Related Research Articles

The Securities Exchange Act of 1934 is a law governing the secondary trading of securities in the United States of America. A landmark of wide-ranging legislation, the Act of '34 and related statutes form the basis of regulation of the financial markets and their participants in the United States. The 1934 Act also established the Securities and Exchange Commission (SEC), the agency primarily responsible for enforcement of United States federal securities law.

An electronic communication network (ECN) is a type of computerized forum or network that facilitates the trading of financial products outside traditional stock exchanges. An ECN is generally an electronic system that widely disseminates orders entered by market makers to third parties and permits the orders to be executed against in whole or in part. The primary products that are traded on ECNs are stocks and currencies. ECNs are generally passive computer-driven networks that internally match limit orders and charge a very small per share transaction fee.

The OTC (Over-The-Counter) Bulletin Board or OTCBB was a United States quotation medium operated by the Financial Industry Regulatory Authority (FINRA) for its subscribing members. FINRA closed the OTCBB on November 8, 2021.

Regulation FD (Fair Disclosure), ordinarily referred to as Regulation FD or Reg FD, is a regulation that was promulgated by the U.S. Securities and Exchange Commission (SEC) in August 2000. The regulation is codified as 17 CFR 243. Although "FD" stands for "fair disclosure", as can be learned from the adopting release, the regulation was and is codified in the Code of Federal Regulations simply as Regulation FD. Subject to certain limited exceptions, the rules generally prohibit public companies from disclosing previously nonpublic, material information to certain parties unless the information is distributed to the public first or simultaneously.

OTC Markets Group is an American financial market providing price and liquidity information for almost 10,000 over-the-counter (OTC) securities. The group has its headquarters in New York City. OTC-traded securities are organized into three markets to inform investors of opportunities and risks: OTCQX, OTCQB and Pink.

The uptick rule is a trading restriction that states that short selling a stock is allowed only on an uptick. For the rule to be satisfied, the short must be either at a price above the last traded price of the security, or at the last traded price when the most recent movement between traded prices was upward.

Securities regulation in the United States is the field of U.S. law that covers transactions and other dealings with securities. The term is usually understood to include both federal and state-level regulation by governmental regulatory agencies, but sometimes may also encompass listing requirements of exchanges like the New York Stock Exchange and rules of self-regulatory organizations like the Financial Industry Regulatory Authority (FINRA).

An order is an instruction to buy or sell on a trading venue such as a stock market, bond market, commodity market, financial derivative market or cryptocurrency exchange. These instructions can be simple or complicated, and can be sent to either a broker or directly to a trading venue via direct market access. There are some standard instructions for such orders.

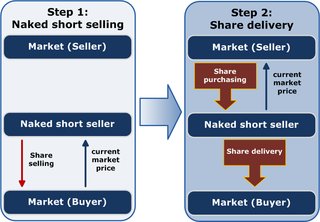

Naked short selling, or naked shorting, is the practice of short-selling a tradable asset of any kind without first borrowing the asset from someone else or ensuring that it can be borrowed. When the seller does not obtain the asset and deliver it to the buyer within the required time frame, the result is known as a "failure to deliver" (FTD). The transaction generally remains open until the asset is acquired and delivered by the seller, or the seller's broker settles the trade on their behalf.

Alternative trading system (ATS) is a US and Canadian regulatory term for a non-exchange trading venue that matches buyers and sellers to find counterparties for transactions. Alternative trading systems are typically regulated as broker-dealers rather than as exchanges. In general, for regulatory purposes, an alternative trading system is an organization or system that provides or maintains a market place or facilities for bringing together purchasers and sellers of securities, but does not set rules for subscribers. An ATS must be approved by the United States Securities and Exchange Commission (SEC) and is an alternative to a traditional stock exchange. The equivalent term under European legislation is a multilateral trading facility (MTF).

National Best Bid and Offer (NBBO) is a regulation by the United States Securities and Exchange Commission that requires brokers to execute customer trades at the best available (lowest) ask price when buying securities, and the best available (highest) bid price when selling securities, as governed by Regulation NMS.

In finance, a dark pool is a private forum for trading securities, derivatives, and other financial instruments. Liquidity on these markets is called dark pool liquidity. The bulk of dark pool trades represent large trades by financial institutions that are offered away from public exchanges like the New York Stock Exchange and the NASDAQ, so that such trades remain confidential and outside the purview of the general investing public. The fragmentation of electronic trading platforms has allowed dark pools to be created, and they are normally accessed through crossing networks or directly among market participants via private contractual arrangements. Generally, dark pools are not available to the public, but in some cases, they may be accessed indirectly by retail investors and traders via retail brokers.

The National Market System (NMS) is a regulatory mechanism that governs the operations of securities trading in the United States. Its primary focus is ensuring transparency and full disclosure regarding stock price quotations and trade executions. It was initiated in 1975, when, in the Securities Acts Amendments of 1975, Congress directed the Securities and Exchange Commission (SEC) to use its authority to facilitate the establishment of a national market system. The system has been updated periodically, for example with the Regulation NMS in 2005 which took into account technological innovations and other market changes.

The South Dakota Small Investors Protection Act is also known as "Initiated Measure 9". This citizen initiated constitutional amendment appeared on the November 4, 2008 general election ballot in South Dakota.

Payment for order flow (PFOF) is the compensation that a stockbroker receives from a market maker in exchange for the broker routing its clients' trades to that market maker. It is a controversial practice that has been called a "kickback" by its critics. Policymakers supportive of PFOF and several people in finance who have a favorable view of the practice have defended it for helping develop new investment apps, low-cost trading, and more efficient execution.

Flash trading, otherwise known as a flash order, is a marketable order sent to a market center that is not quoting the industry's best price or that cannot fill that order in its entirety. The order is then flashed to recipients of the venue's proprietary data feed to see if any of those firms wants to take the other side of the order.

The May 6, 2010, flash crash, also known as the crash of 2:45 or simply the flash crash, was a United States trillion-dollar flash crash which started at 2:32 p.m. EDT and lasted for approximately 36 minutes.

The Securities Acts Amendments of 1975 is a U.S. federal law that amended the Securities Act of 1933 and the Securities Exchange Act of 1934. It was enacted by the 94th United States Congress and signed into law by President Gerald Ford on June 4, 1975. The Securities Acts Amendments imposed an obligation on the Securities and Exchange Commission to consider the impacts that any new regulation would have on competition. The law also empowered the Securities and Exchange Commission (SEC) to establish a national market system and a system for nationwide clearance and settlement of securities transactions, enabling the SEC to enact Regulation NMS, and created the Municipal Securities Rulemaking Board (MSRB), a self-regulatory organization that writes investor protection rules and other rules regulating broker-dealers and banks in the United States municipal securities market.

Securities market participants in the United States include corporations and governments issuing securities, persons and corporations buying and selling a security, the broker-dealers and exchanges which facilitate such trading, banks which safe keep assets, and regulators who monitor the markets' activities. Investors buy and sell through broker-dealers and have their assets retained by either their executing broker-dealer, a custodian bank or a prime broker. These transactions take place in the environment of equity and equity options exchanges, regulated by the U.S. Securities and Exchange Commission (SEC), or derivative exchanges, regulated by the Commodity Futures Trading Commission (CFTC). For transactions involving stocks and bonds, transfer agents assure that the ownership in each transaction is properly assigned to and held on behalf of each investor.

A securities information processor (SIP) is a part of the infrastructure of public market data providers in the United States that process, consolidate, and disseminate quotes and trade data from different US securities exchanges and market centers. An important purpose of the SIPs for US securities is to publish the prevailing National Best Bid Offer (NBBO).

References

- 1 2 3 4 Bondi, Bradley (April 29, 2014). "Memo to Michael Lewis". Forbes.

- ↑ SEC Release No. 34-51808 s. I.B.

- ↑ Joel Seligman, Rethinking Securities Markets, The Business Lawyer, Vol. 57, Feb. 2002, p.641

- ↑ "Regulation NMS - Proposed rules and amendments to joint industry plans". US Securities and Exchange Commission. 2005. Release No. 34-50870; File No. S7-10-04. Archived from the original on Jun 11, 2023.

- ↑ "17 CFR § 242.610 - Access to quotations". Legal Information Institute. Cornell Law School. Archived from the original on Sep 28, 2023.

- ↑ "17 CFR § 242.611 - Order protection rule". Legal Information Institute. Cornell Law School. Archived from the original on Jul 28, 2023.

- ↑ "17 CFR § 242.612 - Minimum pricing increment". Legal Information Institute. Cornell Law School. Archived from the original on Dec 19, 2022.

- ↑ Donald Ross (March 17, 2017). "It's time for the SEC to take a hard look at this stock market rule". The Hill. Archived from the original on May 6, 2021.

- ↑ Bullock, Nicole (30 March 2017). "SEC urged to review rules for equity market trading" . Financial Times. Archived from the original on Oct 6, 2022.

- ↑ Hans R. Stoll, Electronic Trading in Stock Markets, Journal of Economic Perspectives Vol. 20, No. 1, p.171

- 1 2 Hans R. Stoll, Electronic Trading in Stock Markets, Journal of Economic Perspectives Vol. 20, No. 1, p.172