Related Research Articles

Marketing is the act of satisfying and retaining customers. It is one of the primary components of business management and commerce.

Sales are activities related to selling or the number of goods sold in a given targeted time period. The delivery of a service for a cost is also considered a sale. A period during which goods are sold for a reduced price may also be referred to as a "sale".

Price discrimination is a microeconomic pricing strategy where identical or largely similar goods or services are sold at different prices by the same provider in different market segments. Price discrimination is distinguished from product differentiation by the more substantial difference in production cost for the differently priced products involved in the latter strategy. Price discrimination essentially relies on the variation in the customers' willingness to pay and in the elasticity of their demand. For price discrimination to succeed, a firm must have market power, such as a dominant market share, product uniqueness, sole pricing power, etc. All prices under price discrimination are higher than the equilibrium price in a perfectly competitive market. However, some prices under price discrimination may be lower than the price charged by a single-price monopolist. Price discrimination is utilized by the monopolist to recapture some deadweight loss. This Pricing strategy enables firms to capture additional consumer surplus and maximize their profits while benefiting some consumers at lower prices. Price discrimination can take many forms and is prevalent in many industries, from education and telecommunications to healthcare.

In marketing, product bundling is offering several products or services for sale as one combined product or service package. It is a common feature in many imperfectly competitive product and service markets. Industries engaged in the practice include telecommunications services, financial services, health care, information, and consumer electronics. A software bundle might include a word processor, spreadsheet, and presentation program into a single office suite. The cable television industry often bundles many TV and movie channels into a single tier or package. The fast food industry combines separate food items into a "meal deal" or "value meal".

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of product.

Database marketing is a form of direct marketing that uses databases of customers or potential customers to generate personalized communications in order to promote a product or service for marketing purposes. The method of communication can be any addressable medium, as in direct marketing.

In marketing, the unique selling proposition (USP), also called the unique selling point, or the unique value proposition (UVP) in the business model canvas, is the marketing strategy of informing customers about how one's own brand or product is superior to its competitors.

Yield management is a variable pricing strategy, based on understanding, anticipating and influencing consumer behavior in order to maximize revenue or profits from a fixed, time-limited resource. As a specific, inventory-focused branch of revenue management, yield management involves strategic control of inventory to sell the right product to the right customer at the right time for the right price. This process can result in price discrimination, in which customers consuming identical goods or services are charged different prices. Yield management is a large revenue generator for several major industries; Robert Crandall, former Chairman and CEO of American Airlines, gave yield management its name and has called it "the single most important technical development in transportation management since we entered deregulation."

A business can use a variety of pricing strategies when selling a product or service. To determine the most effective pricing strategy for a company, senior executives need to first identify the company's pricing position, pricing segment, pricing capability and their competitive pricing reaction strategy. Pricing strategies and tactics vary from company to company, and also differ across countries, cultures, industries and over time, with the maturing of industries and markets and changes in wider economic conditions.

Business marketing is a marketing practice of individuals or organizations. It allows them to sell products or services to other companies or organizations that resell them, use them in their products or services, or use them to support their works. It is a way to promote business and improve profit too.

Once the strategic plan is in place, retail managers turn to the more managerial aspects of planning. A retail mix is devised for the purpose of coordinating day-to-day tactical decisions. The retail marketing mix typically consists of six broad decision layers including product decisions, place decisions, promotion, price, personnel and presentation. The retail mix is loosely based on the marketing mix, but has been expanded and modified in line with the unique needs of the retail context. A number of scholars have argued for an expanded marketing, mix with the inclusion of two new Ps, namely, Personnel and Presentation since these contribute to the customer's unique retail experience and are the principal basis for retail differentiation. Yet other scholars argue that the Retail Format should be included. The modified retail marketing mix that is most commonly cited in textbooks is often called the 6 Ps of retailing.

An online marketplace is a type of e-commerce website where product or service information is provided by multiple third parties. Online marketplaces are the primary type of multichannel ecommerce and can be a way to streamline the production process.

Dynamic pricing, also referred to as surge pricing, demand pricing, or time-based pricing, is a revenue management pricing strategy in which businesses set flexible prices for products or services based on current market demands. It usually entails raising prices during periods of peak demand and lowering prices during periods of low demand.

The following outline is provided as an overview of and topical guide to marketing:

A marketing channel consists of the people, organizations, and activities necessary to transfer the ownership of goods from the point of production to the point of consumption. It is the way products get to the end-user, the consumer; and is also known as a distribution channel. A marketing channel is a useful tool for management, and is crucial to creating an effective and well-planned marketing strategy.

Premium pricing is the practice of keeping the price of one of the products or service artificially high in order to encourage favorable perceptions among buyers, based solely on the price. Premium refers to a segment of a company's brands, products, or services that carry tangible or imaginary surplus value in the upper mid- to high price range. The practice is intended to exploit the tendency for buyers to assume that expensive items enjoy an exceptional reputation or represent exceptional quality and distinction. A premium pricing strategy involves setting the price of a product higher than similar products. This strategy is sometimes also called skim pricing because it is an attempt to “skim the cream” off the top of the market. It is used to maximize profit in areas where customers are happy to pay more, where there are no substitutes for the product, where there are barriers to entering the market or when the seller cannot save on costs by producing at a high volume.

Customer to customer markets provide a way to allow customers to interact with each other. Traditional markets require business to customer relationships, in which a customer goes to the business in order to purchase a product or service. In customer to customer markets, the business facilitates an environment where customers can sell goods or services to each other. Other types of markets include business to business (B2B) and business to customer (B2C).

Pay what you want is a pricing strategy where buyers pay their desired amount for a given commodity. This amount can sometimes include zero. A minimum (floor) price may be set, and/or a suggested price may be indicated as guidance for the buyer. The buyer can select an amount higher or lower than the standard price for the commodity. Many common PWYW models set the price prior to a purchase, but some defer price-setting until after the experience of consumption. PWYW is a buyer-centered form of participative pricing, also referred to as co-pricing.

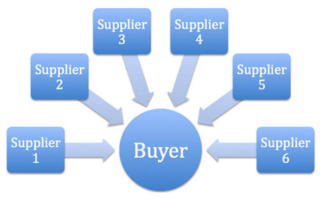

A reverse auction is a type of auction in which the traditional roles of buyer and seller are reversed. Thus, there is one buyer and many potential sellers. In an ordinary auction also known as a forward auction, buyers compete to obtain goods or services by offering increasingly higher prices. In contrast, in a reverse auction, the sellers compete to obtain business from the buyer and prices will typically decrease as the sellers underbid each other.

There are many types of e-commerce models, based on market segmentation, that can be used to conducted business online. The 6 types of business models that can be used in e-commerce include: Business-to-Consumer (B2C), Consumer-to-Business (C2B), Business-to-Business (B2B), Consumer-to-Consumer (C2C), Business-to-Administration (B2A), and Consumer-to-Administration

References

- ↑ Gary Armstrong; Stewart Adam; Sara Denize; Philip Kotler (2014). Principles of Marketing. Pearson plc. p. 265. ISBN 978-1-4860-0253-5.

- ↑ Garrison Jr, Louis P.; Towse, Adrian (4 September 2017). "Value-Based Pricing and Reimbursement in Personalised Healthcare: Introduction to the Basic Health Economics". Journal of Personalized Medicine. 7 (3): 10. doi: 10.3390/jpm7030010 . PMC 5618156 . PMID 28869571.

- 1 2 3 4 5 6 7 Helmond, Marc (2022-09-06). Performance Excellence in Marketing, Sales and Pricing: Leveraging Change, Lean and Innovation Management. Berlin, Germany: Springer International Publishing. pp. 75–81. doi:10.1007/978-3-031-10097-0. eISSN 2192-810X. ISBN 978-3-031-10097-0. ISSN 2192-8096.

- 1 2 Moretti, Livio (2018-11-02). Distribution Strategy: The BESTX Method for Sustainably Managing Networks and Channels. New York City: Springer International Publishing. pp. 156–157. ISBN 978-3-319-91958-4.

- ↑ Töytäri, Pekka; Keränen, Joona; Rajala, Risto (July 2017). "Barriers to implementing value-based pricing in industrial markets: A micro-foundations perspective". Journal of Business Research. 76: 237–246. doi:10.1016/j.jbusres.2016.04.183 – via Elsevier Science Direct.

- 1 2 3 4 Lopez, Santiago (2014-12-15). Value-based Marketing Strategy : Pricing and Costs for Relationship Marketing. Vernon Art and Science Inc. (published 2020-10-06). pp. 103–104. ISBN 9781622730537.

- ↑ "Price your product or service: The difference between cost and value". webarchive.nationalarchives.gov.uk. Department for Business Innovation and Skills. Archived from the original on 2012-08-23. Retrieved 2024-01-10.

- ↑ Miller, Claire Cain (21 August 2009). "Will the Hard-Core Starbucks Customer Pay More? The Chain Plans to Find Out" . The New York Times . pp. B3. Retrieved 2024-01-10.

- ↑ Boomenthal, Andrew (2023-12-05). Anderson, Somer; Munichiello, Katrina (eds.). "Value-Based Pricing". Investopedia. Retrieved 2024-01-10.

- ↑ Doyle, Peter, ed. (2012-01-02). "Value-Based Marketing Strategy". Value-Based Marketing: Marketing Strategies for Corporate Growth and Shareholder Value. Wiley (published 2015-09-18). pp. 189–223. doi:10.1002/9781119207177.ch6. ISBN 978-1-119-20717-7.

- 1 2 "The Difference Between Cost-Based Pricing and Value-Based Pricing | Melbado". melbado.com. 2022. Archived from the original on 2022-12-05. Retrieved 2023-04-22.

- ↑ Hinterhuber, Andreas (4 July 2008). "Customer value‐based pricing strategies: why companies resist" (PDF). Journal of Business Strategy. 29 (4): 41–49. doi:10.1108/02756660810887079. ISSN 0275-6668 – via ProQuest.

- ↑ Guerreiro, Reinaldo; Amaral, Juliana Ventura (2018). "Cost-based price and value-based price: are they conflicting approaches?". Journal of Business & Industrial Marketing. 33 (3): 390–404. doi:10.1108/JBIM-04-2016-0085 – via Emerald Insight.

- ↑ Panagopoulos, Nikolaos G.; Avlonitis, George J. (March 2010). "Performance implications of sales strategy: The moderating effects of leadership and environment" . International Journal of Research in Marketing. 27 (1): 46–57. doi:10.1016/j.ijresmar.2009.11.001 . Retrieved 2024-01-10– via Science Direct.

- ↑ Aspara, Jaakko; Tikkanen, Henrikki (May 2013). "Creating novel consumer value vs. capturing value: Strategic emphases and financial performance implications" . Journal of Business Research. 66 (5): 593–602. doi:10.1016/j.jbusres.2012.04.004 . Retrieved 2024-01-10– via Science Direct.

- ↑ Hogan, John; Nagle, Tom (Spring 2006). "Segmented pricing: using price fences to segment markets and capture value" (PDF). SPG Insights. Strategic Pricing Group. Archived from the original (PDF) on 2017-03-29. Retrieved 2024-01-10– via Wayback Machine.

- ↑ Paranikas, Petros; Whiteford, Grace Puma; Tevelson, Bob; Belz, Dan (July–August 2015). "How to Negotiate with Powerful Suppliers: A framework for assessing your strategic options". Harvard Business Review : 90–96. Retrieved 2024-01-10.

- ↑ Ciotti, Gregory (2012-06-26). "5 Psychological Studies on Pricing That You Absolutely MUST Read". KISSMetrics. Archived from the original on 2012-06-29. Retrieved 2024-01-10.

- ↑ Liozu, Stephan M.; Boland, Richard J.; Hinterhuber, Andreas; Perelli, Sheri (2011-06-02). "Industrial Pricing Orientation: The Organizational Transformation to Value-Based Pricing". First International Conference on Engaged Management Scholarship. doi:10.2139/ssrn.1839838 – via Social Sciences Research Network.

- ↑ Michel, Stefan (2019-08-28). "Pricing Strategy: Value-Based Pricing". Lynda.com - LinkedIn Learning as of January 2024. Archived from the original on 2023-04-25. Retrieved 2024-01-10.

- ↑ Gharpure, Kedar; Ranade, Vidya (2019-10-07). "The 6Ws of Value-based Pricing for B2B". B2B Growth Consulting. Archived from the original on 2019-10-07. Retrieved 2024-01-10.