History

SEACEN started as an unofficial grouping of central banks governors from the International Monetary Fund's Southeast Asia Voting Group. The first meeting of that group was held in Bangkok on 3–4 February 1966, with participating governors from the National Bank of Laos, Central Bank of Malaysia, Central Bank of the Philippines, Central Bank of Sri Lanka, National Bank of Vietnam, Bank of Thailand, and an official from Singapore. The meeting was co-chaired by Ismail Mohamed Ali (Malaysia) and Puey Ungphakorn (Thailand). [1]

At the next meeting in 1967, which took place in Manila, the governors decided to establish a joint training center in Kuala Lumpur. This vision advanced in 1972, when the governors deciding to established the SEACEN Research and Training Centre in which staff from the Malaysian central bank would train colleagues from other countries. Eventually, at their 17th meeting in Thailand on 3 February 1982, eight governors signed an agreement to establish the SEACEN Research and Training Centre as an autonomous entity. [2]

Since 1992, SEACEN has had ongoing formal engagement with Taiwan, including its central bank but also other authorities such as the Central Deposit Insurance Corporation in Taipei. [3] In 2011, the year when the People's Bank of China joined SEACEN, the Central Bank of the Republic of China (Taiwan) protested after SEACEN referred to it inaccurately as "Central Bank, Chinese Taipei". [4]

The Bank for International Settlements (BIS) is an international financial institution which is owned by member central banks. Its primary goal is to foster international monetary and financial cooperation while serving as a bank for central banks. With its establishment in 1929, its initial purpose was to oversee the settlement of World War I war reparations.

The Philippine peso, also referred to by its Filipino name piso, is the official currency of the Philippines. It is subdivided into 100 sentimo, also called centavos.

Banknotes of the Philippine peso are issued by the Bangko Sentral ng Pilipinas for circulation in the Philippines. The smallest amount of legal tender in wide circulation is ₱20 and the largest is ₱1000. The front side of each banknote features prominent people along with buildings, and events in the country's history while the reverse side depicts landmarks and animals.

The Bangko Sentral ng Pilipinas is the central bank of the Philippines. It was established on July 3, 1993, pursuant to the provision of Republic Act 7653 or the New Central Bank Act of 1993 as amended by Republic Act 11211 or the New Central Bank Act of 2019. The principal author was Senator Franklin Drilon. It was signed by President Rodrigo Duterte.

The Philippine International Convention Center is a convention center located in the Cultural Center of the Philippines Complex in Pasay, Metro Manila, Philippines. The facility has been the host of numerous local and foreign conventions, meetings, fairs, and social events.

Rafael Carlos Baltazar Buenaventura was a prominent banker in the Philippines who served as the second Governor of the Bangko Sentral ng Pilipinas ; he served under two Philippine presidents during one of the most tumultuous political transitions in the country's history.

Asia United Bank Corporation, commonly known as Asia United Bank or AUB is a universal bank in the Philippines and licensed by the Bangko Sentral ng Pilipinas (BSP). AUB is the banking arm of the Rebisco Group. It is among the very few banks that was granted a full-branch commercial banking license in 1997 and is operating until this day. In 2013, AUB joined the league of Philippine banks that have become publicly listed and acquired universal banking status. As of 2022, AUB is the thirteenth largest bank in the Philippines in terms of assets.

The University of the Philippines School of Economics is a degree-granting unit of the University of the Philippines Diliman (U.P.), where it occupies the buildings of the Philippine Center for Economic Development (PCED). The school offers two Bachelor of Science degrees, two master's degrees and the Ph.D. in economics.

The Philippine twenty-peso note (₱20) is a denomination of Philippine currency. It is the smallest banknote denomination in general circulation in the Philippines. Philippine president Manuel L. Quezon is currently featured on the front side of the note, while the Banaue Rice Terraces and the Asian palm civet is featured on the reverse side.

The Philippine five hundred-peso note (₱500) is a denomination of Philippine currency. Senator Benigno Aquino Jr. and his wife, President Corazon Aquino are currently featured on the front side of the note, while the Puerto Princesa Subterranean River National Park and the blue-naped parrot are featured on the reverse side. BSP will issue the polymer version of this denomination by 2023 and will be the second denomination in this format after the 1000-Piso polymer banknote issued last April 2022.

The Philippine ten-peso note (₱10) was a denomination of Philippine currency. In its latest incarnation, Apolinario Mabini and Andrés Bonifacio are featured on the front side of the notes, while the Barasoain Church and a Blood Compact scene of the Katipuneros are featured on the reverse side. This banknote was circulated until the demonetization of the New Design Series on January 3, 2018. Its printing was stopped in 2001 and was replaced by coins.

In the Philippines, monetary policy is the way the central bank, the Bangko Sentral ng Pilipinas, controls the supply and availability of money, the cost of money, and the rate of interest. With fiscal policy, monetary policy allows the government to influence the economy, control inflation, and stabilize currency.

Amando Maglalang Tetangco Jr. is a Filipino banker, who served as the third Governor of the Bangko Sentral ng Pilipinas (BSP). He was the first BSP governor to serve two terms, having been first appointed to the office by Philippine president Gloria Macapagal Arroyo in July 3, 2005, and reappointed in July 31, 2011 by President Benigno Aquino III to serve another six-year term.

Citystate Savings Bank is a publicly listed thrift bank listed in the Philippine Stock Exchange. The bank was a partnership between a group of Filipino businessmen led by Ambassador Antonio Cabangon Chua and a Singaporean investment holding company. It was granted the thrift bank license by the Monetary Board of Bangko Sentral ng Pilipinas in 1997. City State offers banking services, such as deposit products and services, cash management, onsite/offsite ATM facilities, corporate and retail banking, and treasury services. The bank caters to the needs of corporate, middle market and retail clients. The bank operates a total of 24 branches nationwide and employs 276 employees at the end of 2009. As of December 27, 2010, Citystate has a total market capitalization of P2.03 billion and share price of P28.00.

The Governor of the Bangko Sentral ng Pilipinas is the chief executive officer of the Bangko Sentral ng Pilipinas, the Philippines' central bank. This position succeeds and replaces the earlier post of Governor of the Central Bank of the Philippines.

Nestor Aldave Espenilla Jr. was a Filipino banker who served as the fourth governor of the Bangko Sentral ng Pilipinas (BSP) from 2017 until his death in 2019. He began working for the BSP in 1981 and was a deputy governor under his predecessor Amando Tetangco Jr.

The New Generation Currency (NGC) Series is the name used to refer to Philippine peso banknotes issued since 2010 and coins issued since 2018. The series uses the Myriad and Twentieth Century typefaces.

This is a list of commemorative coins issued by the Philippines. More info here.

The Center for Agriculture and Rural Development, Inc. is a micro-finance oriented rural bank in the Philippines established in 1997, and is currently regulated by the Bangko Sentral ng Pilipinas. Its main office is located in San Pablo City, Laguna. As of May 2019, Card Bank, Inc. has 750 service offices nationwide.

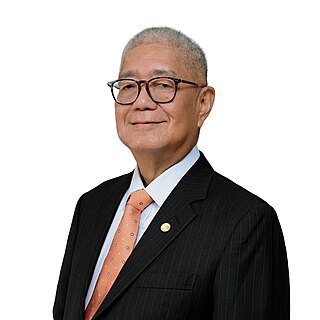

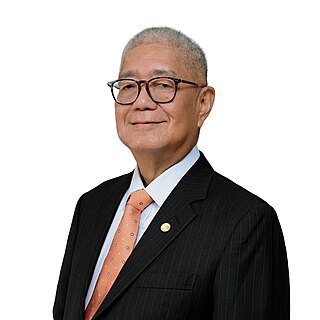

Eli M. Remolona Jr. is a Filipino economist who is currently the governor of the Bangko Sentral ng Pilipinas, central monetary authority of the Philippines, and the ex officio chairman of the Anti-Money Laundering Council, the central anti-money laundering/counter-terrorism financing authority of the Philippines, under the Marcos administration since July 3, 2023.