The socially optimal firm size is the size for a company in a given industry at a given time which results in the lowest production costs per unit of output.

The socially optimal firm size is the size for a company in a given industry at a given time which results in the lowest production costs per unit of output.

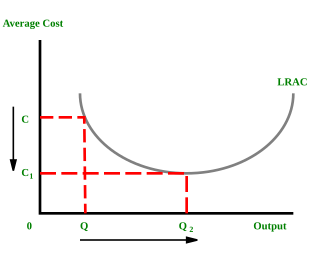

If only diseconomies of scale existed, then the long-run average cost-minimizing firm size would be one worker, producing the minimal possible level of output. However, economies of scale also apply, which state that large firms can have lower per-unit costs due to buying at bulk discounts (components, insurance, real estate, advertising, etc.) and can also limit competition by buying out competitors, setting proprietary industry standards (like Microsoft Windows), etc. If only these "economies of scale" applied, then the ideal firm size would be infinitely large. However, since both apply, the firm must not be too small or too large, to minimize unit costs.

The "diseconomies of scale" do not tend to vary widely by industry, but "economies of scale" do. An auto maker has very high fixed costs, which are lower per unit of output the more output is produced. On the other hand, a florist has very low fixed costs and hence very limited sources of economies of scale. Thus there are disparate degrees of economies of scales for different types of organizations.

An industrial society will tend to have large firms, as industry has substantial economies of scale. A service-based economy will favor smaller firms, as services have limited economies of scale. There will, of course, be exceptions, such as Microsoft, which is a huge services company.

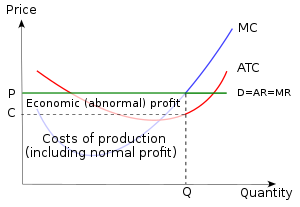

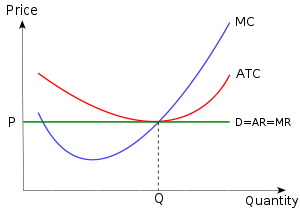

If the market for a product exhibits free entry, meaning that firms can enter (and exit) the market at will with no logistical, legal, or other inhibiting factors, and if firms have U-shaped long-run average cost curves as in the graphs at the right, then in the long run all firms will end up producing at their point of minimum average cost. For suppose a particular firm with the illustrated long-run average cost curve is faced with the market price P indicated in the upper graph. The firm produces at the quantity of output where marginal cost equals marginal revenue (labeled Q in the upper graph), and its per-unit economic profit is the difference between average revenue AR and average total cost ATC at that point, the difference being P minus C in the graph's notation. With firms making economic profit and with free entry, other firms will enter the market for this product, and their additional supply will bring down the market price of the product; this process will continue until there is no longer any economic profit to entice further entrants. The long-run outcome is shown in the second graph, with production by each firm occurring at the newly labelled Q, with marginal cost equalling price at the minimum of the long-run average cost curve, and with the gap between average revenue (the height of the average revenue curve at this Q) and average cost (the height of the average cost curve at this Q) being zero.

Thus with firms possessing U-shaped long-run average cost curves, perfect competition, with (1) firms small enough relative to the overall market that they cannot individually influence the product's market price, and with (2) free entry, leads in the long run to a situation in which no firm is making economic profit, and in which firms are of their socially optimal size (producing at the minimum of their long-run average cost curve).

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept.

A monopoly, as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterised by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

Monopolistic competition is a type of imperfect competition such that there are many producers competing against each other, but selling products that are differentiated from one another and hence are not perfect substitutes. In monopolistic competition, a company takes the prices charged by its rivals as given and ignores the impact of its own prices on the prices of other companies. If this happens in the presence of a coercive government, monopolistic competition will fall into government-granted monopoly. Unlike perfect competition, the company maintains spare capacity. Models of monopolistic competition are often used to model industries. Textbook examples of industries with market structures similar to monopolistic competition include restaurants, cereals, clothing, shoes, and service industries in large cities. The "founding father" of the theory of monopolistic competition is Edward Hastings Chamberlin, who wrote a pioneering book on the subject, Theory of Monopolistic Competition (1933). Joan Robinson published a book The Economics of Imperfect Competition with a comparable theme of distinguishing perfect from imperfect competition. Further work on monopolistic competition was undertaken by Dixit and Stiglitz who created the Dixit-Stiglitz model which has proved applicable used in the sub fields of international trade theory, macroeconomics and economic geography.

A natural monopoly is a monopoly in an industry in which high infrastructural costs and other barriers to entry relative to the size of the market give the largest supplier in an industry, often the first supplier in a market, an overwhelming advantage over potential competitors. Specifically, an industry is a natural monopoly if the total cost of one firm, producing the total output, is lower than the total cost of two or more firms producing the entire production. In that case, it is very probable that a company (monopoly) or minimal number of companies (oligopoly) will form, providing all or most relevant products and/or services. This frequently occurs in industries where capital costs predominate, creating large economies of scale about the size of the market; examples include public utilities such as water services, electricity, telecommunications, mail, etc. Natural monopolies were recognized as potential sources of market failure as early as the 19th century; John Stuart Mill advocated government regulation to make them serve the public good.

An oligopoly is a market in which control over an industry lies in the hands of a few large sellers who own a dominant share of the market. Oligopolistic markets have homogenous products, few market participants, and inelastic demand for the products in those industries. As a result of their significant market power, firms in oligopolistic markets can influence prices through manipulating the supply function. Firms in an oligopoly are also mutually interdependent, as any action by one firm is expected to affect other firms in the market and evoke a reaction or consequential action. As a result, firms in oligopolistic markets often resort to collusion as means of maximising profits.

In economics, specifically general equilibrium theory, a perfect market, also known as an atomistic market, is defined by several idealizing conditions, collectively called perfect competition, or atomistic competition. In theoretical models where conditions of perfect competition hold, it has been demonstrated that a market will reach an equilibrium in which the quantity supplied for every product or service, including labor, equals the quantity demanded at the current price. This equilibrium would be a Pareto optimum.

In economics, profit maximization is the short run or long run process by which a firm may determine the price, input and output levels that will lead to the highest possible total profit. In neoclassical economics, which is currently the mainstream approach to microeconomics, the firm is assumed to be a "rational agent" which wants to maximize its total profit, which is the difference between its total revenue and its total cost.

Economies of scope are "efficiencies formed by variety, not volume". In economics, "economies" is synonymous with cost savings and "scope" is synonymous with broadening production/services through diversified products. Economies of scope is an economic theory stating that average total cost of production decrease as a result of increasing the number of different goods produced. For example, a gas station that sells gasoline can sell soda, milk, baked goods, etc. through their customer service representatives and thus gasoline companies achieve economies of scope.

The following outline is provided as an overview of and topical guide to industrial organization:

In economics, the marginal cost is the change in the total cost that arises when the quantity produced is increased, i.e. the cost of producing additional quantity. In some contexts, it refers to an increment of one unit of output, and in others it refers to the rate of change of total cost as output is increased by an infinitesimal amount. As Figure 1 shows, the marginal cost is measured in dollars per unit, whereas total cost is in dollars, and the marginal cost is the slope of the total cost, the rate at which it increases with output. Marginal cost is different from average cost, which is the total cost divided by the number of units produced.

Monopoly profit is an inflated level of profit due to the monopolistic practices of an enterprise.

In economics, average cost (AC) or unit cost is equal to total cost (TC) divided by the number of units of a good produced :

Marginal revenue is a central concept in microeconomics that describes the additional total revenue generated by increasing product sales by 1 unit. Marginal revenue is the increase in revenue from the sale of one additional unit of product, i.e., the revenue from the sale of the last unit of product. It can be positive or negative. Marginal revenue is an important concept in vendor analysis. To derive the value of marginal revenue, it is required to examine the difference between the aggregate benefits a firm received from the quantity of a good and service produced last period and the current period with one extra unit increase in the rate of production. Marginal revenue is a fundamental tool for economic decision making within a firm's setting, together with marginal cost to be considered.

In economics, a cost curve is a graph of the costs of production as a function of total quantity produced. In a free market economy, productively efficient firms optimize their production process by minimizing cost consistent with each possible level of production, and the result is a cost curve. Profit-maximizing firms use cost curves to decide output quantities. There are various types of cost curves, all related to each other, including total and average cost curves; marginal cost curves, which are equal to the differential of the total cost curves; and variable cost curves. Some are applicable to the short run, others to the long run.

In economics, total cost (TC) is the minimum financial cost of producing some quantity of output. This is the total economic cost of production and is made up of variable cost, which varies according to the quantity of a good produced and includes inputs such as labor and raw materials, plus fixed cost, which is independent of the quantity of a good produced and includes inputs that cannot be varied in the short term such as buildings and machinery, including possibly sunk costs.

In economics, the long-run is a theoretical concept in which all markets are in equilibrium, and all prices and quantities have fully adjusted and are in equilibrium. The long-run contrasts with the short-run, in which there are some constraints and markets are not fully in equilibrium. More specifically, in microeconomics there are no fixed factors of production in the long-run, and there is enough time for adjustment so that there are no constraints preventing changing the output level by changing the capital stock or by entering or leaving an industry. This contrasts with the short-run, where some factors are variable and others are fixed, constraining entry or exit from an industry. In macroeconomics, the long-run is the period when the general price level, contractual wage rates, and expectations adjust fully to the state of the economy, in contrast to the short-run when these variables may not fully adjust.

In economics, supply is the amount of a resource that firms, producers, labourers, providers of financial assets, or other economic agents are willing and able to provide to the marketplace or to an individual. Supply can be in produced goods, labour time, raw materials, or any other scarce or valuable object. Supply is often plotted graphically as a supply curve, with the price per unit on the vertical axis and quantity supplied as a function of price on the horizontal axis. This reversal of the usual position of the dependent variable and the independent variable is an unfortunate but standard convention.

In industrial organization, the minimum efficient scale (MES) or efficient scale of production is the lowest point where the plant can produce such that its long run average costs are minimized. It is also the point at which the firm can achieve necessary economies of scale for it to compete effectively within the market.

In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. It is equal to total revenue minus total cost, including both explicit and implicit costs.

A firm will choose to implement a shutdown of production when the revenue received from the sale of the goods or services produced cannot even cover the variable costs of production. In that situation, the firm will experience a higher loss when it produces, compared to not producing at all.