Keynesian economics are the various macroeconomic theories and models of how aggregate demand strongly influences economic output and inflation. In the Keynesian view, aggregate demand does not necessarily equal the productive capacity of the economy. It is influenced by a host of factors that sometimes behave erratically and impact production, employment, and inflation.

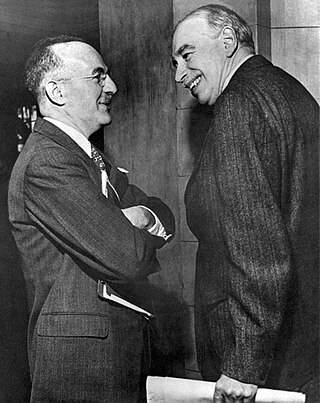

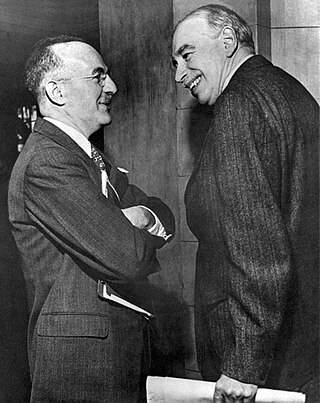

John Maynard Keynes, 1st Baron Keynes,, was an English economist and philosopher whose ideas fundamentally changed the theory and practice of macroeconomics and the economic policies of governments. Originally trained in mathematics, he built on and greatly refined earlier work on the causes of business cycles. One of the most influential economists of the 20th century, he produced writings that are the basis for the school of thought known as Keynesian economics, and its various offshoots. His ideas, reformulated as New Keynesianism, are fundamental to mainstream macroeconomics. He is known as the "father of macroeconomics".

Post-Keynesian economics is a school of economic thought with its origins in The General Theory of John Maynard Keynes, with subsequent development influenced to a large degree by Michał Kalecki, Joan Robinson, Nicholas Kaldor, Sidney Weintraub, Paul Davidson, Piero Sraffa and Jan Kregel. Historian Robert Skidelsky argues that the post-Keynesian school has remained closest to the spirit of Keynes' original work. It is a heterodox approach to economics.

An economist is a professional and practitioner in the social science discipline of economics.

Johan Gustaf Knut Wicksell was a Swedish economist of the Stockholm school. His economic contributions would influence both the Keynesian and Austrian schools of economic thought. He was married to the noted feminist Anna Bugge.

The Austrian business cycle theory (ABCT) is an economic theory developed by the Austrian School of economics about how business cycles occur. The theory views business cycles as the consequence of excessive growth in bank credit due to artificially low interest rates set by a central bank or fractional reserve banks. The Austrian business cycle theory originated in the work of Austrian School economists Ludwig von Mises and Friedrich Hayek. Hayek won the Nobel Prize in Economics in 1974 in part for his work on this theory.

Hyman Philip Minsky was an American economist, a professor of economics at Washington University in St. Louis, and a distinguished scholar at the Levy Economics Institute of Bard College. His research attempted to provide an understanding and explanation of the characteristics of financial crises, which he attributed to swings in a potentially fragile financial system. Minsky is sometimes described as a post-Keynesian economist because, in the Keynesian tradition, he supported some government intervention in financial markets, opposed some of the financial deregulation of the 1980s, stressed the importance of the Federal Reserve as a lender of last resort and argued against the over-accumulation of private debt in the financial markets.

The history of economic thought is the study of the philosophies of the different thinkers and theories in the subjects that later became political economy and economics, from the ancient world to the present day.

Russell David "Russ" Roberts is an American-Israeli economist. He is currently a research fellow at Stanford University's Hoover Institution and president of Shalem College in Jerusalem. He is known for communicating economic ideas in understandable terms as host of the EconTalk podcast.

Axel Leijonhufvud was a Swedish economist and professor emeritus at the University of California, Los Angeles (UCLA), and professor at the University of Trento, Italy. Leijonhufvud focused his studies on macroeconomic monetary theory. In his defining book On Keynesian Economics and the Economics of Keynes (1968) he focuses on a critique of the interpretation of Keynesian economic theory by Keynesian economists. He goes on to call the standard neoclassical synthesis interpretation of the Keynes' General Theory as having misunderstood and misinterpreted Keynes. In one of his papers, "Life Among the Econ" (1973), he takes a comical yet critical look at the inherent clannish nature of economists; the paper was considered a devastating takedown of economics and economists.

Following the global 2007–2008 financial crisis, there was a worldwide resurgence of interest in Keynesian economics among prominent economists and policy makers. This included discussions and implementation of economic policies in accordance with the recommendations made by John Maynard Keynes in response to the Great Depression of the 1930s, most especially fiscal stimulus and expansionary monetary policy.

The Keynesian Revolution was a fundamental reworking of economic theory concerning the factors determining employment levels in the overall economy. The revolution was set against the then orthodox economic framework, namely neoclassical economics.

Macroeconomic theory has its origins in the study of business cycles and monetary theory. In general, early theorists believed monetary factors could not affect real factors such as real output. John Maynard Keynes attacked some of these "classical" theories and produced a general theory that described the whole economy in terms of aggregates rather than individual, microeconomic parts. Attempting to explain unemployment and recessions, he noticed the tendency for people and businesses to hoard cash and avoid investment during a recession. He argued that this invalidated the assumptions of classical economists who thought that markets always clear, leaving no surplus of goods and no willing labor left idle.

The post-war displacement of Keynesianism was a series of events which from mostly unobserved beginnings in the late 1940s, had by the early 1980s led to the replacement of Keynesian economics as the leading theoretical influence on economic life in the developed world. Similarly, the allied discipline known as development economics was largely displaced as the guiding influence on economic policies adopted by developing nations.

Douglas, Heron & Company, also known as the Ayr Bank, was a Scottish bank with its head office at Ayr. It opened in November 1769 and folded in 1772 during the crisis of 1772.

The British credit crisis of 1772–1773, also known as the crisis of 1772, or the panic of 1772, was a peacetime financial crisis which originated in London and then spread to Scotland and the Dutch Republic. It has been described as the first modern banking crisis faced by the Bank of England. New colonies, as Adam Smith observed, had an insatiable demand for capital. Accompanying the more tangible evidence of wealth creation was a rapid expansion of credit and banking, leading to a rash of speculation and dubious financial innovation. In today's language, they bought shares on margin.

Throughout modern history, a variety of perspectives on capitalism have evolved based on different schools of thought.

Alexander Fordyce was an eminent Scottish banker, centrally involved in the bank run on Neale, James, Fordyce and Down which led to the credit crisis of 1772. He fled abroad and was declared bankrupt, but in time he used the profits from other investments to cover the losses.

Thomas MacGillivray Humphrey was an American economist. Until 2005 he was a research advisor and senior economist in the research department of the Federal Reserve Bank of Richmond and editor of the bank's flagship publication, the Economic Quarterly. His publications cover macroeconomics, monetary economics, and the history of economic thought. Mark Blaug called him the "undisputed master" of British classical monetary thought.

The real bills doctrine says that as long as bankers lend to businessmen only against the security (collateral) of short-term 30-, 60-, or 90-day commercial paper representing claims to real goods in the process of production, the loans will be just sufficient to finance the production of goods. The doctrine seeks to have real output determine its own means of purchase without affecting prices. Under the real bills doctrine, there is only one policy role for the central bank: lending commercial banks the necessary reserves against real customer bills, which the banks offer as collateral. The term "real bills doctrine" was coined by Lloyd Mints in his 1945 book, A History of Banking Theory. The doctrine was previously known as "the commercial loan theory of banking".