The Scotland Act 1998 is an Act of the Parliament of the United Kingdom which legislated for the establishment of the devolved Scottish Parliament with tax varying powers and the Scottish Government. It was one of the most significant constitutional pieces of legislation to be passed by the UK Parliament between the passing of the European Communities Act in 1972 and the European Union (Withdrawal) Act in 2018 and is the most significant piece of legislation to affect Scotland since the Acts of Union in 1707 which ratified the Treaty of Union and led to the disbandment of the Parliament of Scotland.

In many states with political systems derived from the Westminster system, a consolidated fund or consolidated revenue fund is the main bank account of the government. General taxation is taxation paid into the consolidated fund, and general spending is paid out of the consolidated fund.

In the United Kingdom, taxation may involve payments to at least three different levels of government: central government, devolved governments and local government. Central government revenues come primarily from income tax, National Insurance contributions, value added tax, corporation tax and fuel duty. Local government revenues come primarily from grants from central government funds, business rates in England, Council Tax and increasingly from fees and charges such as those for on-street parking. In the fiscal year 2014–15, total government revenue was forecast to be £648 billion, or 37.7 per cent of GDP, with net taxes and National Insurance contributions standing at £606 billion.

The Barnett formula is a mechanism used by the Treasury in the United Kingdom to automatically adjust the amounts of public expenditure allocated to Northern Ireland, Scotland and Wales to reflect changes in spending levels allocated to public services in England, Scotland and Wales, as appropriate. The formula applies to a large proportion, but not the whole, of the devolved governments' budgets − in 2013–14 it applied to about 85% of the Scottish Parliament's total budget.

In the United Kingdom, devolved matters are the areas of public policy where the Parliament of the United Kingdom has devolved its legislative power to the national legislatures of Scotland, Wales and Northern Ireland, while reserved matters and excepted matters are the areas where the UK Parliament retains exclusive power to legislate.

The economy of Scotland is an open mixed economy and the second largest economy of the four countries of the United Kingdom. It had an estimated nominal gross domestic product (GDP) of £211.7 billion in 2023, including oil and gas extraction in the country's continental shelf region. Since the Acts of Union 1707, Scotland's economy has been closely aligned with the economy of the rest of the United Kingdom (UK), and England has historically been its main trading partner. Scotland conducts the majority of its trade within the UK: in 2017, Scotland's exports totalled £81.4 billion, of which £48.9 billion (60%) was within the UK, £14.9 billion with the European Union (EU), and £17.6 billion with other parts of the world. Scotland’s imports meanwhile totalled £94.4 billion including intra-UK trade leaving Scotland with a trade deficit of £10.4 billion in 2017.

The Scottish variable rate (SVR) was a mechanism which would have enabled the Scottish Government to vary the basic rate of UK income tax by up to 3p in the pound. The power was never used and was succeeded by the legislative framework for Scottish public finance in the Scotland Act 2012, which gives the Scottish Parliament the power to set a Scottish rate of income tax.

Welsh law is an autonomous part of the English law system composed of legislation made by the Senedd. Wales is part of the legal jurisdiction of England and Wales, one of the three legal jurisdictions of the United Kingdom. However, due to devolution, the law in Wales is increasingly distinct from the law in England, since the Senedd, the devolved parliament of Wales, can legislate on non-reserved matters.

Full fiscal autonomy (FFA) – also known as devolution max, devo-max, or fiscal federalism – is a particular form of far-reaching devolution proposed for Scotland and for Wales. The term has come to describe a constitutional arrangement in which instead of receiving a block grant from the UK Exchequer as at present, the Scottish Parliament or the Senedd would receive all taxation levied in Scotland or Wales; it would be responsible for most spending in Scotland or Wales but make payments to the UK government to cover Scotland or Wales's share of the cost of providing certain UK-wide services, largely defence and foreign relations. Scottish/Welsh fiscal autonomy – stopping short of full political independence – is usually promoted by advocates of a federal United Kingdom.

The Commission on Scottish Devolution, also referred to as the Calman Commission or the Scottish Parliament Commission or Review, was established by an opposition Labour Party motion passed by the Scottish Parliament on 6 December 2007, with the support of the Conservatives and Liberal Democrats. The governing Scottish National Party opposed the creation of the commission.

Devolution is the process in which the central British parliament grants administrative powers to the devolved Scottish Parliament. Prior to the advent of devolution, some had argued for a Scottish Parliament within the United Kingdom – while others have since advocated for complete independence. The people of Scotland first got the opportunity to vote in a referendum on proposals for devolution in 1979 and, although a majority of those voting voted 'Yes', the referendum legislation also required 40% of the electorate to vote 'Yes' for the plans to be enacted and this was not achieved. A second referendum opportunity in 1997, this time on a strong proposal, resulted in an overwhelming 'Yes' victory, leading to the Scotland Act 1998 being passed and the Scottish Parliament being established in 1999.

The Scotland Act 2012 is an Act of the Parliament of the United Kingdom. It sets out amendments to the Scotland Act 1998, with the aim of devolving further powers to Scotland in accordance with the recommendations of the Calman Commission. It received royal assent in 2012.

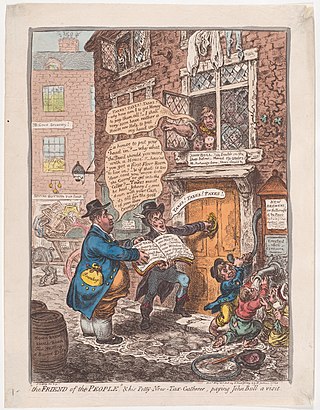

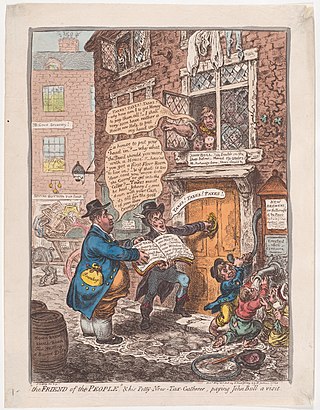

The history of taxation in the United Kingdom includes the history of all collections by governments under law, in money or in kind, including collections by monarchs and lesser feudal lords, levied on persons or property subject to the government, with the primary purpose of raising revenue.

Taxation in Bhutan is conducted by the national government and by its subsidiary local governments. All taxation is ultimately overseen by the Bhutan Ministry of Finance, Department of Revenue and Customs, which is part of the executive Lhengye Zhungtshog (cabinet). The modern legal basis for taxation in Bhutan derives from legislation. Several acts provide for taxation and enforcement only germane to their subject matter and at various levels of government, while a smaller number provide more comprehensive substantive tax law. As a result, the tax scheme of Bhutan is highly decentralized.

The Scotland Act 2016 is an act of the Parliament of the United Kingdom. It sets out amendments to the Scotland Act 1998 and devolves further powers to Scotland. The legislation is based on recommendations given by the report of the Smith Commission, which was established on 19 September 2014 in the wake of the Scottish independence referendum.

The Wales Act 2017 is an Act of the Parliament of the United Kingdom. It sets out amendments to the Government of Wales Act 2006 and devolves further powers to Wales. The legislation is based on the proposals of the St David's Day Command Paper.

The Landfill Tax (Scotland) Act 2014 is an Act of the Scottish Parliament, introduced to the legislature in 2013 and receiving Royal Assent on 21 January 2014, which creates a new Scottish Landfill Tax. The tax applies mainly to waste management companies and local authorities disposing of waste at landfill.

The Land Tax was a land value tax levied in England from 1692 to 1963, though such taxes predate the best-known 1692 Act. Taxes on land date back to the Norman Conquest and beyond, and the Land Tax introduced in 1692 was a natural successor to taxation acts in 1671 and 1689, but the 1692 act "has been regarded as a turning point in the history of English revenue collection. It was from this Act that contemporaries and historians alike date what has come to be known as the eighteenth-century Land Tax". The land tax elements of the 1671, 1689 and 1692 Acts were limited to one year but the 1798 Act made the tax perpetual.

Welsh Rates of Income Tax (WRIT) is part of the UK income tax system and from 6 April 2019 a proportion of income tax paid by taxpayers living in Wales is transferred straight to the Welsh Government to fund Welsh public services. It is administered by HM Revenue and Customs (HMRC), but it is not a devolved tax comparable to Scottish income tax.

Taxation in Wales typically comprises payments to one or more of the three different levels of government: the UK government, the Welsh Government, and local government.