The Fourteenth Amendment to the United States Constitution was adopted on July 9, 1868, as one of the Reconstruction Amendments. Usually considered one of the most consequential amendments, it addresses citizenship rights and equal protection under the law and was proposed in response to issues related to formerly enslaved Americans following the American Civil War. The amendment was bitterly contested, particularly by the states of the defeated Confederacy, which were forced to ratify it in order to regain representation in Congress. The amendment, particularly its first section, is one of the most litigated parts of the Constitution, forming the basis for landmark Supreme Court decisions such as Brown v. Board of Education (1954) regarding racial segregation, Roe v. Wade (1973) regarding abortion, Bush v. Gore (2000) regarding the 2000 presidential election, Obergefell v. Hodges (2015) regarding same-sex marriage, and Students for Fair Admissions v. Harvard (2023) regarding race-based college admissions. The amendment limits the actions of all state and local officials, and also those acting on behalf of such officials.

Corporate personhood or juridical personality is the legal notion that a juridical person such as a corporation, separately from its associated human beings, has at least some of the legal rights and responsibilities enjoyed by natural persons. In most countries, a corporation has the same rights as a natural person to hold property, enter into contracts, and to sue or be sued.

Separate but equal was a legal doctrine in United States constitutional law, according to which racial segregation did not necessarily violate the Fourteenth Amendment to the United States Constitution, which nominally guaranteed "equal protection" under the law to all people. Under the doctrine, as long as the facilities provided to each race were equal, state and local governments could require that services, facilities, public accommodations, housing, medical care, education, employment, and transportation be segregated by race, which was already the case throughout the states of the former Confederacy. The phrase was derived from a Louisiana law of 1890, although the law actually used the phrase "equal but separate".

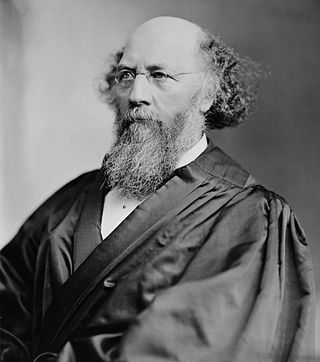

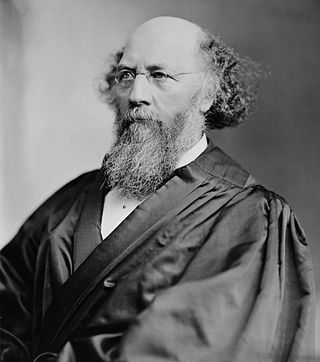

Morrison Remick "Mott" Waite was an American attorney, jurist, and politician from Ohio. He served as the seventh chief justice of the United States from 1874 until his death in 1888. During his tenure, the Waite Court took a narrow interpretation of federal authority related to laws and amendments that were enacted during the Reconstruction Era to expand the rights of freedmen and protect them from attacks by white supremacy groups such as the Ku Klux Klan.

United States v. Cruikshank, 92 U.S. 542 (1876), was a landmark decision of the United States Supreme Court ruling that the U.S. Bill of Rights did not limit the power of private actors or state governments despite the adoption of the Fourteenth Amendment. It reversed the federal criminal convictions for the civil rights violations committed in aid of anti-Reconstruction murders. Decided during the Reconstruction Era, the case represented a major defeat for federal efforts to protect the civil rights of African Americans.

A Due Process Clause is found in both the Fifth and Fourteenth Amendments to the United States Constitution, which prohibit the deprivation of "life, liberty, or property" by the federal and state governments, respectively, without due process of law.

Stephen Johnson Field was an American jurist. He was an Associate Justice of the United States Supreme Court from May 20, 1863, to December 1, 1897, the second longest tenure of any justice. Prior to this appointment, he was the fifth Chief Justice of California.

The Equal Protection Clause is part of the first section of the Fourteenth Amendment to the United States Constitution. The clause, which took effect in 1868, provides "nor shall any State ... deny to any person within its jurisdiction the equal protection of the laws." It mandates that individuals in similar situations be treated equally by the law.

John Chandler Bancroft Davis, commonly known as Bancroft Davis, was an attorney, diplomat, judge of the Court of Claims, and Reporter of Decisions of the Supreme Court of the United States.

Apodaca v. Oregon, 406 U.S. 404 (1972), was a United States Supreme Court case in which the Court held that state juries may convict a defendant by a less-than-unanimous verdict in a felony criminal case. The four-justice plurality opinion of the court, written by Justice White, affirmed the judgment of the Oregon Court of Appeals and held that there was no constitutional right to a unanimous verdict. Although federal law requires federal juries to reach criminal verdicts unanimously, the Court held Oregon's practice did not violate the Sixth Amendment right to trial by jury and so allowed it to continue. In Johnson v. Louisiana, a case decided on the same day, the Court held that Louisiana's similar practice of allowing criminal convictions by a jury vote of 9–3 did not violate due process or equal protection under the Fourteenth Amendment.

Smyth v. Ames, 171 U.S. 361 (1898), also called The Maximum Freight Case, was an 1898 United States Supreme Court case. The Supreme Court voided a Nebraska railroad tariff law, declaring that it violated the Fourteenth Amendment to the United States Constitution in that it takes property without the due process of law. The Court defined the constitutional limits of governmental power to set railroad and utility rates by stating that regulated industries have the right to a "fair return". The ruling was later overturned in Federal Power Commission v. Hope Natural Gas Co.

Tax protesters in the United States advance a number of constitutional arguments asserting that the imposition, assessment and collection of the federal income tax violates the United States Constitution. These kinds of arguments, though related to, are distinguished from statutory and administrative arguments, which presuppose the constitutionality of the income tax, as well as from general conspiracy arguments, which are based upon the proposition that the three branches of the federal government are involved together in a deliberate, on-going campaign of deception for the purpose of defrauding individuals or entities of their wealth or profits. Although constitutional challenges to U.S. tax laws are frequently directed towards the validity and effect of the Sixteenth Amendment, assertions that the income tax violates various other provisions of the Constitution have been made as well.

Williams v. Rhodes, 393 U.S. 23 (1968), is a decision by the United States Supreme Court which held that Ohio had violated the equal protection rights under the Fourteenth Amendment of two political parties by refusing to print their candidates' names on the ballot.

Griffin v. Illinois, 351 U.S. 12 (1956), was a case in which United States Supreme Court held that a criminal defendant may not be denied the right to appeal by inability to pay for a trial transcript.

Santa Clara Pueblo v. Martinez, 436 U.S. 49 (1978), was a landmark case in the area of federal Indian law involving issues of great importance to the meaning of tribal sovereignty in the contemporary United States. The Supreme Court sustained a law passed by the governing body of the Santa Clara Pueblo that explicitly discriminated on the basis of sex. In so doing, the Court advanced a theory of tribal sovereignty that weighed the interests of tribes sufficient to justify a law that, had it been passed by a state legislature or Congress, would have almost certainly been struck down as a violation of equal protection.

Hunter v. Underwood, 471 U.S. 222 (1985), was a case in which the United States Supreme Court, in a unanimous decision, invalidated the criminal disenfranchisement provision of § 182 of the Alabama Constitution as a violation of the Equal Protection Clause of the Fourteenth Amendment to the U.S. Constitution.

The Waite Court refers to the Supreme Court of the United States from 1874 to 1888, when Morrison Waite served as the seventh Chief Justice of the United States. Waite succeeded Salmon P. Chase as Chief Justice after the latter's death. Waite served as Chief Justice until his death, at which point Melville Fuller was nominated and confirmed as Waite's successor.

A campaign finance reform amendment refers to any proposed amendment to the United States Constitution to authorize greater restrictions on spending related to political speech, and to overturn Supreme Court rulings which have narrowed such laws under the First Amendment. Several amendments have been filed since Citizens United v. Federal Election Commission and the Occupy movement.

Johnson v. Louisiana, 406 U. S. 356 (1972), was a court case in the U.S. Supreme Court involving the Due Process Clause and Equal Protection Clause of the Fourteenth Amendment to the United States Constitution. The U.S. Supreme Court ruled that the Louisiana law that allowed less-than unanimous jury verdicts to convict persons charged with a felony, does not violate the Due Process clause. This case was argued on a similar basis as Apodaca v. Oregon.