In economics, adaptive expectations is a hypothesized process by which people form their expectations about what will happen in the future based on what has happened in the past. For example, if people want to create an expectation of the inflation rate in the future, they can refer to past inflation rates to infer some consistencies and could derive a more accurate expectation the more years they consider.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

In economics, inflation is a general increase in the prices of goods and services in an economy. This is usually measured using the consumer price index (CPI). When the general price level rises, each unit of currency buys fewer goods and services; consequently, inflation corresponds to a reduction in the purchasing power of money. The opposite of CPI inflation is deflation, a decrease in the general price level of goods and services. The common measure of inflation is the inflation rate, the annualized percentage change in a general price index. As prices faced by households do not all increase at the same rate, the consumer price index (CPI) is often used for this purpose.

The IS–LM model, or Hicks–Hansen model, is a two-dimensional macroeconomic model which is used as a pedagogical tool in macroeconomic teaching. The IS–LM model shows the relationship between interest rates and output in the short run in a closed economy. The intersection of the "investment–saving" (IS) and "liquidity preference–money supply" (LM) curves illustrates a "general equilibrium" where supposed simultaneous equilibria occur in both the goods and the money markets. The IS–LM model shows the importance of various demand shocks on output and consequently offers an explanation of changes in national income in the short run when prices are fixed or sticky. Hence, the model can be used as a tool to suggest potential levels for appropriate stabilisation policies. It is also used as a building block for the demand side of the economy in more comprehensive models like the AD–AS model.

Financial economics is the branch of economics characterized by a "concentration on monetary activities", in which "money of one type or another is likely to appear on both sides of a trade". Its concern is thus the interrelation of financial variables, such as share prices, interest rates and exchange rates, as opposed to those concerning the real economy. It has two main areas of focus: asset pricing and corporate finance; the first being the perspective of providers of capital, i.e. investors, and the second of users of capital. It thus provides the theoretical underpinning for much of finance.

Rational expectations is an economic theory that seeks to infer the macroeconomic consequences of individuals' decisions based on all available knowldege. It assumes that individuals actions are based on the best available economic theory and information, and concludes that government policies cannot succeed by assuming widespread systematic error by individuals.

New Keynesian economics is a school of macroeconomics that strives to provide microeconomic foundations for Keynesian economics. It developed partly as a response to criticisms of Keynesian macroeconomics by adherents of new classical macroeconomics.

The Phillips curve is an economic model, named after Bill Phillips, that correlates reduced unemployment with increasing wages in an economy. While Phillips did not directly link employment and inflation, this was a trivial deduction from his statistical findings. Paul Samuelson and Robert Solow made the connection explicit and subsequently Milton Friedman and Edmund Phelps put the theoretical structure in place.

The theory of consumer choice is the branch of microeconomics that relates preferences to consumption expenditures and to consumer demand curves. It analyzes how consumers maximize the desirability of their consumption, by maximizing utility subject to a consumer budget constraint. Factors influencing consumers' evaluation of the utility of goods include: income level, cultural factors, product information and physio-psychological factors.

Consumption is the act of using resources to satisfy current needs and wants. It is seen in contrast to investing, which is spending for acquisition of future income. Consumption is a major concept in economics and is also studied in many other social sciences.

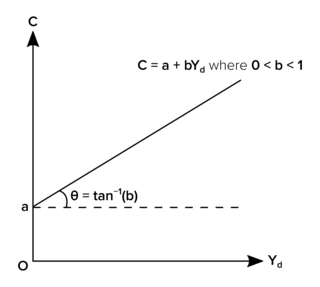

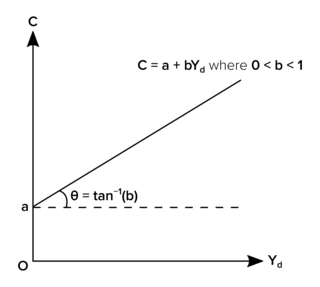

In economics, the consumption function describes a relationship between consumption and disposable income. The concept is believed to have been introduced into macroeconomics by John Maynard Keynes in 1936, who used it to develop the notion of a government spending multiplier.

A macroeconomic model is an analytical tool designed to describe the operation of the problems of economy of a country or a region. These models are usually designed to examine the comparative statics and dynamics of aggregate quantities such as the total amount of goods and services produced, total income earned, the level of employment of productive resources, and the level of prices.

In economics, a shock is an unexpected or unpredictable event that affects an economy, either positively or negatively. Technically, it is an unpredictable change in exogenous factors—that is, factors unexplained by an economic model—which may influence endogenous economic variables.

Average propensity to consume (APC) is a concept developed by John Maynard Keynes to analyze the consumption function, which is a formula where total consumption expenditures (C) of a household consist of autonomous consumption (Ca) and income (Y) multiplied by marginal propensity to consume. According to Keynes, the individual's real income determines saving and consumption decisions.

The permanent income hypothesis (PIH) is a model in the field of economics to explain the formation of consumption patterns. It suggests consumption patterns are formed from future expectations and consumption smoothing. The theory was developed by Milton Friedman and published in his A Theory of Consumption Function, published in 1957 and subsequently formalized by Robert Hall in a rational expectations model. Originally applied to consumption and income, the process of future expectations is thought to influence other phenomena. In its simplest form, the hypothesis states changes in permanent income, rather than changes in temporary income, are what drive changes in consumption.

In monetary economics, the demand for money is the desired holding of financial assets in the form of money: that is, cash or bank deposits rather than investments. It can refer to the demand for money narrowly defined as M1, or for money in the broader sense of M2 or M3.

Dynamic stochastic general equilibrium modeling is a macroeconomic method which is often employed by monetary and fiscal authorities for policy analysis, explaining historical time-series data, as well as future forecasting purposes. DSGE econometric modelling applies general equilibrium theory and microeconomic principles in a tractable manner to postulate economic phenomena, such as economic growth and business cycles, as well as policy effects and market shocks.

Consumption smoothing is an economic concept for the practice of optimizing a person's standard of living through an appropriate balance between savings and consumption over time. An optimal consumption rate should be relatively similar at each stage of a person's life rather than fluctuate wildly. Luxurious consumption at an old age does not compensate for an impoverished existence at other stages in one's life.

In economics, the absolute income hypothesis concerns how a consumer divides their disposable income between consumption and saving. It is part of the theory of consumption proposed by economist John Maynard Keynes. The hypothesis was subject to further research in the 1960s and 70s, most notably by American economist James Tobin (1918–2002).

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.