Related Research Articles

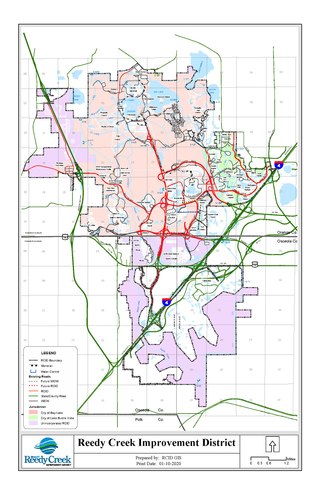

The Central Florida Tourism Oversight District (CFTOD), formerly the Reedy Creek Improvement District (RCID), is the governing jurisdiction and special taxing district for the land of Walt Disney World Resort. It includes 39.06 sq mi (101.2 km2) within Orange and Osceola counties in Florida. It acts with most of the same authority and responsibility as a county government. It includes the cities of Bay Lake and Lake Buena Vista, as well as unincorporated land.

In law, conveyancing is the transfer of legal title of real property from one person to another, or the granting of an encumbrance such as a mortgage or a lien. A typical conveyancing transaction has two major phases: the exchange of contracts and completion.

A public company is a company whose ownership is organized via shares of stock which are intended to be freely traded on a stock exchange or in over-the-counter markets. A public company can be listed on a stock exchange, which facilitates the trade of shares, or not. In some jurisdictions, public companies over a certain size must be listed on an exchange. In most cases, public companies are private enterprises in the private sector, and "public" emphasizes their reporting and trading on the public markets.

In economics, insurance, and risk management, adverse selection is a market situation where buyers and sellers have different information. The result is that participants with key information might participate selectively in trades at the expense of other parties who do not have the same information.

A credit default swap (CDS) is a financial swap agreement that the seller of the CDS will compensate the buyer in the event of a debt default or other credit event. That is, the seller of the CDS insures the buyer against some reference asset defaulting. The buyer of the CDS makes a series of payments to the seller and, in exchange, may expect to receive a payoff if the asset defaults.

A real estate agent, referred to often as a real estate broker, is a person who represents sellers or buyers of real estate or real property. While a broker may work independently, an agent usually works under a licensed broker to represent clients. Brokers and agents are licensed by the state to negotiate sales agreements and manage the documentation required for closing real estate transactions. Buyers and sellers are generally advised to consult a licensed real estate professional for a written definition of an individual state's laws of agency. Many states require written disclosures to be signed by all parties outlining the duties and obligations.

The law of agency is an area of commercial law dealing with a set of contractual, quasi-contractual and non-contractual fiduciary relationships that involve a person, called the agent, that is authorized to act on behalf of another to create legal relations with a third party. Succinctly, it may be referred to as the equal relationship between a principal and an agent whereby the principal, expressly or implicitly, authorizes the agent to work under their control and on their behalf. The agent is, thus, required to negotiate on behalf of the principal or bring them and third parties into contractual relationship. This branch of law separates and regulates the relationships between:

A repurchase agreement, also known as a repo, RP, or sale and repurchase agreement, is a form of short-term borrowing, mainly in government securities. The dealer sells the underlying security to investors and, by agreement between the two parties, buys them back shortly afterwards, usually the following day, at a slightly higher price.

A hire purchase (HP), also known as an installment plan, is an arrangement whereby a customer agrees to a contract to acquire an asset by paying an initial installment and repaying the balance of the price of the asset plus interest over a period of time. Other analogous practices are described as closed-end leasing or rent to own.

A management buyout (MBO) is a form of acquisition in which a company's existing managers acquire a large part, or all, of the company, whether from a parent company or individual. Management-, and/or leveraged buyout became noted phenomena of 1980s business economics. These so-called MBOs originated in the US, spreading first to the UK and then throughout the rest of Europe. The venture capital industry has played a crucial role in the development of buyouts in Europe, especially in smaller deals in the UK, the Netherlands, and France.

A real estate contract is a contract between parties for the purchase and sale, exchange, or other conveyance of real estate. The sale of land is governed by the laws and practices of the jurisdiction in which the land is located. Real estate called leasehold estate is actually a rental of real property such as an apartment, and leases cover such rentals since they typically do not result in recordable deeds. Freehold conveyances of real estate are covered by real estate contracts, including conveying fee simple title, life estates, remainder estates, and freehold easements. Real estate contracts are typically bilateral contracts and should have the legal requirements specified by contract law in general and should also be in writing to be enforceable.

In law, liable means "responsible or answerable in law; legally obligated". Legal liability concerns both civil law and criminal law and can arise from various areas of law, such as contracts, torts, taxes, or fines given by government agencies. The claimant is the one who seeks to establish, or prove, liability.

Gazumping occurs when a seller accepts a verbal offer on the property from one potential buyer, but then accepts a higher offer from someone else. It can also refer to the seller raising the asking price or asking for more money at the last minute, after previously verbally agreeing to a lower one. In either case, the original buyer is left in a bad situation, and either has to offer a higher price or lose the purchase. The term gazumping is most commonly used in the United Kingdom and Ireland, although similar practices can be found in some other jurisdictions.

In commercial law, a principal is a person, legal or natural, who authorizes an agent to act to create one or more legal relationships with a third party. This branch of law is called agency and relies on the common law proposition qui facit per alium, facit per se.

Mortgage fraud refers to an intentional misstatement, misrepresentation, or omission of information relied upon by an underwriter or lender to fund, purchase, or insure a loan secured by real property.

A dummy purchaser is an agent who buys property on behalf of another, usually to conceal the true purpose of the acquisition. For instance, a shopping mall developer may hire a dummy buyer to purchase the needed vacant lots. Disclosing the principal's identity might prompt the landowners to hold out for a higher price; hence the need for secrecy. It has been hypothesized that dummy buyers could help private sector developers obtain the land needed for highway construction without the need for eminent domain invocation. A principal in such a relationship may be a partially disclosed principal or a completely undisclosed principal. A dummy purchaser is also sometimes called a straw man.

Consensu or obligatio consensu or obligatio consensu contracta or obligations ex consensu or contractus ex consensu or contracts consensu or consensual contracts or obligations by consent are, in Roman law, those contracts which do not require formalities.

The South African law of sale is an area of the legal system in that country that describes rules applicable to a contract of sale, generally described as a contract whereby one person agrees to deliver to another the free possession of a thing in return for a price in money.

The Indian Sale of Goods Act, 1930 is a mercantile law which came into existence on 1 July 1930, during the British Raj, borrowing heavily from the United Kingdom's Sale of Goods Act 1893. It provides for the setting up of contracts where the seller transfers or agrees to transfer the title (ownership) in the goods to the buyer for consideration. It is applicable all over India. Under the act, goods sold from owner to buyer must be sold for a certain price and at a given period of time. The act was amended on 23 September 1963, and was renamed to the Sale of Goods Act, 1930. It is still in force in India, after being amended in 1963, and in Bangladesh, as the Sale of Goods Act, 1930 (Bangladesh).

In Bulgaria, the law of obligations is set out by the Obligations and Contracts Act (OCA). According to article 20a, OCA contracts shall have the force of law for the parties that conclude them.

References

- ↑ Hill, Gerald N.; Hill, Kathleen (2002). The people's law dictionary : taking the mystery out of legal language. New York, NY: MJF Books. ISBN 9781567315530.

- ↑ Mann, Richard; Roberts, Barry (2013-01-16). "29: Relationship with Third Parties". Business Law and the Regulation of Business (11th ed.). p. 607. ISBN 978-1133587576.