SoftBank Group Corp. is a Japanese multinational investment holding company headquartered in Minato, Tokyo which focuses on investment management. The group primarily invests in companies operating in technology that offer goods and services to customers in a multitude of markets and industries ranging from the internet to automation. With over $100 billion in capital at its onset, SoftBank's Vision Fund is the world's largest technology-focused venture capital fund. Fund investors included sovereign wealth funds from countries in the Middle East.

TPG Inc., previously known as Texas Pacific Group and TPG Capital, is an American private equity firm based in Fort Worth, Texas. TPG manages investment funds in growth capital, venture capital, public equity, and debt investments. The firm invests in a range of industries including consumer/retail, media and telecommunications, industrials, technology, travel, leisure, and health care. TPG became a public company in January 2022, trading on the NASDAQ under the ticker symbol “TPG”.

Point72 Asset Management, is an American hedge fund. It was founded in 2014 by Steve Cohen, after his previous company S.A.C. Capital Advisors pleaded guilty to insider trading charges.

Citadel LLC is an American multinational hedge fund and financial services company. Founded in 1990 by Ken Griffin, it has more than $58 billion in assets under management as of January 2024. The company has over 2,800 employees, with corporate headquarters in Miami, Florida, and offices throughout North America, Asia, and Europe. Founder, CEO and Co-CIO Griffin owns approximately 85% of the firm. As of December 2022, Citadel is one of the most profitable hedge funds in the world, posting $74 billion in net gains since its inception in 1990, making it the most successful hedge fund in history, according to CNBC.

Jared Corey Kushner is an American businessman, investor, and former government official. He is the son-in-law of former president Donald Trump through his marriage to Ivanka Trump, and served as a senior advisor to Trump from 2017 to 2021. He was also Director of the Office of American Innovation.

Kushner Companies LLC is an American real estate developer in the New York City metropolitan area. The company's biggest presence is in the New Jersey residential market.

Apollo Global Management, Inc. is an American asset management firm that primarily invests in alternative assets. As of 2022, the company had $548 billion of assets under management, including $392 billion invested in credit, including mezzanine capital, hedge funds, non-performing loans, and collateralized loan obligations, $99 billion invested in private equity, and $46.2 billion invested in real assets, which includes real estate and infrastructure. The company invests money on behalf of pension funds, financial endowments, and sovereign wealth funds, as well as other institutional and individual investors.

Insight Partners is a global venture capital and private equity firm that invests in high-growth technology, software, and Internet businesses. The company is headquartered in New York City, with offices in London, Tel Aviv, and Palo Alto.

The Madoff investment scandal was a major case of stock and securities fraud discovered in late 2008. In December of that year, Bernie Madoff, the former Nasdaq chairman and founder of the Wall Street firm Bernard L. Madoff Investment Securities LLC, admitted that the wealth management arm of his business was an elaborate multi-billion-dollar Ponzi scheme.

Joshua Kushner is an American businessman, heir, and investor. He is the founder and managing partner of the venture capital firm Thrive Capital, co-founder of Oscar Health, and the son of real estate developer Charles Kushner. He is the brother of Jared Kushner, son-in-law and former senior advisor to former U.S. President Donald Trump. He is also a minority owner of the Memphis Grizzlies.

Thomas Joseph Barrack Jr. is an American private equity real estate investor and the founder and executive chairman of Colony Capital, a publicly traded real estate investment trust (REIT). Barrack has for decades been a close friend of and fundraiser for former U.S. President Donald Trump, representing him in television news appearances. He was senior advisor to Trump's presidential campaign and served as the chairman of his Inaugural Committee.

Millennium Management is an investment management firm with a multistrategy hedge fund offering. In 2023, it was one of the world's largest alternative asset management firms with over $61.1 billion assets under management as of January 2024. The firm operates in America, Europe and Asia. As of 2022, Millennium had posted the fourth highest net gains of any hedge fund since its inception in 1989.

Oscar Health, Inc. is an American health insurance company, founded in 2012 by Joshua Kushner, Kevin Nazemi and Mario Schlosser, and is headquartered in New York City. The company focuses on the health insurance industry through telemedicine, healthcare focused technological interfaces, and transparent claims pricing systems which would make it easier for patients to navigate.

The Public Investment Fund is the sovereign wealth fund of Saudi Arabia. It is among the largest sovereign wealth funds in the world with total estimated assets of US$925 billion. It was created in 1971 for the purpose of investing funds on behalf of the Government of Saudi Arabia. The wealth fund is controlled by Crown Prince Mohammed bin Salman, Saudi Arabia's de facto ruler since 2015.

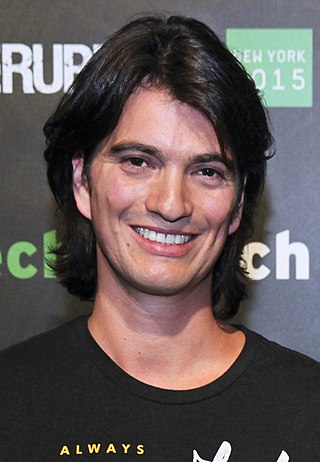

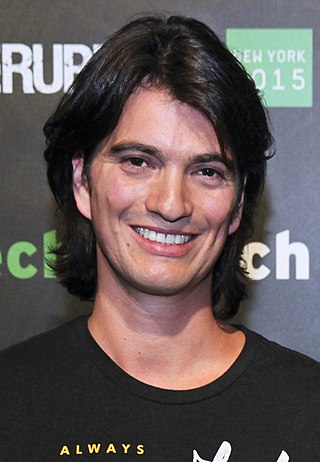

Adam Neumann is an Israeli-American billionaire businessman and investor. In 2010, he co-founded WeWork with Miguel McKelvey, where he was CEO from 2010 to 2019. In 2019, he co-founded a family office dubbed 166 2nd Financial Services with his wife, Rebekah Neumann, to manage their personal wealth, investing over a billion dollars in real estate and venture startups.

Melvin Capital Management LP was an American investment management firm based in New York City. It was founded in 2014 by Gabriel Plotkin, who named the firm after his late grandfather.

Adam Seth Boehler is an American businessman and government official who was unanimously confirmed by the U.S. Senate to serve as the first chief executive officer of the U.S. International Development Finance Corporation. He is currently the chief executive officer of Rubicon Founders, a health care investment firm based in Nashville. He is the founder of Landmark Health, the largest provider of home-based medical care in the United States.

The Abraham Accords are bilateral agreements on Arab–Israeli normalization signed between Israel and the United Arab Emirates and between Israel and Bahrain on September 15, 2020. Mediated by the United States, the announcement of August 13, 2020, concerned Israel and the UAE before the subsequent announcement of an agreement between Israel and Bahrain on September 11, 2020. On September 15, 2020, the signing of the agreements was hosted by US president Trump on the Truman Balcony of the White House amid elaborate staging intended to evoke the signings of historic formal peace treaties in prior administrations.

The SoftBank Vision Fund is a venture capital fund founded in 2017. It is managed by SoftBank Investment Advisers, a subsidiary of the SoftBank Group. With over $100 billion in capital, it is the world's largest technology-focused investment fund. In 2019, SoftBank Vision Fund 2 was founded. The total fair value of both funds as of 31 March 2021 was $154 billion.

Thrive Capital is an American venture capital firm based in New York City. It focuses on software and internet investments. The firm was founded by Joshua Kushner who is also co-founder of Oscar Health and minority owner of the Memphis Grizzlies.