In economics, Kondratiev waves are hypothesized cycle-like phenomena in the modern world economy. The phenomenon is closely connected with the technology life cycle.

Macroeconomics is a branch of economics that deals with the performance, structure, behavior, and decision-making of an economy as a whole. This includes regional, national, and global economies. Macroeconomists study topics such as output/GDP and national income, unemployment, price indices and inflation, consumption, saving, investment, energy, international trade, and international finance.

Nancy Laura Stokey has been the Frederick Henry Prince Distinguished Service Professor of Economics at the University of Chicago since 1990 and focuses particularly on mathematical economics while recently conducting research about Growth Theory, economic dynamics, and fiscal/monetary policy. She earned her BA in economics from the University of Pennsylvania in 1972 and her PhD from Harvard University in 1978, under the direction of thesis advisor Kenneth Arrow. She is a Fellow of the Econometric Society, the American Academy of Arts and Sciences and the National Academy of Sciences. She previously served as a co editor of Econometrica and was a member of the Expert Panel of the Copenhagen Consensus. She received her Honorary Doctor of Laws (L.L.D) in 2012 from the University of Western Ontario.

Computational Economics is an interdisciplinary research discipline that involves computer science, economics, and management science. This subject encompasses computational modeling of economic systems. Some of these areas are unique, while others established areas of economics by allowing robust data analytics and solutions of problems that would be arduous to research without computers and associated numerical methods.

John Brian Taylor is the Mary and Robert Raymond Professor of Economics at Stanford University, and the George P. Shultz Senior Fellow in Economics at Stanford University's Hoover Institution.

The overlapping generations (OLG) model is one of the dominating frameworks of analysis in the study of macroeconomic dynamics and economic growth. In contrast, to the Ramsey–Cass–Koopmans neoclassical growth model in which individuals are infinitely-lived, in the OLG model individuals live a finite length of time, long enough to overlap with at least one period of another agent's life.

Financial econometrics is the application of statistical methods to financial market data. Financial econometrics is a branch of financial economics, in the field of economics. Areas of study include capital markets, financial institutions, corporate finance and corporate governance. Topics often revolve around asset valuation of individual stocks, bonds, derivatives, currencies and other financial instruments.

Lars Peter Hansen is an American economist. He is the David Rockefeller Distinguished Service Professor in Economics, Statistics, and the Booth School of Business, at the University of Chicago and a 2013 recipient of the Nobel Memorial Prize in Economics.

William Arnold Barnett is an American economist, whose current work is in the fields of chaos, bifurcation, and nonlinear dynamics in socioeconomic contexts, econometric modeling of consumption and production, and the study of the aggregation problem and the challenges of measurement in economics.

Complexity economics is the application of complexity science to the problems of economics. It relaxes several common assumptions in economics, including general equilibrium theory. While it does not reject the existence of an equilibrium, it sees such equilibria as "a special case of nonequilibrium", and as an emergent property resulting from complex interactions between economic agents. The complexity science approach has also been applied to computational economics.

The neoclassical synthesis (NCS), neoclassical–Keynesian synthesis, or just neo-Keynesianism was a neoclassical economics academic movement and paradigm in economics that worked towards reconciling the macroeconomic thought of John Maynard Keynes in his book The General Theory of Employment, Interest and Money (1936). It was formulated most notably by John Hicks (1937), Franco Modigliani (1944), and Paul Samuelson (1948), who dominated economics in the post-war period and formed the mainstream of macroeconomic thought in the 1950s, 60s, and 70s.

John Young Campbell is a British-American economist. He is the Morton L. and Carole S. Olshan Professor of Economics at the Department of Economics at Harvard University since 1994.

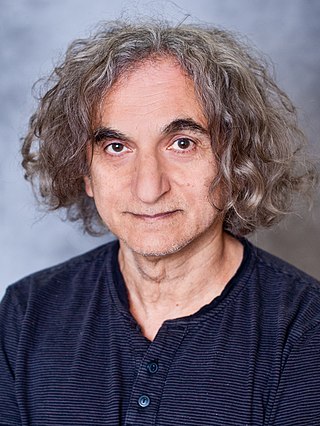

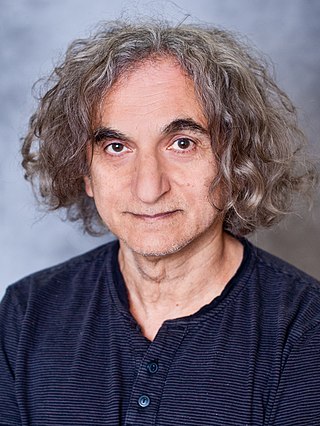

Oded Galor is an Israeli-American economist who is currently Herbert H. Goldberger Professor of Economics at Brown University. He is the founder of unified growth theory.

The Deutsche Bank Prize in Financial Economics honors renowned researchers who have made influential contributions to the fields of finance and money and macroeconomics, and whose work has led to practical and policy-relevant results. It was awarded biannually from 2005 to 2015 by the Center for Financial Studies (CFS), in partnership with Goethe University Frankfurt, and is sponsored by Deutsche Bank Donation Fund. The award carried an endowment of €50,000, which was donated by the Stiftungsfonds Deutsche Bank im Stifterverband für die Deutsche Wissenschaft.

The Bernacer Prize is awarded annually to European young economists who have made outstanding contributions in the fields of macroeconomics and finance. The prize is named after Germán Bernácer, an early Spanish macroeconomist.

Richard M. Goodwin was an American mathematician and economist.

Anwar M. Shaikh is a Pakistani American heterodox economist in the tradition of classical political economy and Marxian economics.

John Geanakoplos is an American economist, and the current James Tobin Professor of Economics at Yale University.

Brigitte Young, is Professor Emeritus of International political economy at the Institute of Political Science, University of Münster, Germany. Her research areas include economic globalization, global governance, feminist economics, international trade, global financial market governance and monetary policy. She has worked on EU-US financial regulatory frameworks, European economic and monetary integration and heterodox economic theories. She is the author of many journal articles and books in English and German on the Global financial crisis of 2008–2009, the US Subprime mortgage crisis, the European sovereign-debt crisis, and the role of Germany and France in resolving the Euro crisis.

Masanao Aoki was a Japanese engineer and economist. He was a Professor emeritus of Economics at University of California, Los Angeles.