The Standard and Poor's 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 of the largest companies listed on stock exchanges in the United States. It is one of the most commonly followed equity indices and includes approximately 80% of the total market capitalization of U.S. public companies.

An exchange-traded fund (ETF) is a type of investment fund that is also an exchange-traded product, i.e., it is traded on stock exchanges. ETFs own financial assets such as stocks, bonds, currencies, debts, futures contracts, and/or commodities such as gold bars. The list of assets that each ETF owns, as well as their weightings, is posted on the website of the issuer daily, or quarterly in the case of active non-transparent ETFs. Many ETFs provide some level of diversification compared to owning an individual stock.

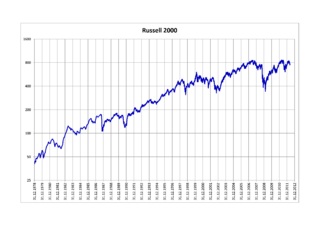

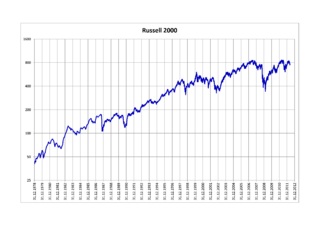

The Russell 2000 Index is a small-cap U.S. stock market index that makes up the smallest 2,000 stocks in the Russell 3000 Index. It was started by the Frank Russell Company in 1984. The index is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group (LSEG).

Russell indexes are a family of global stock market indices from FTSE Russell that allow investors to track the performance of distinct market segments worldwide. Many investors use mutual funds or exchange-traded funds based on the FTSE Russell Indexes as a way of gaining exposure to certain portions of the U.S. stock market. Additionally, many investment managers use the Russell Indexes as benchmarks to measure their own performance. Russell's index design has led to more assets benchmarked to its U.S. index family than all other U.S. equity indexes combined.

The Russell 1000 Index is a stock market index that tracks the highest-ranking 1,000 stocks in the Russell 3000 Index, which represent about 93% of the total market capitalization of that index. As of 31 December 2023, the stocks of the Russell 1000 Index had a weighted average market capitalization of $666.0 billion and a median market capitalization of $13.9 billion. As of 8 May 2020, components ranged in market capitalization from $1.8 billion to $1.4 trillion. The index, which was launched on January 1, 1984, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The S&P Latin America 40 is a stock market index from Standard & Poor's. It tracks Latin American stocks.

The Russell Midcap Index measures performance of the 800 smallest companies in the Russell 1000 Index. As of 30 November 2022, the stocks of the Russell Midcap Index have a weighted average market capitalization of approximately $22.64 billion, median market capitalization of $9.91 billion, and the market capitalization of the largest company is $54.74 billion. The index, which was launched on November 1, 1991, is maintained by FTSE Russell, a subsidiary of the London Stock Exchange Group.

The S&P 100 Index is a stock market index of United States stocks maintained by Standard & Poor's.

An inverse exchange-traded fund is an exchange-traded fund (ETF), traded on a public stock market, which is designed to perform as the inverse of whatever index or benchmark it is designed to track. These funds work by using short selling, trading derivatives such as futures contracts, and other leveraged investment techniques.

The S&P MidCap 400 Index, more commonly known as the S&P 400, is a stock market index from S&P Dow Jones Indices.

The S&P SmallCap 600 Index is a stock market index established by S&P Global Ratings. It covers roughly the small-cap range of American stocks, using a capitalization-weighted index.

The Russell Top 200 Index measures the performance of the 200 largest companies in the Russell 1000 Index, with a weighted average market capitalization of $186 billion. The median capitalization is $48 billion; the smallest company in the index has an approximate capitalization of $14 billion.

The Russell Top 50 Index measures the performance of the largest companies in the Russell 3000 Index. It includes approximately 50 of the largest securities based on a combination of their market cap and current index membership and represents approximately 40% of the total market capitalization of the Russell 3000.

The Russell 2500 Index measures the performance of the 2,500 smallest companies in the Russell 3000 Index, with a weighted average market capitalization of approximately $4.3 billion, median capitalization of $1.2 billion and market capitalization of the largest company of $18.7 billion.

The Russell Microcap Index measures the performance of the microcap segment of the U.S. equity market. It makes up less than 3% of the U.S. equity market. It includes 1,000 of the smallest securities in the Russell 2000 Index based on a combination of their market cap and current index membership and it also includes up to the next 1,000 stocks. As of 31 December 2016, the weighted average market capitalization for a company in the index was $535 million; the median market cap was $228 million. The market cap of the largest company in the index was $3.6 billion.

The Russell Small Cap Completeness Index measures the performance of the companies in the Russell 3000 Index excluding the companies in the S&P 500. As of 30 April 2021, the index contains 2,561 holdings. It provides a performance standard for active money managers seeking a liquid extended benchmark, and can be used for a passive investment strategy in the extended market. Weighted average market capitalization is approximately $15.4 billion.

Invesco PowerShares is an American boutique investment management firm based near Chicago which manages a family of exchange-traded funds or ETFs. The company has been part of Invesco, which markets the PowerShares product, since 2006.

The SPDR S&P 500 ETF trust is an exchange-traded fund which trades on the NYSE Arca under the symbol SPY. SPDR is an acronym for the Standard & Poor's Depositary Receipts, the former name of the ETF. It is designed to track the S&P 500 stock market index. This fund is the largest and oldest ETF in the world. SPDR is a trademark of Standard and Poor's Financial Services LLC, a subsidiary of S&P Global. The ETF's CUSIP is 78462F103 and its ISIN is US78462F1030. The trustee of the SPDR S&P 500 ETF Trust is State Street Bank and Trust Company. The fund has a net expense ratio of 0.0945%.

The Barron's 400 Index or B400 is a stock market index of 400 public companies in the United States, as selected by editors and associates of Barron's magazine. Established in 2007, the Barron's 400 has tended to outperform certain other major indexes at least through the first half of 2013.