Related Research Articles

Tax law or revenue law is an area of legal study in which public or sanctioned authorities, such as federal, state and municipal governments use a body of rules and procedures (laws) to assess and collect taxes in a legal context. The rates and merits of the various taxes, imposed by the authorities, are attained via the political process inherent in these bodies of power, and not directly attributable to the actual domain of tax law itself.

The University of Pennsylvania Carey Law School is the law school of the University of Pennsylvania, an Ivy League university located in Philadelphia. It is among the most selective and oldest law schools in the United States, and is currently ranked sixth overall by U.S. News & World Report. It offers the degrees of Juris Doctor (J.D.), Master of Laws (LL.M.), Master of Comparative Laws (LL.C.M.), Master in Law (M.L.), and Doctor of the Science of Law (S.J.D.).

Haig–Simons income or Schanz–Haig–Simons income is an income measure used by public finance economists to analyze economic well-being which defines income as consumption plus change in net worth. It is represented by the mathematical formula:

A wealth tax is a tax on an entity's holdings of assets. This includes the total value of personal assets, including cash, bank deposits, real estate, assets in insurance and pension plans, ownership of unincorporated businesses, financial securities, and personal trusts. Typically, liabilities are deducted from an individual's wealth, hence it is sometimes called a net wealth tax. Wealth taxes are in use in many countries around the world and seek to reduce the accumulation of wealth by individuals.

Edwin Robert Anderson Seligman (1861–1939), was an American economist who spent his entire academic career at Columbia University in New York City. Seligman is best remembered for his pioneering work involving taxation and public finance. His principles for a progressive federal income tax were adopted by Congress after the passage of the Sixteenth Amendment. A prolific scholar and teacher, his students had great influence on the fiscal architecture of postcolonial nations. He served as an influential founding member of the American Economics Association.

The Temple University James E. Beasley School of Law is the professional graduate law school of Temple University, located in Philadelphia, Pennsylvania. Founded in 1895, the law school has an enrollment of about 530 students.

Michael Jay Boskin is the T. M. Friedman Professor of Economics and senior Fellow at Stanford University's Hoover Institution. He also is chief executive officer and president of Boskin & Co., an economic consulting company.

Edward McCaffery is a tax law professor at the University of Southern California Law School and also a visiting professor of Law and Economics at the California Institute of Technology. At USC he is Robert C. Packard Trustee Chair in Law and Professor of Law, Economics and Political Science. He teaches Federal Income Taxation, Property, Intellectual Property, and Tax Law and Policy at USC, Law and Economics and Law and Technology at the California Institute of Technology. He also teaches Corporate Taxation, Federal Income Taxation, Partnership Taxation, Property and a Tax Policy seminar.

The University of Florida Fredric G. Levin College of Law, also known as UF Law, is the law school of the University of Florida located in Gainesville, Florida. Founded in 1909, it is the oldest operating public law school in Florida, and second oldest overall in the state.

Joel B. Slemrod is an American economist and academic, currently serving as a professor of economics at the University of Michigan and the Paul W. McCracken Collegiate Professor of Business Economics and Public Policy at the Stephen M. Ross School of Business at the University of Michigan.

Randolph Evernghim Paul (1890–1956) was a name partner of the international law firm of Paul, Weiss, Rifkind, Wharton & Garrison and was a lawyer specializing in tax law. He is credited as "an architect of the modern tax system."

Michael Knoll is the Theodore K. Warner Professor of Law & Professor of Real Estate at the University of Pennsylvania Law School, Co-Director of the Center for Tax Law and Policy, and the Deputy Dean.

Chris William Sanchirico is the Samuel A. Blank Professor of Law, Business and Public Policy at the University of Pennsylvania Carey Law School (primary) and the Wharton School (secondary). He is a leading expert on tax law and policy.

John Kent McNulty was an American legal scholar, who was a professor of law at the University of California, Berkeley for 38 years from 1964 to 2002 and who as a legal educator and scholar, was influential in shaping U.S. tax law policy debate during the later quarter of the 20th century.

Penn State Law, located in University Park, Pennsylvania, is one of two separately accredited law schools of the Pennsylvania State University. Penn State Law offers J.D., LL.M., and S.J.D. degrees. The school also offers a joint J.D./M.B.A. with the Smeal College of Business, a joint JD-MIA degree with the School of International Affairs, which is also located in the Lewis Katz Building, as well as joint degrees with other graduate programs at Penn State.

Nancy Christine Staudt is the dean of the Washington University in St. Louis School of Law and the Howard and Caroline Cayne Professor of Law. She is a scholar in tax, tax policy, and empirical legal studies.

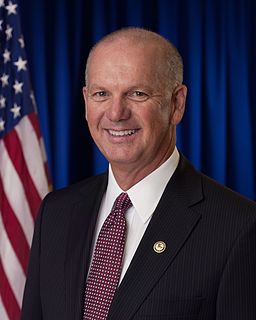

David J. Hickton is the director and founder of the University of Pittsburgh Institute for Cyber Law, Policy and Security. Prior to that, he was the 57th U.S. Attorney for the Western District of Pennsylvania. He resigned following the election of President Donald Trump and began his position at Pitt in January 2017. While a U.S. Attorney, Hickton brought several indictments for cybertheft and hacking. He also played a key role in combating the opioid abuse epidemic in Western Pennsylvania. Prior to becoming U.S. Attorney, Hickton engaged in the private practice of law, specifically in the areas of transportation, litigation, commercial and white collar crime.

Alan J. Auerbach is an American economist. He is currently the director of the Robert D. Burch Center for Tax Policy and Public Finance at the University of California, Berkeley. He received his undergraduate degree in economics and mathematics from Yale University and earned his Ph.D. in economics at Harvard University and was an assistant and then an associate professor at Harvard. He was then a professor of law and economics at the University of Pennsylvania.

Bernard Wolfman was the Dean of the University of Pennsylvania Law School as well as its Gemmill Professor of Tax Law and Tax Policy, and the Fessenden Professor of Law at Harvard Law School.

Lily L. Batchelder is the Robert C. Kopple Family Professor of Taxation at New York University. She was the former chief tax counsel to the U.S. Senate Finance Committee under the Obama administration and appointed to head Joe Biden’s IRS transition team. On March 11, 2021 President Joe Biden announced his intent to nominate her to be Assistant Secretary for Tax Policy under Secretary Janet Yellen. On April 15, 2021 President Biden announced his nomination of Batchelder had been transmitted to the Senate.

References

- 1 2 "Penn Law Faculty: Reed Shuldiner, expert on Tax Policy, Income Taxation". www.law.upenn.edu.

- 1 2 "C.V."

- ↑ Saunders, Laura (18 May 2018). "Who Will and Won't Pay the AMT, America's Rich-Person Tax?" – via www.wsj.com.

- ↑ Vigdor, Neil (12 October 2014). "Foley dogged by questions about tax write-offs for the rich". NewsTimes.