Eur-Lex is the official online database of European Union law and other public documents of the European Union (EU), published in 24 official languages of the EU. The Official Journal (OJ) of the European Union is also published on EUR-Lex. Users can access EUR-Lex free of charge and also register for a free account, which offers extra features.

Comitology in the European Union refers to a process by which EU law is implemented or adjusted by the European Commission working in conjunction with committees of national representatives from the EU member states, colloquially called "comitology committees". These are chaired by the European Commission. The official term for the process is committee procedure. Comitology committees are part of the EU's broader system of committees that assist in the making, adoption, and implementation of EU laws.

Sustainability reporting refers to the disclosure, whether voluntary, solicited, or required, of non-financial performance information to outsiders of the organization. Sustainability reporting deals with qualitative and quantitative information concerning environmental, social, economic and governance issues. These are the criteria often gathered under the acronym ESG.

The European Institute of Innovation and Technology (EIT) is an independent body of the European Union with juridical personality, established in 2008 intended to strengthen Europe's ability to innovate. The EIT’s three “core pillars” of activities are: entrepreneurial education programmes and courses across Europe that transform students into entrepreneurs; business creation and acceleration services that scale ideas and budding businesses; and innovation-driven research projects that turn ideas into products by connecting partners, investors, and expertise.

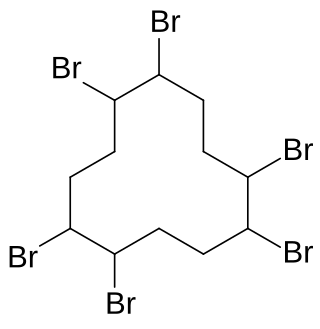

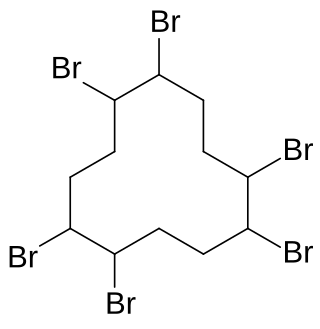

Hexabromocyclododecane is a brominated flame retardant. It consists of twelve carbon, eighteen hydrogen, and six bromine atoms tied to the ring. Its primary application is in extruded (XPS) and expanded (EPS) polystyrene foam used as thermal insulation in construction. Other uses are upholstered furniture, automobile interior textiles, car cushions and insulation blocks in trucks, packaging material, video cassette recorder housing, and electric and electronic equipment. According to UNEP, "HBCD is produced in China, Europe, Japan, and the USA. The known current annual production is approximately 28,000 tonnes per year. The main share of the market volume is used in Europe and China". Due to its persistence, toxicity, and ecotoxicity, the Stockholm Convention on Persistent Organic Pollutants decided in May 2013 to list hexabromocyclododecane in Annex A to the convention with specific exemptions for production and use in expanded polystyrene and extruded polystyrene in buildings. Because HBCD has 16 possible stereo-isomers with different biological activities, the substance poses a difficult problem for manufacture and regulation.

The Publications Office of the European Union is the official provider of publishing services and data, information and knowledge management services to all EU institutions, bodies and agencies. This makes it the central point of access to EU law, publications, open data, research results, procurement notices, and other official information.

Directive 2003/30/EC was a European Union directive for promoting the use of biofuels for EU transport. The directive entered into force in May 2003, and stipulated that national measures must be taken by countries across the EU aiming at replacing 5.75% of all transport fossil fuels with biofuels by 2010. The directive also called for an intermediate target of 2% by 31 December 2005. The target of 5.75% was to be met by 31 December 2010. These percentages were to be calculated on the basis of energy content of the fuel and were to apply to petrol and diesel fuel for transport purposes placed on the markets of member states. Member states were encouraged to take on national "indicative" targets in conformity with the overall target.

The Civil Mediation Council (CMC) is the recognised authority in England and Wales for all matters related to civil, commercial, workplace and other non-family mediation. It is the first point of contact for the Government, the judiciary, the legal profession and industry on mediation issues.

Environmental, social, and governance (ESG), is a set of aspects, including environmental issues, social issues and corporate governance that can be considered in investing. Investing with ESG considerations is sometimes referred to as responsible investing or, in more proactive cases, impact investing.

The European Securities and Markets Authority (ESMA) is an agency of the European Union located in Paris.

The European Union's Third Energy Package is a legislative package for an internal gas and electricity market in the European Union. Its purpose is to further open up the gas and electricity markets in the European Union. The package was proposed by the European Commission in September 2007, and adopted by the European Parliament and the Council of the European Union in July 2009. It entered into force on 3 September 2009.

Council Implementing Regulation (EU) No. 282/2011 was adopted by the Council of the European Union on 15 March 2011. This was mainly because the terms and wording of Directive 2006/112/EC have been inconclusive in some cases. The Regulation provided new implementing measures for the VAT Directive. Especially due to the amendment of the VAT Directive itself and the consistent case-law of the European Court of Justice, the former Implementing Regulation (EC) No. 1777/2005 had to be recast and clarified in certain aspects. This Implementing Regulation became effective on 1 July 2011 and does not have to be transported into national legislation of the individual member states of the European Union and thus is directly applicable.

Directive on intra-EU-transfers of defence-related products is a European Union Directive with relevance for the European Economic Area. "Transfer" in this context means "any transmission or movement of a defence-related product from a supplier to a recipient in another Member State".

Enterprise 2020 was an initiative launched in October 2010 to address the European and global challenges that question patterns of living, working, learning, communicating, consuming and sharing resources. The initiative aimed to promote responsible and sustainable business practice and prepare businesses for emerging societal challenges across the globe, including climate change, demographic change, resource scarcity and increased urbanisation. In the context of the European Union's Europe 2020 strategy, Enterprise 2020 highlighted the contribution of businesses to achieve the EU goals for building a 'smart, sustainable and inclusive' economy delivering high levels of employment, productivity and social cohesion by 2020.

The European Legislation Identifier (ELI) ontology is a vocabulary for representing metadata about national and European Union (EU) legislation. It is designed to provide a standardized way to identify and describe the context and content of national or EU legislation, including its purpose, scope, relationships with other legislations and legal basis. This will guarantee easier identification, access, exchange and reuse of legislation for public authorities, professional users, academics and citizens. ELI paves the way for knowledge graphs, based on semantic web standards, of legal gazettes and official journals.

European company law is the part of European Union law which concerns the formation, operation and insolvency of companies in the European Union. The EU creates minimum standards for companies throughout the EU, and has its own corporate forms. All member states continue to operate separate companies acts, which are amended from time to time to comply with EU Directives and Regulations. There is, however, also the option of businesses to incorporate as a Societas Europaea (SE), which allows a company to operate across all member states.

eIDAS is an EU regulation with the stated purpose of governing "electronic identification and trust services for electronic transactions". It passed in 2014 and its provisions came into effect between 2016 and 2018.

The Capital Markets Union (CMU) is an economic policy initiative launched by the former president of the European Commission, Jean-Claude Juncker in the initial exposition of his policy agenda on 15 July 2014. The main target was to create a single market for capital in the whole territory of the EU by the end of 2019. The reasoning behind the idea was to address the issue that corporate finance relies on debt (i.e. bank loans) and the fact that capital markets in Europe were not sufficiently integrated so as to protect the EU and especially the Eurozone from future crisis. The Five Presidents Report of June 2015 proposed the CMU in order to complement the Banking union of the European Union and eventually finish the Economic and Monetary Union (EMU) project. The CMU is supposed to attract 2000 billion dollars more on the European capital markets, on the long-term.

Sustainable finance is the set of practices, standards, norms, regulations and products that pursue financial returns alongside environmental and/or social objectives. It is sometimes used interchangeably with Environmental, Social & Governance (ESG) investing. However, many distinguish between ESG integration for better risk-adjusted returns and a broader field of sustainable finance that also includes impact investing, social finance and ethical investing.