Bayesian probability is an interpretation of the concept of probability, in which, instead of frequency or propensity of some phenomenon, probability is interpreted as reasonable expectation representing a state of knowledge or as quantification of a personal belief.

Zero-sum game is a mathematical representation in game theory and economic theory of a situation that involves two sides, where the result is an advantage for one side and an equivalent loss for the other. In other words, player one's gain is equivalent to player two's loss, with the result that the net improvement in benefit of the game is zero.

In economics, utility is a measure of the satisfaction that a certain person has from a certain state of the world. Over time, the term has been used in two different meanings.

Gábor Szegő was a Hungarian-American mathematician. He was one of the foremost mathematical analysts of his generation and made fundamental contributions to the theory of orthogonal polynomials and Toeplitz matrices building on the work of his contemporary Otto Toeplitz.

Decision theory is a branch of applied probability theory and analytic philosophy concerned with the theory of making decisions based on assigning probabilities to various factors and assigning numerical consequences to the outcome.

The expected utility hypothesis is a foundational assumption in mathematical economics concerning decision making under uncertainty. It postulates that rational agents maximize utility, meaning the subjective desirability of their actions. Rational choice theory, a cornerstone of microeconomics, builds this postulate to model aggregate social behaviour.

Oskar Morgenstern was a German-born economist. In collaboration with mathematician John von Neumann, he founded the mathematical field of game theory as applied to the social sciences and strategic decision-making.

In decision theory, subjective expected utility is the attractiveness of an economic opportunity as perceived by a decision-maker in the presence of risk. Characterizing the behavior of decision-makers as using subjective expected utility was promoted and axiomatized by L. J. Savage in 1954 following previous work by Ramsey and von Neumann. The theory of subjective expected utility combines two subjective concepts: first, a personal utility function, and second a personal probability distribution.

Oskar Perron was a German mathematician.

Robert Duncan Luce was an American mathematician and social scientist, and one of the most preeminent figures in the field of mathematical psychology. At the end of his life, he held the position of Distinguished Research Professor of Cognitive Science at the University of California, Irvine.

Luther Pfahler Eisenhart was an American mathematician, best known today for his contributions to semi-Riemannian geometry.

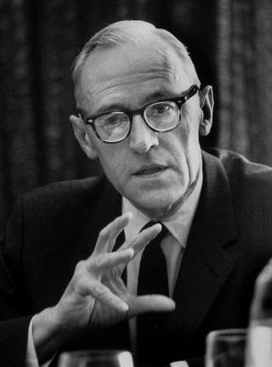

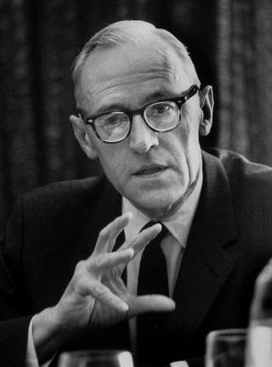

Howard Raiffa was an American academic who was the Frank P. Ramsey Professor (Emeritus) of Managerial Economics, a joint chair held by the Business School and Harvard Kennedy School at Harvard University. He was an influential Bayesian decision theorist and pioneer in the field of decision analysis, with works in statistical decision theory, game theory, behavioral decision theory, risk analysis, and negotiation analysis. He helped found and was the first director of the International Institute for Applied Systems Analysis.

Nathan Jacobson was an American mathematician.

The Allais paradox is a choice problem designed by Maurice Allais to show an inconsistency of actual observed choices with the predictions of expected utility theory. Rather than adhering to rationality, the Allais paradox proves that individuals rarely make rational decisions consistently when required to do so immediately. The independence axiom of expected utility theory, which requires that the preferences of an individual should not change when altering two lotteries by equal proportions, was proven to be violated by the paradox.

Generalized expected utility is a decision-making metric based on any of a variety of theories that attempt to resolve some discrepancies between expected utility theory and empirical observations, concerning choice under risky (probabilistic) circumstances. Given its motivations and approach, generalized expected utility theory may properly be regarded as a subfield of behavioral economics, but it is more frequently located within mainstream economic theory.

Jacob Marschak was an American economist.

In decision theory, the von Neumann–Morgenstern (VNM) utility theorem shows that, under certain axioms of rational behavior, a decision-maker faced with risky (probabilistic) outcomes of different choices will behave as if they are maximizing the expected value of some function defined over the potential outcomes at some specified point in the future. This function is known as the von Neumann–Morgenstern utility function. The theorem is the basis for expected utility theory.

Gustav Doetsch was a German mathematician, aviation researcher, decorated war veteran, and Nazi supporter.

Georges Louis Bouligand was a French mathematician. He worked in analysis, mechanics, analytical and differential geometry, topology, and mathematical physics. He is known for introducing the concept of paratingent cones and contingent cones.

The book Mathematical Foundations of Quantum Mechanics (1932) by John von Neumann is an important early work in the development of quantum theory.