A pay-as-you-earn tax (PAYE), or pay-as-you-go (PAYG) in Australia, is a withholding of taxes on income payments to employees. Amounts withheld are treated as advance payments of income tax due. They are refundable to the extent they exceed tax as determined on tax returns. PAYE may include withholding the employee portion of insurance contributions or similar social benefit taxes. In most countries, they are determined by employers but subject to government review. PAYE is deducted from each paycheck by the employer and must be remitted promptly to the government. Most countries refer to income tax withholding by other terms, including pay-as-you-go tax.

A corporate tax, also called corporation tax or company tax, is a type of direct tax levied on the income or capital of corporations and other similar legal entities. The tax is usually imposed at the national level, but it may also be imposed at state or local levels in some countries. Corporate taxes may be referred to as income tax or capital tax, depending on the nature of the tax.

Three key types of withholding tax are imposed at various levels in the United States:

Form 1099 is one of several IRS tax forms used in the United States to prepare and file an information return to report various types of income other than wages, salaries, and tips. The term information return is used in contrast to the term tax return although the latter term is sometimes used colloquially to describe both kinds of returns.

Taxation in Ireland in 2017 came from Personal Income taxes, and Consumption taxes, being VAT and Excise and Customs duties. Corporation taxes represents most of the balance, but Ireland's Corporate Tax System (CT) is a central part of Ireland's economic model. Ireland summarises its taxation policy using the OECD's Hierarchy of Taxes pyramid, which emphasises high corporate tax rates as the most harmful types of taxes where economic growth is the objective. The balance of Ireland's taxes are Property taxes and Capital taxes.

Tax withholding, also known as tax retention, pay-as-you-earn tax or tax deduction at source, is income tax paid to the government by the payer of the income rather than by the recipient of the income. The tax is thus withheld or deducted from the income due to the recipient. In most jurisdictions, tax withholding applies to employment income. Many jurisdictions also require withholding taxes on payments of interest or dividends. In most jurisdictions, there are additional tax withholding obligations if the recipient of the income is resident in a different jurisdiction, and in those circumstances withholding tax sometimes applies to royalties, rent or even the sale of real estate. Governments use tax withholding as a means to combat tax evasion, and sometimes impose additional tax withholding requirements if the recipient has been delinquent in filing tax returns, or in industries where tax evasion is perceived to be common.

The United States federal government and most state governments impose an income tax. They are determined by applying a tax rate, which may increase as income increases, to taxable income, which is the total income less allowable deductions. Income is broadly defined. Individuals and corporations are directly taxable, and estates and trusts may be taxable on undistributed income. Partnerships are not taxed, but their partners are taxed on their shares of partnership income. Residents and citizens are taxed on worldwide income, while nonresidents are taxed only on income within the jurisdiction. Several types of credits reduce tax, and some types of credits may exceed tax before credits. Most business expenses are deductible. Individuals may deduct certain personal expenses, including home mortgage interest, state taxes, contributions to charity, and some other items. Some deductions are subject to limits, and an Alternative Minimum Tax (AMT) applies at the federal and some state levels.

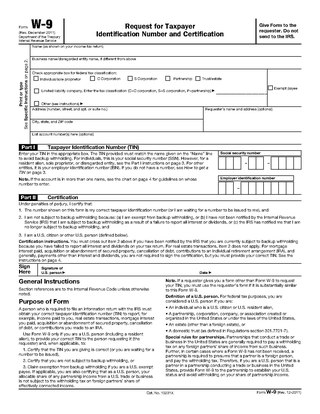

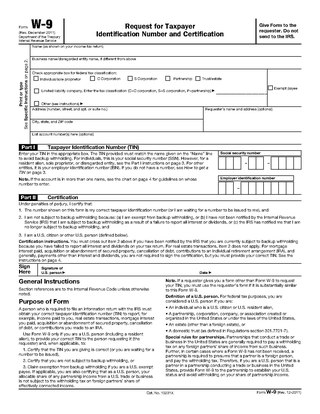

Form W-9 is used in the United States income tax system by a third party who must file an information return with the Internal Revenue Service (IRS). It requests the name, address, and taxpayer identification information of a taxpayer.

Income taxes in Canada constitute the majority of the annual revenues of the Government of Canada, and of the governments of the Provinces of Canada. In the fiscal year ending March 31, 2018, the federal government collected just over three times more revenue from personal income taxes than it did from corporate income taxes.

Income tax in India is governed by Entry 82 of the Union List of the Seventh Schedule to the Constitution of India, empowering the central government to tax non-agricultural income; agricultural income is defined in Section 10(1) of the Income-tax Act, 1961. Income-tax law consists of the 1961 act, Income Tax Rules 1962, Notifications and Circulars issued by the Central Board of Direct Taxes (CBDT), annual Finance Acts, and judicial pronouncements by the Supreme and high courts.

Tax on cash withdrawal is a form of advance taxation and is a strategy to keep tax evasion in check. This mode of tax collection is also called the presumptive tax regime. Globally, 3 countries are known to consider this approach namely, Pakistan, India and Greece.

The United States Internal Revenue Service (IRS) uses forms for taxpayers and tax-exempt organizations to report financial information, such as to report income, calculate taxes to be paid to the federal government, and disclose other information as required by the Internal Revenue Code (IRC). There are over 800 various forms and schedules. Other tax forms in the United States are filed with state and local governments.

In India, a Tax Deduction and Collection Account Number (TAN) is a 10 digit alpha-numeric number issued by the Income Tax Department to the persons who are required to deduct or collect tax on payments made by them under the Indian Income Tax Act, 1961.

Taxation may involve payments to a minimum of two different levels of government: central government through SARS or to local government. Prior to 2001 the South African tax system was "source-based", where in income is taxed in the country where it originates. Since January 2001, the tax system was changed to "residence-based" wherein taxpayers residing in South Africa are taxed on their income irrespective of its source. Non residents are only subject to domestic taxes.

A fixed deposit (FD) is a tenured deposit account provided by banks or non-bank financial institutions which provides investors a higher rate of interest than a regular savings account, until the given maturity date. It may or may not require the creation of a separate account. The term fixed deposit is most commonly used in India and the United States. It is known as a term deposit or time deposit in Canada, Australia, New Zealand, and as a bond in the United Kingdom.

Indian tax forms are used to document information in compliance with the Income Tax Act of 1961 and in accordance with the Income Tax Rules, which govern the process of filing income tax returns in India.

Profession tax is the tax levied and collected by the state governments in India. It is a direct tax. A person earning an income from salary or anyone practicing a profession such as chartered accountant, company secretary,cost accoutant, lawyer, doctor etc. are required to pay this professional tax. Different states have different rates and methods of collection. In India, profession tax is imposed every month. However, not all states impose this tax. The states which impose professional tax are Karnataka, Bihar, West Bengal, Andhra Pradesh, Telangana, Maharashtra, Tamil Nadu, Gujarat, Assam, Kerala, Meghalaya, Odisha, Tripura, Madhya Pradesh, Jharkhand and Sikkim, Mizoram. Business owners, working individuals, merchants and people carrying out various occupations come under the purview of this tax.

In Slovakia, taxes are levied by the state and local governments. Tax revenue stood at 18.732% of the country's gross domestic product in 2019. The tax-to-GDP ratio in the Slovakia increased by 0.4 percentage points from 34.3% in 2018 to 34.7% in 2019. The most important revenue sources for the state government are income tax, social security, value-added tax and corporate tax.

In the United States, Form 1099-MISC is a variant of Form 1099 used to report miscellaneous income. One notable use of Form 1099-MISC was to report amounts paid by a business to a non-corporate US resident independent contractor for services, but starting tax year 2020, this use was moved to the separate Form 1099-NEC. The ubiquity of the form has also led to use of the phrase "1099 workers" or "the 1099 economy" to refer to the independent contractors themselves. Other uses of Form 1099-MISC include rental income, royalties, and Native American gaming profits.

The Interest and Dividend Tax Compliance Act of 1983 was passed as Title I of Public Law 98–67, on Aug. 5, 1983, in the United States. As described in the conference report, it contained these provisions: