In economics, a free market is a system in which the prices for goods and services are self-regulated by the open market and by consumers. In a free market, the laws and forces of supply and demand are free from any intervention by a government or other authority, and from all forms of economic privilege, monopolies and artificial scarcities. Proponents of the concept of free market contrast it with a regulated market in which a government intervenes in supply and demand through various methods such as tariffs used to restrict trade and to protect the local economy. In an idealized free-market economy, prices for goods and services are set freely by the forces of supply and demand and are allowed to reach their point of equilibrium without intervention by government policy.

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another and hence are not perfect substitutes. In monopolistic competition, a firm takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other firms. In the presence of coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the firm maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereal, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the subject, Theory of Monopolistic Competition (1933). Joan Robinson published a book The Economics of Imperfect Competition with a comparable theme of distinguishing perfect from imperfect competition. Further work on monopolistic competition was undertaken by Dixit and Stiglitz who created the Dixit-Stiglitz model which has proved applicable used in the sub fields of international trade theory, macroeconomics and economic geography.

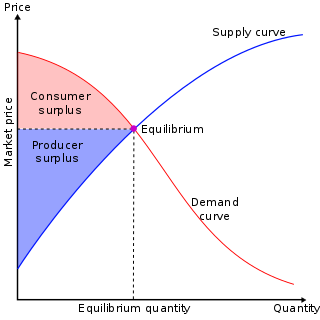

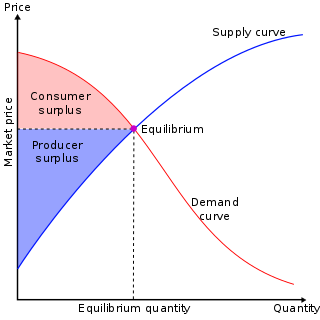

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted.

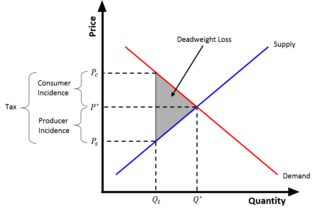

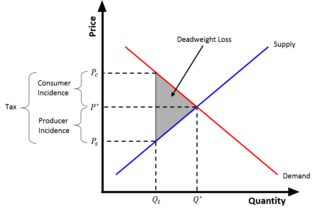

Deadweight loss, also known as excess burden, is a measure of lost economic efficiency when the socially optimal quantity of a good or a service is not produced. Non-optimal production can be caused by monopoly pricing in the case of artificial scarcity, a positive or negative externality, a tax or subsidy, or a binding price ceiling or price floor such as a minimum wage.

In mainstream economics, economic surplus, also known as total welfare or Marshallian surplus, refers to two related quantities:

This aims to be a complete article list of economics topics:

A subsidy or government incentive is a form of financial aid or support extended to an economic sector generally with the aim of promoting economic and social policy. Although commonly extended from the government, the term subsidy can relate to any type of support – for example from NGOs or as implicit subsidies. Subsidies come in various forms including: direct and indirect.

A price is the quantity of payment or compensation given by one party to another in return for one unit of goods or services. A price is influenced by production costs, supply of the desired item, and demand for the product. A price may be determined by a monopolist or may be imposed on the firm by market conditions.

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of product.

A hedge is an investment position intended to offset potential losses or gains that may be incurred by a companion investment. A hedge can be constructed from many types of financial instruments, including stocks, exchange-traded funds, insurance, forward contracts, swaps, options, gambles, many types of over-the-counter and derivative products, and futures contracts.

Social cost in neoclassical economics is the sum of the private costs resulting from a transaction and the costs imposed on the consumers as a consequence of being exposed to the transaction for which they are not compensated or charged. In other words, it is the sum of private and external costs.

A price floor is a government- or group-imposed price control or limit on how low a price can be charged for a product, good, commodity, or service. A price floor must be higher than the equilibrium price in order to be effective. The equilibrium price, commonly called the "market price", is the price where economic forces such as supply and demand are balanced and in the absence of external influences the (equilibrium) values of economic variables will not change, often described as the point at which quantity demanded and quantity supplied are equal. Governments use price floors to keep certain prices from going too low.

The tax wedge is the deviation from the equilibrium price/quantity as a result of the taxation of a good. Because of the tax, consumers pay more for the good than they did before the tax, and suppliers receive less for the good than they did before the tax. Put differently, the tax wedge is the difference between what consumers pay and what producers receive from a transaction. The tax effectively drives a "wedge" between the price consumers pay and the price producers receive for a product.

In economics, tax incidence or tax burden is the effect of a particular tax on the distribution of economic welfare. Economists distinguish between the entities who ultimately bear the tax burden and those on whom tax is initially imposed. The tax burden measures the true economic weight of the tax, measured by the difference between real incomes or utilities before and after imposing the tax, taking into account how the tax leads prices to change. If a 10% tax is imposed on sellers of butter, for example, but the market price rises 8% as a result, most of the burden is on buyers, not sellers. The concept of tax incidence was initially brought to economists' attention by the French Physiocrats, in particular François Quesnay, who argued that the incidence of all taxation falls ultimately on landowners and is at the expense of land rent. Tax incidence is said to "fall" upon the group that ultimately bears the burden of, or ultimately suffers a loss from, the tax. The key concept of tax incidence is that the tax incidence or tax burden does not depend on where the revenue is collected, but on the price elasticity of demand and price elasticity of supply. As a general policy matter, the tax incidence should not violate the principles of a desirable tax system, especially fairness and transparency.

A business can use a variety of pricing strategies when selling a product or service. To determine the most effective pricing strategy for a company, senior executives need to first identify the company's pricing position, pricing segment, pricing capability and their competitive pricing reaction strategy.

In economics, partial equilibrium is a condition of economic equilibrium which takes into consideration only a part of the market to attain equilibrium.

Rental value is the fair market value of property while rented out in a lease. More generally, it may be the consideration paid under the lease for the right to occupy, or the royalties or return received by a lessor (landlord) under a license to real property. In the science and art of appraisal, it is the amount that would be paid for rental of similar real property in the same condition and in the same area.

An economic profit is the difference between the revenue a business has received from its outputs and the opportunity costs of its inputs. An economic profit differs from an accounting profit as it considers both the firms implicit and explicit costs, where as an accounting profit only considers the explicit costs which appear on a firms financial statements. Due to the additional implicit costs being considered, the economic profit usually differs from the accounting profit.

This glossary of economics is a list of definitions of terms and concepts used in economics, its sub-disciplines, and related fields.