In the United States, a 401(k) plan is an employer-sponsored, defined-contribution, personal pension (savings) account, as defined in subsection 401(k) of the U.S. Internal Revenue Code. Periodic employee contributions come directly out of their paychecks, and may be matched by the employer. This pre-tax option is what makes 401(k) plans attractive to employees, and many employers offer this option to their (full-time) workers. 401(k) payable is a general ledger account that contains the amount of 401(k) plan pension payments that an employer has an obligation to remit to a pension plan administrator. This account is classified as a payroll liability, since the amount owed should be paid within one year.

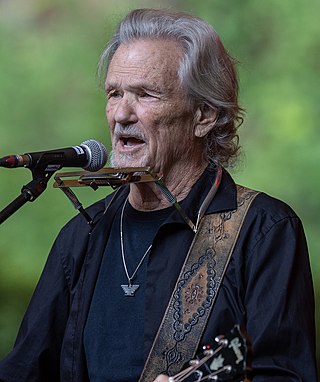

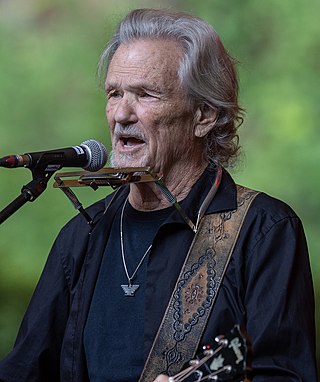

Kristoffer Kristofferson is an American retired country singer, songwriter, and actor. Among his songwriting credits are "Me and Bobby McGee", "For the Good Times", "Sunday Mornin' Comin' Down", and "Help Me Make It Through the Night", all of which were hits for other artists.

The Whitewater controversy, Whitewater scandal, Whitewatergate, or simply Whitewater, was an American political controversy during the 1990s. It began with an investigation into the real estate investments of Bill and Hillary Clinton and their associates, Jim and Susan McDougal, in the Whitewater Development Corporation. This failed business venture was incorporated in 1979 with the purpose of developing vacation properties on land along the White River near Flippin, Arkansas.

The Black Friday is the term for a gold panic on September 24, 1869, which triggered a financial crisis in the United States. It was the result of a conspiracy between two investors, Jay Gould, later joined by his partner James Fisk, and Abel Corbin, a small time speculator who had married Virginia (Jennie) Grant, the younger sister of President Ulysses S. Grant. They formed the Gold Ring to corner the gold market and force up the price of the metal on the New York Gold Exchange. The scandal took place during the Grant Presidency. The Secretary of the Treasury, George S. Boutwell, had a policy to sell Treasury gold at biweekly intervals for a sinking fund to pay off the national debt. Along with other, non-routine gold sales, this acted to stabilize the dollar and boost the economy. The country had gone through tremendous upheaval during the Civil War and was not yet fully restored.

The Panic of 1837 was a financial crisis in the United States that began a major depression, which lasted until the mid-1840s. Profits, prices, and wages dropped, westward expansion was stalled, unemployment rose, and pessimism abounded.

Nicholas Biddle was an American financier who served as the third and last president of the Second Bank of the United States. Throughout his life Biddle worked as an editor, diplomat, author, and politician who served in both houses of the Pennsylvania state legislature. He is best known as the chief opponent of Andrew Jackson in the Bank War.

An individual retirement account (IRA) in the United States is a form of pension provided by many financial institutions that provides tax advantages for retirement savings. It is a trust that holds investment assets purchased with a taxpayer's earned income for the taxpayer's eventual benefit in old age. An individual retirement account is a type of individual retirement arrangement as described in IRS Publication 590, Individual Retirement Arrangements (IRAs). Other arrangements include employer-established benefit trusts and individual retirement annuities, by which a taxpayer purchases an annuity contract or an endowment contract from a life insurance company.

Financial services are economic services tied to finance provided by financial institutions. Financial services encompass a broad range of service sector activities, especially as concerns financial management and consumer finance.

Bank fraud is the use of potentially illegal means to obtain money, assets, or other property owned or held by a financial institution, or to obtain money from depositors by fraudulently posing as a bank or other financial institution. In many instances, bank fraud is a criminal offence.

A bank run or run on the bank occurs when many clients withdraw their money from a bank, because they believe the bank may fail in the near future. In other words, it is when, in a fractional-reserve banking system, numerous customers withdraw cash from deposit accounts with a financial institution at the same time because they believe that the financial institution is, or might become, insolvent. When they transfer funds to another institution, it may be characterized as a capital flight. As a bank run progresses, it may become a self-fulfilling prophecy: as more people withdraw cash, the likelihood of default increases, triggering further withdrawals. This can destabilize the bank to the point where it runs out of cash and thus faces sudden bankruptcy. To combat a bank run, a bank may acquire more cash from other banks or from the central bank, or limit the amount of cash customers may withdraw, either by imposing a hard limit or by scheduling quick deliveries of cash, encouraging high-return term deposits to reduce on-demand withdrawals or suspending withdrawals altogether.

The Panic of 1907, also known as the 1907 Bankers' Panic or Knickerbocker Crisis, was a financial crisis that took place in the United States over a three-week period starting in mid-October, when the New York Stock Exchange suddenly fell almost 50% from its peak the previous year. The panic occurred during a time of economic recession, and there were numerous runs affecting banks and trust companies. The 1907 panic eventually spread throughout the nation when many state and local banks and businesses entered bankruptcy. The primary causes of the run included a retraction of market liquidity by a number of New York City banks and a loss of confidence among depositors, exacerbated by unregulated side bets at bucket shops.

The savings and loan crisis of the 1980s and 1990s was the failure of 32% of savings and loan associations (S&Ls) in the United States from 1986 to 1995. An S&L or "thrift" is a financial institution that accepts savings deposits and makes mortgage, car and other personal loans to individual members.

Harshad Shantilal Mehta was an Indian stockbroker and a convicted fraudster. Mehta's involvement in the 1992 Indian securities scam made him infamous as a market manipulator.

Bankers Trust was a historic American banking organization. The bank merged with Alex. Brown & Sons in 1997 before being acquired by Deutsche Bank in 1999. Deutsche Bank sold the Trust and Custody division of Bankers Trust to State Street Corporation in 2003.

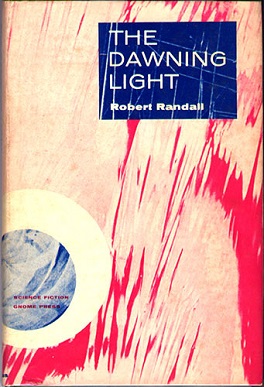

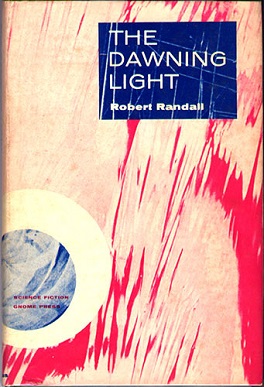

The Dawning Light is a 1959 science fiction novel published under the name Robert Randall, collaborative pseudonym of American writers Robert Silverberg and Randall Garrett. It depicts the changes, after the events of The Shrouded Planet by the same authors, in the society of the fictional planet Nidor, a world perpetually covered in dense cloud, inhabited by humanoids resembling humans but differing in several respects, notably in being covered from head to foot in short downy fur. The technological level of the society is about that of Renaissance Europe, and has been that way for thousands of years.

The Silver Tongued Devil and I is the second studio album recorded by singer-songwriter Kris Kristofferson. It was produced by Fred Foster, released in July 1971 on Monument Records and followed his critically acclaimed debut Kristofferson.

The Freedman's Saving and Trust Company, known as the Freedman's Savings Bank, was a private savings bank chartered by the U.S. Congress on March 3, 1865, to collect deposits from the newly emancipated communities. The bank opened 37 branches across 17 states and Washington DC within 7 years and collected funds from over 67,000 depositors. At the height of its success, the Freedman's Savings Bank held assets worth more than $3.7 million in 1872 dollars, which translates to approximately $80 million in 2021.

The Diamond–Dybvig model is an influential model of bank runs and related financial crises. The model shows how banks' mix of illiquid assets and liquid liabilities may give rise to self-fulfilling panics among depositors. Diamond and Dybvig, along with Ben Bernanke, were the recipients of the 2022 Nobel Prize in Economics for their work on the Diamond-Dybvig model.

A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. Lending activities can be directly performed by the bank or indirectly through capital markets.

The 1992 Indian stock market scam was a market manipulation carried out by Harshad Shantilal Mehta with other bankers and politicians on the Bombay Stock Exchange. The scam caused significant disruption to the stock market of India, defrauding investors of over ten million USD.