Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

In finance, an exchange rate is the rate at which one currency will be exchanged for another currency. Currencies are most commonly national currencies, but may be sub-national as in the case of Hong Kong or supra-national as in the case of the euro.

Monetary policy is the policy adopted by the monetary authority of a nation to affect monetary and other financial conditions to accomplish broader objectives like high employment and price stability. Further purposes of a monetary policy may be to contribute to economic stability or to maintain predictable exchange rates with other currencies. Today most central banks in developed countries conduct their monetary policy within an inflation targeting framework, whereas the monetary policies of most developing countries' central banks target some kind of a fixed exchange rate system. A third monetary policy strategy, targeting the money supply, was widely followed during the 1980s, but has diminished in popularity since that, though it is still the official strategy in a number of emerging economies.

In macroeconomics and modern monetary policy, a devaluation is an official lowering of the value of a country's currency within a fixed exchange-rate system, in which a monetary authority formally sets a lower exchange rate of the national currency in relation to a foreign reference currency or currency basket. The opposite of devaluation, a change in the exchange rate making the domestic currency more expensive, is called a revaluation. A monetary authority maintains a fixed value of its currency by being ready to buy or sell foreign currency with the domestic currency at a stated rate; a devaluation is an indication that the monetary authority will buy and sell foreign currency at a lower rate.

The cruzeiro real was the short-lived currency of Brazil between August 1, 1993, and June 30, 1994. It was subdivided in 100 centavos; however, this subunit was used only for accounting purposes, and coins and banknotes worth 10 to 500 of the preceding cruzeiro remained valid and were used for the purpose of corresponding to centavos of the cruzeiro real, especially when the redenomination was carried out. The currency had the ISO 4217 code BRR.

Gustavo Henrique de Barroso Franco is a Brazilian economist. Former Governor of the Brazilian Central Bank, is best known for being one of the "fathers" of the Real Plan, the 1994 monetary reform that ended hyperinflation in Brazil. He teaches economics at the Catholic University in Rio de Janeiro since 1986. He is also a businessman, consultant and has served on many boards. He founded Rio Bravo Investimentos where he works as Senior Advisor. He has written several books, academic papers and contributes regularly to newspapers and magazines.

The Convertibility plan was a plan by the Argentine Currency Board that pegged the Argentine peso to the U.S. dollar between 1991 and 2002 in an attempt to eliminate hyperinflation and stimulate economic growth. While it initially met with considerable success, the board's actions ultimately failed. The peso was only pegged to the dollar until 2002.

Chronic inflation is an economic phenomenon occurring when a country experiences high inflation for a prolonged period due to continual increases in the money supply among other things. In countries with chronic inflation, inflation expectations become 'built-in', and it becomes extremely difficult to reduce the inflation rate because the process of reducing inflation by, for example, slowing down the growth rate of the money supply, will often lead to high unemployment until inflationary expectations have adjusted to the new situation.

The Daily Unidade Real de Valor, or URV, was a non-monetary reference currency created in March 1994, as part of the Plano Real in Brazil. It was the most theoretically sophisticated piece of the Plano Real and was based on a previous academic work by Pérsio Arida and André Lara Resende, the "Larida Plan", published in 1984.

The following is a timeline of the Brazilian economic stabilization plans in the "new Republic" era, a period characterized by intense inflation of the local currency, exceeding 2,700% in the period of 1989 to 1990.

The Collor Plan, is the name given to a collection of economic reforms and inflation-stabilization plans carried out in Brazil during the presidency of Fernando Collor de Mello, between 1990 and 1992. The plan was officially called New Brazil Plan, but it became closely associated with Collor himself, and "Plano Collor" became its de facto name.

The economic history of Brazil covers various economic events and traces the changes in the Brazilian economy over the course of the history of Brazil. Portugal, which first colonized the area in the 16th century, enforced a colonial pact with Brazil, an imperial mercantile policy, which drove development for the subsequent three centuries. Independence was achieved in 1822. Slavery was fully abolished in 1888. Important structural transformations began in the 1930s, when important steps were taken to change Brazil into a modern, industrialized economy.

Currency intervention, also known as foreign exchange market intervention or currency manipulation, is a monetary policy operation. It occurs when a government or central bank buys or sells foreign currency in exchange for its own domestic currency, generally with the intention of influencing the exchange rate and trade policy.

After the dissolution of the Soviet Union in 1991 and the end of its centrally-planned economy, the Russian Federation succeeded it under president Boris Yeltsin. The Russian government used policies of shock therapy to liberalize the economy as part of the transition to a market economy, causing a sustained economic recession. GDP per capita levels returned to their 1991 levels by the mid-2000s. The economy of Russia is much more stable today than in the early 1990s, but inflation still remains an issue. Historically and currently, the Russian economy has differed sharply from major developed economies because of its weak legal system, underdevelopment of modern economic activities, technological backwardness, and lower living standards.

The Brazilian real is the official currency of Brazil. It is subdivided into 100 centavos. The Central Bank of Brazil is the central bank and the issuing authority. The real replaced the cruzeiro real in 1994.

Hyperinflation in Brazil occurred between the first three months of 1990. The monthly inflation rates between January and March 1990 were 71.9%, 71.7% and 81.3% respectively. As accepted by the International Monetary Fund (IMF), hyperinflation is defined as a period of time in which the average price level of goods and services rise by more than 50% a month.

The BONEX Plan was a forced conversion of bank time deposits to Treasury bonds performed by the Argentine government in January 1990.

The cruzeiro was the currency of Brazil between 1990 and 1993. It was the third iteration of a Brazilian currency named "cruzeiro", and replaced the cruzado novo at par. It was used until 1993, when it was replaced by the cruzeiro real at a rate of 1 cruzeiro real = 1000 cruzeiros.

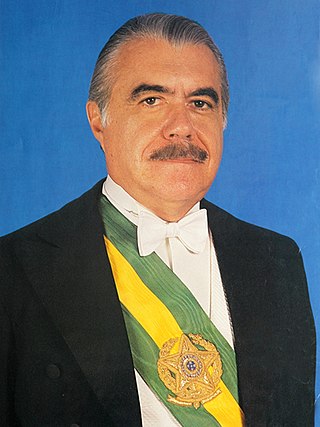

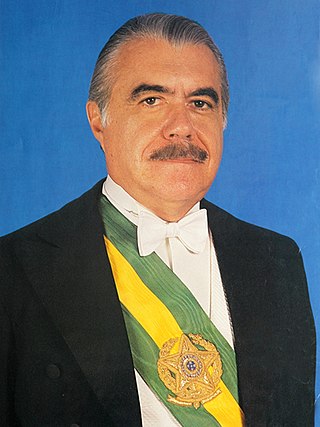

The Cruzado Plan was a set of economic measures launched by the Brazilian government on February 28, 1986, based on Decree-Law No. 2883 of February 27, 1986, with José Sarney as president and Dilson Funaro as Minister of Finance. The plan was approved in the Chamber of Deputies with 344 votes in favor and 13 against, while in the Federal Senate only 1 of the 49 parliamentarians voted against.