Related Research Articles

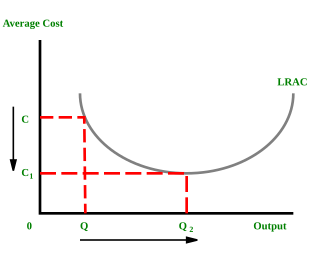

In microeconomics, economies of scale are the cost advantages that enterprises obtain due to their scale of operation, and are typically measured by the amount of output produced per unit of time. A decrease in cost per unit of output enables an increase in scale. At the basis of economies of scale, there may be technical, statistical, organizational or related factors to the degree of market control. This is just a partial description of the concept.

In microeconomics, supply and demand is an economic model of price determination in a market. It postulates that, holding all else equal, in a competitive market, the unit price for a particular good, or other traded item such as labor or liquid financial assets, will vary until it settles at a point where the quantity demanded will equal the quantity supplied, resulting in an economic equilibrium for price and quantity transacted. The concept of supply and demand forms the theoretical basis of modern economics.

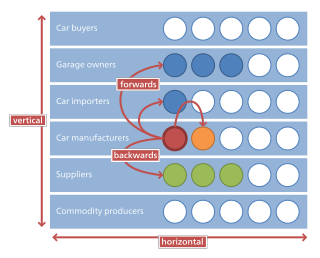

In microeconomics, management and international political economy, vertical integration is an arrangement in which the supply chain of a company is integrated and owned by that company. Usually each member of the supply chain produces a different product or (market-specific) service, and the products combine to satisfy a common need. It contrasts with horizontal integration, wherein a company produces several items that are related to one another. Vertical integration has also described management styles that bring large portions of the supply chain not only under a common ownership but also into one corporation.

The invisible hand is a metaphor used by the Scottish moral philosopher Adam Smith that describes the inducement a merchant has to keep his capital, thereby increasing the domestic capital stock and enhancing military power, both of which are in the public interest and neither of which he intended. Some later authors have broadened this to imply the unintended greater social impacts brought about by individuals acting in their own self-interests. Smith originally mentioned the term in his work Theory of Moral Sentiments in 1759, but it has actually become known from his main work The Wealth of Nations, where the phrase is mentioned only once, in connection with import restrictions.

Post Fordism is a term used to describe the growth of new production methods defined by flexible production, the individualization of labor relations and fragmentation of markets into distinct segments, after the demise of Fordist production. It was widely advocated by French Marxist economists and American labor economists in the 1970s and 1980s. Definitions of the nature and scope of post-Fordism vary considerably and are a matter of debate among scholars.

Alfred DuPont Chandler Jr. was a professor of business history at Harvard Business School and Johns Hopkins University, who wrote extensively about the scale and the management structures of modern corporations. His works redefined business and economic history of industrialization. He received the Pulitzer Prize for History for his work, The Visible Hand: The Managerial Revolution in American Business (1977). He was a member of both the American Academy of Arts and Sciences and the American Philosophical Society. He has been called "the doyen of American business historians".

The theory of the firm consists of a number of economic theories that explain and predict the nature of the firm, company, or corporation, including its existence, behaviour, structure, and relationship to the market. Firms are key drivers in economics, providing goods and services in return for monetary payments and rewards. Organisational structure, incentives, employee productivity, and information all influence the successful operation of a firm in the economy and within itself. As such major economic theories such as Transaction cost theory, Managerial economics and Behavioural theory of the firm will allow for an in-depth analysis on various firm and management types.

Economic integration is the unification of economic policies between different states, through the partial or full abolition of tariff and non-tariff restrictions on trade.

The term information revolution describes the "radical changes wrought by computer technology on the storage of and access to information since the mid-1980s" or current economic, social and technological trends beyond the Industrial Revolution.

Articles in economics journals are usually classified according to JEL classification codes, which derive from the Journal of Economic Literature. The JEL is published quarterly by the American Economic Association (AEA) and contains survey articles and information on recently published books and dissertations. The AEA maintains EconLit, a searchable data base of citations for articles, books, reviews, dissertations, and working papers classified by JEL codes for the years from 1969. A recent addition to EconLit is indexing of economics journal articles from 1886 to 1968 parallel to the print series Index of Economic Articles.

Vertical disintegration refers to a specific organizational form of industrial production. As opposed to vertical integration, in which production occurs within a singular organization, vertical disintegration means that various diseconomies of scale or scope have broken a production process into separate companies, each performing a limited subset of activities required to create a finished product.

Richard Normand Langlois is an American economist and currently professor at the University of Connecticut. He studied physics and English literature at Williams College, he received a Master's in astronomy from Yale University, and he received his PhD in Engineering-Economic Systems from Stanford.

Merger guidelines in the United States are a set of internal rules promulgated by the Antitrust Division of the Department of Justice (DOJ) in conjunction with the Federal Trade Commission (FTC). These rules have been revised over the past four decades. They govern the process by which these two regulatory bodies scrutinize and/or challenge a potential merger. Grounds for challenges include increased market concentration and threat to competition within a relevant market.

A bilateral monopoly is a market structure consisting of both a monopoly and a monopsony.

Business economics is a field in applied economics which uses economic theory and quantitative methods to analyze business enterprises and the factors contributing to the diversity of organizational structures and the relationships of firms with labour, capital and product markets. A professional focus of the journal Business Economics has been expressed as providing "practical information for people who apply economics in their jobs."

Business history is a historiographical field which examines the history of firms, business methods, government regulation and the effects of business on society. It also includes biographies of individual firms, executives, and entrepreneurs. It is related to economic history. It is distinct from "company history" which refers to official histories, usually funded by the company itself.

The following outline is provided as an overview of and topical guide to economics:

The Visible Hand: The Managerial Revolution in American Business is a book by American business historian Alfred D. Chandler Jr., published by the Belknap Press imprint of Harvard University Press in 1977. Chandler argues that in the nineteenth century, Adam Smith's famous invisible hand of the market was supplanted by the "visible hand" of middle management, which became "the most powerful institution in the American economy".

Economic democracy is a socioeconomic philosophy that proposes to shift ownership and decision-making power from corporate shareholders and corporate managers to a larger group of public stakeholders that includes workers, consumers, suppliers, communities and the broader public. No single definition or approach encompasses economic democracy, but most proponents claim that modern property relations externalize costs, subordinate the general well-being to private profit and deny the polity a democratic voice in economic policy decisions. In addition to these moral concerns, economic democracy makes practical claims, such as that it can compensate for capitalism's inherent effective demand gap.

The "visible hand" is an economic concept describes the replacement of the regulatory function of the market mechanism by government intervention. Simply put, it refers to government intervention.

References

- 1 2 3 4 5 "Technology and the Vanishing Hand". The Past Speaks. 2012-05-21. Archived from the original on 2014-02-25. Retrieved 2013-07-25.

- ↑ Sen, Amartya. Introduction. The Theory of Moral Sentiments. By Adam Smith. 6th ed. 1790. New York: Penguin, 2009. vii–xxix.

- ↑ Olsen, James Stewart. Encyclopedia of the Industrial Revolution. Greenwood Publishing Group, 2002. pp. 153–154

- ↑ "Harvard Business School Professor Alfred D. Chandler, Jr., Preeminent Business Historian, Dead at 88". AScribe. May 11, 2007. Archived from the original on March 25, 2016. Retrieved December 9, 2012.

- ↑ Chandler, Alfred. The Visible Hand. Belknap Press, 1977. ISBN 978-0674940529. Introduction.

- 1 2 Langlois, Richard N. (Apr 2003). "The Vanishing Hand: the Changing Dynamics of Industrial Capitalism". Industrial and Corporate Change 12(2): 351-385. Archived from the original on 2012-11-12. Retrieved 2013-07-25.

- 1 2 3 Langlois, Dick (Jul 3, 2010). "More on Managerial Coordination and the Vanishing Hand". Organizations and Markets. Archived from the original on October 23, 2013. Retrieved July 25, 2013.

- ↑ "Vertical (Dis)integration and Technological Change". 2012-05-18. Archived from the original on 2016-05-13. Retrieved 2016-05-10.

- ↑ "The vanishing hand: the changing dynamics of industrial capitalism". Industrial and Corporate Change. Archived from the original on 2011-01-20. Retrieved 2013-07-25.