Related Research Articles

A pension is a fund into which amounts are paid regularly during an individual's working career, and from which periodic payments are made to support the person's retirement from work. A pension may be:

A pension fund, also known as a superannuation fund in some countries, is any program, fund, or scheme which provides retirement income.

Welfare, or commonly social welfare, is a type of government support intended to ensure that members of a society can meet basic human needs such as food and shelter. Social security may either be synonymous with welfare, or refer specifically to social insurance programs which provide support only to those who have previously contributed, as opposed to social assistance programs which provide support on the basis of need alone. The International Labour Organization defines social security as covering support for those in old age, support for the maintenance of children, medical treatment, parental and sick leave, unemployment and disability benefits, and support for sufferers of occupational injury.

National Insurance (NI) is a fundamental component of the welfare state in the United Kingdom. It acts as a form of social security, since payment of NI contributions establishes entitlement to certain state benefits for workers and their families.

Unemployment benefits, also called unemployment insurance, unemployment payment, unemployment compensation, or simply unemployment, are payments made by governmental bodies to unemployed people. Depending on the country and the status of the person, those sums may be small, covering only basic needs, or may compensate the lost time proportionally to the previous earned salary.

Social welfare, assistance for the ill or otherwise disabled and the old, has long been provided in Japan by both the government and private companies. Beginning in the 1920s, the Japanese government enacted a series of welfare programs, based mainly on European models, to provide medical care and financial support. During the post-war period, a comprehensive system of social security was gradually established. Universal health insurance and a pension system were established in 1960.

A social welfare model is a system of social welfare provision and its accompanying value system. It usually involves social policies that affect the welfare of a country's citizens within the framework of a market or mixed economy.

The Italian welfare state is based partly upon the corporatist-conservative model and partly upon the universal welfare model.

Social security in India includes a variety of statutory insurances and social grant schemes bundled into a formerly complex and fragmented system run by the Indian government at the federal and the state level. The Directive Principles of State Policy, enshrined in Part IV of the Indian Constitution reflects that India is a welfare state. Food security to all Indians are guaranteed under the National Food Security Act, 2013 where the government provides highly subsidised food grains or a food security allowance to economically vulnerable people. The system has since been universalised with the passing of The Code on Social Security, 2020. These cover most of the Indian population with social protection in various situations in their lives.

Welfare in France includes all systems whose purpose is to protect people against the financial consequences of social risks.

Defined benefit (DB) pension plan is a type of pension plan in which an employer/sponsor promises a specified pension payment, lump-sum, or combination thereof on retirement that depends on an employee's earnings history, tenure of service and age, rather than depending directly on individual investment returns. Traditionally, many governmental and public entities, as well as a large number of corporations, provide defined benefit plans, sometimes as a means of compensating workers in lieu of increased pay.

The National Pension Service is a public pension fund in South Korea. It is the third largest in the world with over $800 billion in assets, and is the largest investor in South Korea.

According to the International Labour Organization, social security is a human right that aims at reducing and preventing poverty and vulnerability throughout the life cycle of individuals. Social security includes different kinds of benefits A social pension is a stream of payments from the state to an individual that starts when someone retires and continues to be paid until death. This type of pension represents the non-contributory part of the pension system, the other being the contributory pension, as per the most common form of composition of these systems in most developed countries.

In France, pensions fall into five major divisions;

The Swiss pension system rests on three pillars:

- the state-run pension scheme for the aged, orphans, and surviving spouses ;

- the pension funds run by investment foundations, which are tied to employers ;

- voluntary, private investments.

Compared to other liberal democracies, Ireland's pension policies have average coverage, which includes 78 percent of the workforce, and it offers different types of pensions for employees to choose from. The Irish pension system is designed as a pay-as-you-go program and is based on both public and private pension programs.

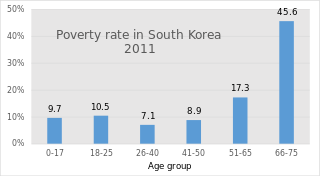

South Korea's pension scheme was introduced relatively recently, compared to other democratic nations. Half of the country's population aged 65 and over lives in relative poverty, or nearly four times the 13% average for member countries of the Organisation for Economic Co-operation and Development (OECD). This makes old age poverty an urgent social problem. Public social spending by general government is half the OECD average, and is the lowest as a percentage of GDP among OECD member countries.

Pensions in Denmark consist of both private and public programs, all managed by the Agency for the Modernisation of Public Administration under the Ministry of Finance. Denmark created a multipillar system, consisting of an unfunded social pension scheme, occupational pensions, and voluntary personal pension plans. Denmark's system is a close resemblance to that encouraged by the World Bank in 1994, emphasizing the international importance of establishing multifaceted pension systems based on public old-age benefit plans to cover the basic needs of the elderly. The Danish system employed a flat-rate benefit funded by the government budget and available to all Danish residents. The employment-based contribution plans are negotiated between employers and employees at the individual firm or profession level, and cover individuals by labor market systems. These plans have emerged as a result of the centralized wage agreements and company policies guaranteeing minimum rates of interest. The last pillar of the Danish pension system is income derived from tax-subsidized personal pension plans, established with life insurance companies and banks. Personal pensions are inspired by tax considerations, desirable to people not covered by the occupational scheme.

Public pensions in Greece are designed to provide incomes to Greek pensioners upon reaching retirement. For decades pensions in Greece were known to be among the most generous in the European Union, allowing many pensioners to retire earlier than pensioners in other European countries. This placed a heavy burden on Greece's public finances which made the Greek state increasingly vulnerable to external economic shocks, culminating in a recession due to the 2008 financial crisis and subsequent European debt crisis. This series of crises has forced the Greek government to implement economic reforms aimed at restructuring the pension system and eliminating inefficiencies within it. Measures in the Greek austerity packages imposed upon Greek citizens by the European Central Bank have achieved some success at reforming the pension system despite having stark ramifications for standards of living in Greece, which have seen a sharp decline since the beginning of the crisis.

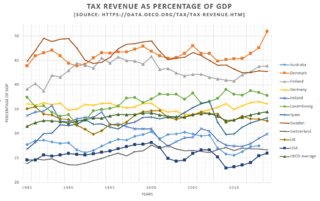

Tax revenue in Luxembourg was 38.65% of GDP in 2017, which is just above the average OECD in 2017.

References

- ↑ "Social security". Luxembourg.public.lu. Retrieved 2016-11-30.

- 1 2 3 Hartmann-Hirsch, Claudia (2010). "The State of the Luxembourg's Welfare State: the Effects of the Crisis on a Corporatist Model Shifting to a Universalistic Model" (PDF). CEPS/INSTEAD Working Papers. 2010–44.

- 1 2 3 "Social Security in Luxembourg - Luxembourg - Angloinfo". Angloinfo. Retrieved 2016-12-03.

- ↑ "Data: Luxembourg". OECD. Retrieved 16 May 2024.

- 1 2 "The World Factbook — Central Intelligence Agency". www.cia.gov. Retrieved 2016-11-30.

- ↑ "Nationalities". Statistiques.lu. Retrieved 16 May 2024.

- ↑ "Overview of the labour market". Portrail de l'emploi, Government of the Grand Ducky of Luxembourg. Retrieved 16 May 2024.

- ↑ "Society: Demographics". statista. Retrieved 16 May 2024.

- ↑ "Social security". Luxembourg.public.lu. Retrieved 2016-12-02.