Adam Smith was a Scottish economist and philosopher who was a pioneer in the thinking of political economy and key figure during the Scottish Enlightenment. Seen by some as "The Father of Economics" or "The Father of Capitalism", he wrote two classic works, The Theory of Moral Sentiments (1759) and An Inquiry into the Nature and Causes of the Wealth of Nations (1776). The latter, often abbreviated as The Wealth of Nations, is considered his magnum opus and the first modern work that treats economics as a comprehensive system and as an academic discipline. Smith refuses to explain the distribution of wealth and power in terms of God's will and instead appeals to natural, political, social, economic, legal, environmental and technological factors and the interactions among them. Among other economic theories, the work introduced Smith's idea of absolute advantage.

A land value tax (LVT) is a levy on the value of land without regard to buildings, personal property and other improvements upon it. It is also known as a location value tax, a point valuation tax, a site valuation tax, split rate tax, or a site-value rating.

Henry George was an American political economist and journalist. His writing was immensely popular in 19th-century America and sparked several reform movements of the Progressive Era. He inspired the economic philosophy known as Georgism, the belief that people should own the value they produce themselves, but that the economic value of land should belong equally to all members of society. George famously argued that a single tax on land values would create a more productive and just society.

Tax reform is the process of changing the way taxes are collected or managed by the government and is usually undertaken to improve tax administration or to provide economic or social benefits. Tax reform can include reducing the level of taxation of all people by the government, making the tax system more progressive or less progressive, or simplifying the tax system and making the system more understandable or more accountable.

Georgism, also called in modern times Geoism, and known historically as the single tax movement, is an economic ideology holding that people should own the value that they produce themselves, while the economic rent derived from land—including from all natural resources, the commons, and urban locations—should belong equally to all members of society. Developed from the writings of American economist and social reformer Henry George, the Georgist paradigm seeks solutions to social and ecological problems, based on principles of land rights and public finance that attempt to integrate economic efficiency with social justice.

The Community Charge, commonly known as the poll tax, was a system of local taxation introduced by Margaret Thatcher's government whereby each taxpayer was taxed the same fixed sum, with the precise amount being set by each local authority. It replaced domestic rates in Scotland from 1989, prior to its introduction in England and Wales from 1990. The abolition of the poll tax was announced in 1991 and it was replaced in 1993 by the current system of the Council Tax.

Geolibertarianism is a political and economic ideology that integrates libertarianism with Georgism. It favors a taxation system based on income derived from land and natural resources instead of on labor, coupled with a minimalist model of government, as in libertarianism. The term was coined by the late economist Fred Foldvary in 1981.

A single tax is a system of taxation based mainly or exclusively on one tax, typically chosen for its special properties, often being a tax on land value.

The Scottish Land Restoration League was a Georgist political party.

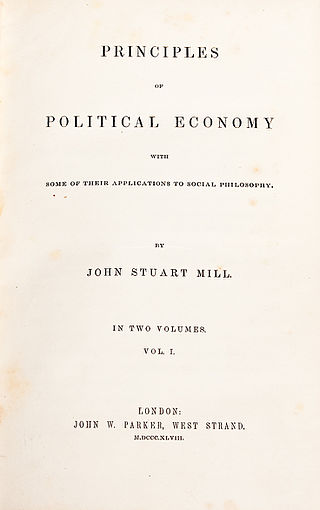

Principles of Political Economy (1848) by John Stuart Mill was one of the most important economics or political economy textbooks of the mid-nineteenth century. It was revised until its seventh edition in 1871, shortly before Mill's death in 1873, and republished in numerous other editions. Beside discussing descriptive issues such as which nations tended to benefit more in a system of trade based on comparative advantage, the work also discussed normative issues such as ideal systems of political economy, critiquing proposed systems such as communism and socialism. Along with A System of Logic, Principles of Political Economy established Mill's reputation as a leading public intellectual. Mill's sympathetic attitude in this work and in other essays toward contemporary socialism, particularly Fourierism, earned him esteem from the working class as one of their intellectual champions.

The Commission on Scottish Devolution, also referred to as the Calman Commission or the Scottish Parliament Commission or Review, was established by an opposition Labour Party motion passed by the Scottish Parliament on 6 December 2007, with the support of the Conservatives and Liberal Democrats. The governing Scottish National Party opposed the creation of the commission.

Land value taxation has a long history in the United States dating back from Physiocrat influence on Thomas Jefferson and Benjamin Franklin. It is most famously associated with Henry George and his book Progress and Poverty (1879), which argued that because the supply of land is fixed and its location value is created by communities and public works, the economic rent of land is the most logical source of public revenue. and which had considerable impact on turn-of-the-century reform movements in America and elsewhere.

Land Values was the monthly newspaper precursor of the contemporary magazine Land&Liberty. The periodical started life in June 1894 as The Single Tax, changing its name to Land Values in June 1902.

Land&Liberty is a quarterly magazine of popular political economics: its focus is the relationship between land and natural resource rights and 21st century economic policy. Published in the UK it covers international affairs and events from a global perspective.

The Henry George Foundation is an independent UK economic and social justice think tank and public education group concerned with "the development of sound relationships between the citizen, our communities and our shared natural and common resources". The Henry George Foundation describes itself as "active on three broad fronts: research, education, and advocacy". The Foundation takes its name from Henry George, the 19th Century economist and proponent of the taxation of land values.

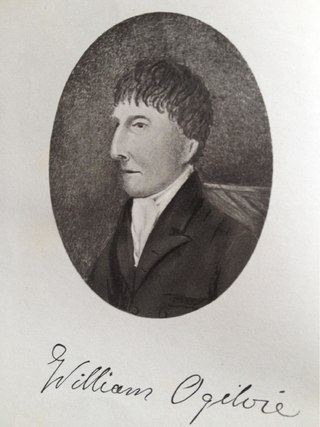

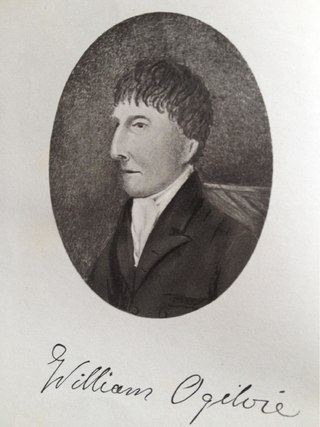

William Ogilvie of Pittensear FRSE FSA (Scot) (1736–1819), known as the Rebel Professor and described by his biographer as the ''Euclid of Land law Reform', was a Scottish classicist, numismatist and author of an influential historic land reform treatise. Published in London in 1781, An Essay on the Right of Property in Land was issued anonymously, necessarily it seems in a revolutionary age.

The English League for the Taxation of Land Values was a Georgist political group. It was a historic precursor of two present-day reform bodies: the international umbrella organisation the IU and the UK think tank the Henry George Foundation. The object of the League was

the taxation for national and local purposes of the 'unimproved value of the land', ie the value of the land apart from the buildings or other improvements in or upon it. The League actively support[ed] all proposals in Parliament for separate valuation of land, and for making land values the basis of national and local taxation.

The Scottish League for the Taxation of Land Values is an independent national campaigning organisation that advocates radical reform of Scotland's system of taxation. Known as The Scottish League, the organisation advances the programme of the nineteenth-century American social reformer Henry George. The League publishes books and other material, and is a participant in the ongoing public debate over the future of Scotland’s land and tax system.

Richard Murphy is a former British chartered accountant and political economist who campaigns on issues of tax avoidance and tax evasion. He advises the Trades Union Congress on economics and taxation, and founded the Tax Justice Network. He is a Professor of Accounting Practice at University of Sheffield Management School.

Benjamin Ricketson Tucker was an American individualist anarchist and self-identified socialist. Tucker was the editor and publisher of the American individualist anarchist periodical Liberty (1881–1908). Tucker described his form of anarchism as "consistent Manchesterism" and stated that "the Anarchists are simply unterrified Jeffersonian Democrats."