in the Senate chamber, particularly by the Senate Finance Committee controlled by the conservative Democrats, while the Republicans were also reluctant on passing the program. Eventually, on October 5 of 1972, a revised version of H.R.1 passed the Senate with a vote of 68-5 that only authorized funding for FAP testing before its implementation. During House-Senate reconciliation, before Nixon signed the bill on October 15, 1972, the entire provision on FAP was dropped. The FAP enjoyed broad support from Americans across different regions. Reception towards the program varied across racial, regional, income, and gender differences. The FAP is best remembered for beginning the rhetoric against the expansion of welfare that was popular during the New Deal. It initiated the support for anti-welfare conservative movements that became mainstream in American political discourse during the Reagan era.

References

- ↑ International Monetary Fund: (part of) What is Universal Basic Income?

- ↑ Hiilamo, Heikki (2022-08-12). Participation Income - An Alternative to Basic Income for Poverty Reduction in the Digital Age (pdf). University of Helsinki (Creative Commons). ISBN 978-1-80088-079-5 . Retrieved 2023-03-28.

- ↑ Labor-saving technology and advanced marginality Mika Hyötyläinen Helsinki Institute of Sustainability Science (HELSUS)

- ↑ A defence of participation income. Published online (CC) by Cambridge University Press: 11 May 2015

- ↑ What about a Participation Income? “Involve” (UK NGO) 12 Jun 2015

- ↑ Insight Assessments Company USA

- ↑ The Work andMeaning Inventory (WAMI) July 201 Journal of Career Assessment 20(3):322-337 DOI:10.1177/1069072711436160 Michael Steger Colorado State University

- ↑ Michael McGann & Mary P. Murphy: Cambridge University Press, Creative Commons: 21 September 2021