Halifax is a British banking brand operating as a trading division of Bank of Scotland, itself a wholly owned subsidiary of Lloyds Banking Group.

The Co-operative Bank plc is a British retail and commercial bank based in Manchester, England. Established as a bank for co-operators and co-operatives following the principles of the Rochdale Pioneers, the business evolved in the 20th century into a mid-sized British high street bank, operating throughout the UK mainland. Transactions took place at cash desks in co-op stores until the 1960s, when the bank set up a small network of branches that grew from 6 to a high of 160. Branches for residents of the Isle of Man and the Channel Islands were closed in the 2010s during a significant rescaling exercise. As of 2023 it has 50 branches in the UK.

The Abbey National Building Society was formed in 1944 by the merger of the Abbey Road and the National building societies.

Banco de Sabadell, S.A. is a Spanish multinational financial services company headquartered in Alicante and Barcelona, Spain. It is the 4th-largest Spanish banking group. It includes several banks, brands, subsidiaries and associated banks. It is a universal bank and specialises in serving small and medium enterprises (SMEs) and the affluent with a bias towards international trade.

Lloyds Bank plc is a British retail and commercial bank with branches across England and Wales. It has traditionally been considered one of the "Big Four" clearing banks. Lloyds Bank is the largest retail bank in Britain, and has an extensive network of branches and ATMs in England and Wales and offers 24-hour telephone and online banking services.

The Trustee Savings Bank (TSB) was a British financial institution that operated between 1810 and 1995 when it was merged with Lloyds Bank. Trustee savings banks originated to accept savings deposits from those with moderate means. Their shares were not traded on the stock market but, unlike mutually held building societies, depositors had no voting rights; nor did they have the power to direct the financial and managerial goals of the organisation. Directors were appointed as trustees on a voluntary basis. The first trustee savings bank was established by Rev. Henry Duncan of Ruthwell in Dumfriesshire for his poorest parishioners in 1810, with its sole purpose being to serve the local people in the community. Between 1970 and 1985, the various trustee savings banks in the United Kingdom were amalgamated into a single institution named TSB Group plc, which was floated on the London Stock Exchange. In 1995, the TSB merged with Lloyds Bank to form Lloyds TSB, at that point the largest bank in the UK by market share and the second-largest by market capitalisation.

Tesco Personal Finance plc, trading as Tesco Bank, is a British retail bank which was formed in July 1997. The bank was formed as part of a 50:50 joint venture between The Royal Bank of Scotland and Tesco, the largest supermarket in the United Kingdom, employing 2,800 people.

Intelligent Finance (IF) is a UK offset bank, a division of Bank of Scotland plc which is part of Lloyds Banking Group. It was established as a division of Halifax plc in 1999 by Jim Spowart, who helped establish other direct financial services firms including Direct Line.

Birmingham Midshires is an online trading name of Bank of Scotland plc. It is headquartered at Pendeford Business Park, Wolverhampton. It previously had 67 branches throughout England and Wales. Previously, Birmingham Midshires was a building society, known as the Birmingham Midshires Building Society.

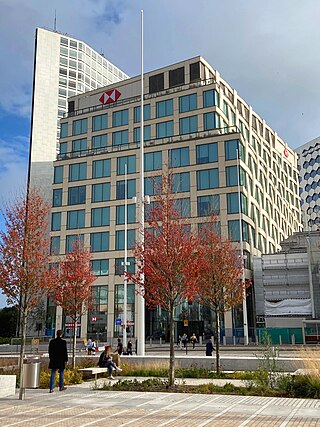

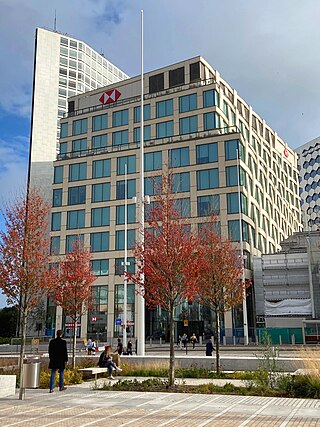

HSBC UK Bank plc is a British multinational banking and financial services organisation based in Birmingham, England. It is a wholly owned subsidiary of the global HSBC banking and financial group, which has been headquartered in London since 1993. The UK headquarters of HSBC is located at One Centenary Square in Birmingham.

Virgin Money is a banking and financial services brand operating in the United Kingdom as a trading name of Clydesdale Bank plc.

Bank of Scotland International Limited was the international banking division of Bank of Scotland. Established in 2003, it was headquartered in Jersey, and operated branches on the Isle of Man and Hong Kong, until merging with Lloyds TSB Offshore in 2011 as Lloyds TSB International brand.

National Westminster Bank, trading as NatWest, is a major retail and commercial bank in the United Kingdom based in London, England. It was established in 1968 by the merger of National Provincial Bank and Westminster Bank. In 2000, it became part of The Royal Bank of Scotland Group, which was re-named NatWest Group in 2020. Following ringfencing of the group's core domestic business, the bank became a direct subsidiary of NatWest Holdings; NatWest Markets comprises the non-ringfenced investment banking arm. The British government currently owns 35% of NatWest Group after spending £45 billion bailing out the lender in 2008; the proportion at one point was 54.7%. NatWest International is a trading name of RBS International, which also sits outside the ringfence.

HBOS plc is a banking and insurance company in the United Kingdom, a wholly owned subsidiary of the Lloyds Banking Group, having been taken over in January 2009. It was the holding company for Bank of Scotland plc, which operated the Bank of Scotland and Halifax brands in the UK, as well as HBOS Australia and HBOS Insurance & Investment Group Limited, the group's insurance division.

Lloyds Banking Group plc is a British financial institution formed through the acquisition of HBOS by Lloyds TSB in 2009. It is one of the UK's largest financial services organisations, with 30 million customers and 65,000 employees. Lloyds Bank was founded in 1765 but the wider Group's heritage extends over 320 years, dating back to the founding of the Bank of Scotland by the Parliament of Scotland in 1695.

Santander UK plc is a British bank, wholly owned by the Spanish Santander Group. Santander UK plc manages its affairs autonomously, with its own local management team, responsible solely for its performance.

Cheltenham & Gloucester plc (C&G) was a mortgage and savings provider in the United Kingdom, a subsidiary of Lloyds Banking Group. C&G specialised in mortgages and savings products. Previously, C&G was a building society, the Cheltenham and Gloucester Building Society. Its headquarters were in Barnwood, Gloucester, Gloucestershire, England. C&G was closed to new mortgage and savings business on 9 September 2013.

Lloyds Bank International is a wholly owned subsidiary of Lloyds Bank Corporate Markets in the United Kingdom, which is in turn part of Lloyds Banking Group, one of the largest banking groups in Europe.

Sabadell Solbank was a Spanish bank owned by Banco de Sabadell, which focussed on retail banking for Europeans living in the coastal areas of southern Spain. In 2014, it was fully integrated into the parent company.