A currency is a standardization of money in any form, in use or circulation as a medium of exchange, for example banknotes and coins. A more general definition is that a currency is a system of money in common use within a specific environment over time, especially for people in a nation state. Under this definition, the British Pound sterling (£), euros (€), Japanese yen (¥), and U.S. dollars (US$) are examples of (government-issued) fiat currencies. Currencies may act as stores of value and be traded between nations in foreign exchange markets, which determine the relative values of the different currencies. Currencies in this sense are either chosen by users or decreed by governments, and each type has limited boundaries of acceptance; i.e., legal tender laws may require a particular unit of account for payments to government agencies.

Crypto-anarchism or cyberanarchism is a political ideology focusing on protection of privacy, political freedom, and economic freedom, the adherents of which use cryptographic software for confidentiality and security while sending and receiving information over computer networks. In his 1988 "Crypto Anarchist Manifesto", Timothy C. May introduced the basic principles of crypto-anarchism, encrypted exchanges ensuring total anonymity, total freedom of speech, and total freedom to trade. In 1992, he read the text at the founding meeting of the cypherpunk movement.

William Rees-Mogg, Baron Rees-Mogg was a British newspaper journalist who was Editor of The Times from 1967 to 1981. In the late 1970s, he served as High Sheriff of Somerset, and in the 1980s was Chairman of the Arts Council of Great Britain and Vice-Chairman of the BBC's Board of Governors. He was the father of the politicians Sir Jacob and Annunziata Rees-Mogg.

Digital currency is any currency, money, or money-like asset that is primarily managed, stored or exchanged on digital computer systems, especially over the internet. Types of digital currencies include cryptocurrency, virtual currency and central bank digital currency. Digital currency may be recorded on a distributed database on the internet, a centralized electronic computer database owned by a company or bank, within digital files or even on a stored-value card.

James Dale Davidson is an American private investor and investment writer, co-writer of the newsletter Strategic Investment, and co-author with William Rees-Mogg of Blood in the Streets: Investment Profits in a World Gone Mad (1987), The Great Reckoning (1991), and The Sovereign Individual (1997). He wrote The Plague of the Black Debt - How to Survive the Coming Depression in 1993 in which he predicted that as part of a "deep depression...Clinton is going to be a one-term president...I am as sure of this as I am that the sun will rise tomorrow" and that the US national debt would increase by a trillion dollars during Clinton's "one-term" presidency. He further wrote in the book that Boris Yeltsin, President of the Russian Federation, would lose his job and that Russia will come under the control of a nationalist, militarist regime. He has been credited with predicting the U.S. subprime mortgage crisis, though much earlier than it actually occurred.

A cryptocurrency exchange, or a digital currency exchange (DCE), is a business that allows customers to trade cryptocurrencies or digital currencies for other assets, such as conventional fiat money or other digital currencies. Exchanges may accept credit card payments, wire transfers or other forms of payment in exchange for digital currencies or cryptocurrencies. A cryptocurrency exchange can be a market maker that typically takes the bid–ask spreads as a transaction commission for its service or, as a matching platform, simply charges fees.

A private currency is a currency issued by a private entity, be it an individual, a commercial business, a nonprofit or decentralized common enterprise. It is often contrasted with fiat currency issued by governments or central banks. In many countries, the issuance of private paper currencies and/or the minting of metal coins intended to be used as currency may even be a criminal act such as in the United States. Digital cryptocurrency is sometimes treated as an asset instead of a currency. Cryptocurrency is illegal as a currency in a few countries.

Virtual currency, or virtual money, is a digital currency that is largely unregulated, issued and usually controlled by its developers, and used and accepted electronically among the members of a specific virtual community. In 2014, the European Banking Authority defined virtual currency as "a digital representation of value that is neither issued by a central bank or a public authority, nor necessarily attached to a fiat currency but is accepted by natural or legal persons as a means of payment and can be transferred, stored or traded electronically." A digital currency issued by a central bank is referred to as a central bank digital currency.

Bitcoin is a decentralized digital currency. Bitcoin transactions are verified by network nodes through cryptography and recorded in a public distributed ledger called a blockchain. The cryptocurrency was invented in 2008 by an unknown entity under the name Satoshi Nakamoto. Use of bitcoin as a currency began in 2009, when its implementation was released as open-source software.

A cryptocurrency, crypto-currency, or crypto is a digital currency designed to work as a medium of exchange through a computer network that is not reliant on any central authority, such as a government or bank, to uphold or maintain it. It is a decentralized system for verifying that the parties to a transaction have the money they claim to have, eliminating the need for traditional intermediaries, such as banks, when funds are being transferred between two entities.

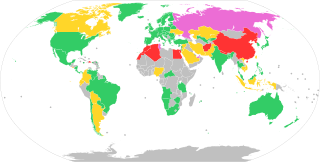

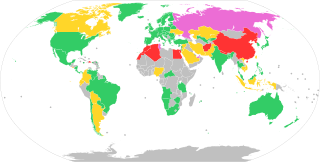

The legal status of cryptocurrencies varies substantially from one jurisdiction to another, and is still undefined or changing in many of them. Whereas, in the majority of countries the usage of cryptocurrency isn't in itself illegal, its status and usability as a means of payment varies, with differing regulatory implications.

United States virtual currency law is financial regulation as applied to transactions in virtual currency in the U.S. The Commodity Futures Trading Commission has regulated and may continue to regulate virtual currencies as commodities. The Securities and Exchange Commission also requires registration of any virtual currency traded in the U.S. if it is classified as a security and of any trading platform that meets its definition of an exchange.

Bitcoin is a digital asset designed by its pseudonymous inventor, Satoshi Nakamoto, to work as a currency.

A central bank digital currency is a digital currency issued by a central bank, rather than by a commercial bank. It is also a liability of the central bank and denominated in the sovereign currency, as is the case with physical banknotes and coins.

A cryptocurrency wallet is a device, physical medium, program or a service which stores the public and/or private keys for cryptocurrency transactions. In addition to this basic function of storing the keys, a cryptocurrency wallet more often offers the functionality of encrypting and/or signing information. Signing can for example result in executing a smart contract, a cryptocurrency transaction, identification, or legally signing a 'document'.

Cryptocurrency and crime describes notable examples of cybercrime related to theft of cryptocurrencies and some of the methods or security vulnerabilities commonly exploited. Cryptojacking is a form of cybercrime specific to cryptocurrencies that has been used on websites to hijack a victim's resources and use them for hashing and mining cryptocurrency.

A stablecoin is a type of cryptocurrency where the value of the digital asset is supposed to be pegged to a reference asset, which is either fiat money, exchange-traded commodities, or another cryptocurrency.

Cryptoeconomics is an evolving economic paradigm for a cross-disciplinary approach to the study of digital economies and decentralized finance (DeFi) applications. Cryptoeconomics integrates concepts and principles from traditional economics, cryptography, computer science, and game theory disciplines. Just as traditional economics provides a theoretical foundation for traditional financial services, cryptoeconomics provides a theoretical foundation for DeFi services bought and sold via fiat cryptocurrencies, and executed by smart contracts.

Cryptocurrency in Nigeria describes the extent of cryptocurrency use, social acceptance and regulation in Nigeria.

The Great Transition is a 2022 non-fiction book that maps the development of the finance industry and the influence that decentralized finance has on traditional banking, society, and entire economies.