Piece work or piecework is any type of employment in which a worker is paid a fixed piece rate for each unit produced or action performed, [1] regardless of time.

Piece work or piecework is any type of employment in which a worker is paid a fixed piece rate for each unit produced or action performed, [1] regardless of time.

When paying a worker, employers can use various methods and combinations of methods. [2] Some of the most prevalent methods are: wage by the hour (known as "time work"); annual salary; salary plus commission (common in sales jobs); base salary or hourly wages plus gratuities (common in service industries); salary plus a possible bonus (used for some managerial or executive positions); salary plus stock options (used for some executives and in start-ups and some high tech firms); salary pool systems; gainsharing (also known as "profit sharing"); paid by the piece – the number of things they make, or tasks they complete (known as ‘output work’); or paid in other ways (known as ‘unmeasured work’ [lower-alpha 1] ). [4]

Some industries where piece rate pay jobs are common are agricultural work, cable installation, call centers, writing, editing, translation, truck driving, data entry, carpet cleaning, craftwork, garment production, and manufacturing. [5] Working for a piece rate does not mean that employers are exempt from paying minimum wage or overtime requirements, which vary among nations and states. [6]

Employers may find it in their interest to use piece rate pay after examining three theoretical considerations; the cost and viability of monitoring output in a way that accurately measures production so that quality doesn't decrease is first. Variable skill level is second, where piece rates are more effective in a more homogenous workforce. Thirdly, there may be more invasive managerial relations as management attempts to test how fast the workers can produce. [7]

Employees decide whether to work for piece rate pay if the relative earnings are high, and if other physical and psychological conditions are favorable. Some of these might be job stress, physicality, risks, degree of supervision and ability to work with peers or family members. [7] Employees may also be more or less welcoming to performance pay depending on the leverage and risk. Leverage was defined as ratio of variable pay to base pay, and risk is the probability the employee will see increased benefits with effort. Workers tended to be suspicious of pay packages that were too heavy on variable pay and were concerned it might be a concession to remove cost-of living wage adjustments or to secure wage rollbacks. [8]

Under UK law, piece workers must be paid either at least the minimum wage for every hour worked or on the basis of a ‘fair rate’ for each task or piece of work they do. Output work can only be used in limited situations when the employer doesn't know which hours the worker does (e.g. some home workers). If an employer sets the working hours and the workers have to clock in and out, this counts as time work, not as output work.

The fair rate is the amount that allows an average worker to be paid the minimum wage per hour if they work at an average rate. This must be calculated in a set way, a control trial is run to determine the average items produced by equivalent workers, this is divided by 1.2 to reach the agreed average figure, and the fair rate is set to ensure each worker achieves the minimum wage. [9] [lower-alpha 2]

There are several software programs that determine the time that a trained operator should take to perform an operation. These make unit estimations based on the individual motions that an operator is required to make to complete a task. In a service setting, the output of piece work can be measured by the number of operations completed, as when a telemarketer is paid by the number of calls made or completed, regardless of the outcome of the calls (pay for only certain positive outcomes is more likely to be called a sales commission or incentive pay).[ citation needed ] Crowdsourcing systems such as Mechanical Turk involve minute information-processing tasks (such as identifying photos or recognizing signatures) for which workers are compensated on a per-task basis.[ citation needed ]

As a term and as a common form of labor, 'piece work' had its origins in the guild system of work during the Commercial Revolution [ dubious ] and before the Industrial Revolution.[ citation needed ] Since the phrase 'piece work' first appears in writing around the year 1549, it is likely that at about this time, the master craftsmen of the guild system began to assign their apprentices work on pieces which could be performed at home, rather than within the master's workshop. [ citation needed ] In the British factory system, workers mass-produced parts from a fixed design as part of a division of labor, but did not have the advantage of machine tools or metalworking jigs.[ citation needed ] Simply counting the number of pieces produced by a worker was likely easier than accounting for that worker's time, as would have been required for the computation of an hourly wage.[ dubious ]

Piece work took on new importance with the advent of machine tools, such as the machine lathe in 1751.[ citation needed ] Machine tools made possible by the American system of manufacturing (attributed to Eli Whitney) in 1799 in which workers could truly make just a single part but make many copies of it for later assembly by others.[ citation needed ] The reality of the earlier English system had been that handcrafted pieces rarely fit together on the first try, and a single artisan was ultimately required to rework all parts of a finished good.[ dubious ][ citation needed ] By the early 19th century, the accuracy of machine tools meant that piecework parts were produced fully ready for final assembly.

Frederick Winslow Taylor was one of the main champions of the piece rate system in the late 19th century. Although there were many piece rate systems in use, they were largely resented and manipulative. One of the most influential tenets of Scientific Management was Taylor's popularization of the "differential piece rate system", which relied on accurate measurements of productivity rates to create a "standard" production output target. Those who were not able to meet the target suffered a penalty and were likely fired. Taylor spread that in published papers in 1895, and the timed piece rate system gave birth to creating modern cost control and, as a result, modern corporate organization. [10]

In the mid-19th century, the practice of distributing garment assembly among lower-skilled and lower-paid workers came to be known in Britain as the sweating system [ citation needed ] and arose at about the same time that a practical (foot-powered) sewing machine, was developed. [ citation needed ]Factories that collected sweating system workers at a single location, working at individual machines, and being paid piece rates became pejoratively known as sweatshops.[ citation needed ]

There can be improper record keeping at the hands of supervisors attempting to cheat employees, to build piece rate systems that prevent workers from earning higher wages. That is often at the cost of both the worker and the enterprise, however, as the quality and the sustainability of the business will be threatened by decreases in quality or productivity of workers attempting to stay afloat. Put another way, if the payment for producing a well-made item is not enough to support a worker, workers will need to work faster, produce more items per hour, and sacrifice quality. [11]

Today, piece work and sweatshops remain closely linked conceptually even though each has continued to develop separately.[ citation needed ] The label "sweatshop" now refers more to long hours, poor working conditions, and low pay even if they pay an hourly or daily wage labour, instead of a piece rate.[ citation needed ]

In the United States, the Fair Labor Standards Act requires that all employees, including piece work employees, earn at least the minimum wage. In calculating an appropriate piece work rate, employers must keep track of average productivity rates for specific activities and set a piece work rate that ensures that all workers are able to earn minimum wage. [12] If a worker earns less than the minimum wage, the employer has to pay the difference. Exceptions to this rule include instances where: (i) the worker is a family member of the employer; (ii) if in any calendar quarter of the preceding year there were fewer than 500 person-days of work lasting at least one hour; (iii) in agricultural businesses, if a worker primarily takes care of livestock on the range; (iv) if non-local hand-harvesting workers are under 16, are employed on the same farm as their parent, and receive the piece work rate for those over 16. [13]

Incentivizes Productivity: Piece rate pay encourages workers to increase their output as they directly benefit from producing more.

Flexibility: Piece rate pay can offer flexibility to workers as they can often choose their own hours and work at their own pace, especially in jobs such as freelance writing or data entry.

Potential for Higher Earnings: Skilled workers who are efficient in their tasks can potentially earn more through piece rate pay than through traditional hourly wages.

Quality Concerns: Workers may sacrifice quality for quantity to maximize their earnings, leading to potential issues with the quality of goods or services produced.

Risk of Exploitation: Some employers may set piece rates unfairly low, leading to workers being underpaid for their labor, especially in industries with low barriers to entry.

Lack of Stability: Piece rate pay may not provide a stable income, as earnings can fluctuate based on factors such as demand for the product or service and individual productivity levels.

Employment is a relationship between two parties regulating the provision of paid labour services. Usually based on a contract, one party, the employer, which might be a corporation, a not-for-profit organization, a co-operative, or any other entity, pays the other, the employee, in return for carrying out assigned work. Employees work in return for wages, which can be paid on the basis of an hourly rate, by piecework or an annual salary, depending on the type of work an employee does, the prevailing conditions of the sector and the bargaining power between the parties. Employees in some sectors may receive gratuities, bonus payments or stock options. In some types of employment, employees may receive benefits in addition to payment. Benefits may include health insurance, housing, and disability insurance. Employment is typically governed by employment laws, organisation or legal contracts.

Overtime is the amount of time someone works beyond normal working hours. The term is also used for the pay received for this time. Normal hours may be determined in several ways:

A wage is payment made by an employer to an employee for work done in a specific period of time. Some examples of wage payments include compensatory payments such as minimum wage, prevailing wage, and yearly bonuses, and remunerative payments such as prizes and tip payouts. Wages are part of the expenses that are involved in running a business. It is an obligation to the employee regardless of the profitability of the company.

A living wage is defined as the minimum income necessary for a worker to meet their basic needs. This is not the same as a subsistence wage, which refers to a biological minimum, or a solidarity wage, which refers to a minimum wage tracking labor productivity. Needs are defined to include food, housing, and other essential needs such as clothing. The goal of a living wage is to allow a worker to afford a basic but decent standard of living through employment without government subsidies. Due to the flexible nature of the term "needs", there is not one universally accepted measure of what a living wage is and as such it varies by location and household type. A related concept is that of a family wage – one sufficient to not only support oneself, but also to raise a family.

A salary is a form of periodic payment from an employer to an employee, which may be specified in an employment contract. It is contrasted with piece wages, where each job, hour or other unit is paid separately, rather than on a periodic basis. Salary can also be considered as the cost of hiring and keeping human resources for corporate operations, and is hence referred to as personnel expense or salary expense. In accounting, salaries are recorded in payroll accounts.

The term efficiency wages was introduced by Alfred Marshall to denote the wage per efficiency unit of labor. Marshallian efficiency wages are those calculated with efficiency or ability exerted being the unit of measure rather than time. That is, the more efficient worker will be paid more than a less efficient worker for the same amount of hours worked.

The National Minimum Wage Act 1998 creates a minimum wage across the United Kingdom. From 1 April 2024, the minimum wage is £11.44 for people aged 21 and over, £8.60 for 18- to 20-year-olds, and £6.40 for 16- to 17-year-olds and apprentices.

Personnel economics has been defined as "the application of economic and mathematical approaches and econometric and statistical methods to traditional questions in human resources management". It is an area of applied micro labor economics, but there are a few key distinctions. One distinction, not always clearcut, is that studies in personnel economics deal with the personnel management within firms, and thus internal labor markets, while those in labor economics deal with labor markets as such, whether external or internal. In addition, personnel economics deals with issues related to both managerial-supervisory and non-supervisory workers.

Performance-related pay or pay for performance, not to be confused with performance-related pay rise, is a salary or wages paid system based on positioning the individual, or team, on their pay band according to how well they perform. Car salesmen or production line workers, for example, may be paid in this way, or through commission.

The Labor Code of the Philippines is the legal code governing employment practices and labor relations in the Philippines. It was enacted through Presidential Decree No. 442 on Labor day, May 1, 1974, by President Ferdinand Marcos in the exercise of his then extant legislative powers.

Minimum wage law is the body of law which prohibits employers from hiring employees or workers for less than a given hourly, daily or monthly minimum wage. More than 90% of all countries have some kind of minimum wage legislation.

An hourly worker or hourly employee is an employee paid an hourly wage for their services, as opposed to a fixed salary. Hourly workers may often be found in service and manufacturing occupations, but are common across a variety of fields. Hourly employment is often associated but not synonymous with at-will employment.

The Fair Labor Standards Act of 1938 29 U.S.C. § 203 (FLSA) is a United States labor law that creates the right to a minimum wage, and "time-and-a-half" overtime pay when people work over forty hours a week. It also prohibits employment of minors in "oppressive child labor". It applies to employees engaged in interstate commerce or employed by an enterprise engaged in commerce or in the production of goods for commerce, unless the employer can claim an exemption from coverage. The Act was enacted by the 75th Congress and signed into law by President Franklin D. Roosevelt in 1938.

Wage Payment Systems are the different methods adopted by organizations by which they remunerate labour. There exist several systems of employee wage payment and incentives, which can be classified under the following names.

Microwork is a series of many small tasks which together comprise a large unified project, and it is completed by many people over the Internet. Microwork is considered the smallest unit of work in a virtual assembly line. It is most often used to describe tasks for which no efficient algorithm has been devised, and require human intelligence to complete reliably. The term was developed in 2008 by Leila Chirayath Janah of Samasource.

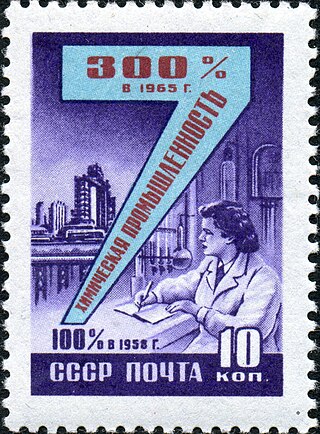

During the Khrushchev era, especially from 1956 through 1962, the Soviet Union attempted to implement major wage reforms intended to move Soviet industrial workers away from the mindset of overfulfilling quotas that had characterised the Soviet economy during the preceding Stalinist period and toward a more efficient financial incentive.

The Labor policy in the Philippines is specified mainly by the country's Labor Code of the Philippines and through other labor laws. They cover 38 million Filipinos who belong to the labor force and to some extent, as well as overseas workers. They aim to address Filipino workers’ legal rights and their limitations with regard to the hiring process, working conditions, benefits, policymaking on labor within the company, activities, and relations with employees.

The National Minimum Wage Regulations 1999 were passed as a statutory instrument under the National Minimum Wage Act 1998 to specify various detailed points about how to calculate whether someone is being paid the minimum wage, who gets it, and how to enforce it.

Italy does not have a nationally unified labor code. Labor legislation is wide-ranging, with laws, regulations and statutes that bear on labor relations. The Constitution of Italy contains declarations of principle relating to fair payment, maximum working hours, vacation, protection of women and minors, social insurance, illness, disability, industrial diseases and accidents, Freedom of Association and the right to strike. The Workers' Statute of 1970 was modified, and plays an important role.

After the Chinese Communist Party (CCP) extended its ruling to most parts of China and set up a national government in Beijing in 1949, it encountered a lot of new tasks. The first was to rebuild the economy, which deteriorated sharply during the last years of Nationalist Party (KMT) governing. The strategy that led CCP to state power is termed as "using the rural areas to encircle the cities" (农村包围城市). Thus, one difficulty CCP had in economy was that it had little experience in dealing with the urban part of the economy. Furthermore, facing the threat of KMT's fighting back, it needed to consolidate its political power. To meet these challenges, a new and coherent wage system in the economic sector was needed. Naturally, this transformation of wage system had both political goals and economic goals. Economically, via setting up a new wage system, CCP wanted to stabilize the economic situation, to ensure normal people's everyday living and also to further develop the economy. Politically, CCP not only wanted to distinguish itself from the old KMT regime by this new wage system, but also to make the wage system suitable for the future socialist economy. After two wage reforms in 1952 and 1956, a new wage system was established, and its influence continued to today.

Footnotes

Citations

{{cite journal}}: CS1 maint: DOI inactive as of March 2024 (link){{cite web}}: External link in |publisher={{cite web}}: External link in |publisher={{cite web}}: External link in |publisher=Bibliography