A monopoly, as described by Irving Fisher, is a market with the "absence of competition", creating a situation where a specific person or enterprise is the only supplier of a particular thing. This contrasts with a monopsony which relates to a single entity's control of a market to purchase a good or service, and with oligopoly and duopoly which consists of a few sellers dominating a market. Monopolies are thus characterised by a lack of economic competition to produce the good or service, a lack of viable substitute goods, and the possibility of a high monopoly price well above the seller's marginal cost that leads to a high monopoly profit. The verb monopolise or monopolize refers to the process by which a company gains the ability to raise prices or exclude competitors. In economics, a monopoly is a single seller. In law, a monopoly is a business entity that has significant market power, that is, the power to charge overly high prices, which is associated with a decrease in social surplus. Although monopolies may be big businesses, size is not a characteristic of a monopoly. A small business may still have the power to raise prices in a small industry.

Inkjet printing is a type of computer printing that recreates a digital image by propelling droplets of ink onto paper and plastic substrates. Inkjet printers were the most commonly used type of printer in 2008, and range from small inexpensive consumer models to expensive professional machines. By 2019, laser printers outsold inkjet printers by nearly a 2:1 ratio, 9.6% vs 5.1% of all computer peripherals. As of 2023, sublimation printers have outsold inkjet printers by nearly a 2:1 ratio, accounting for 9.6% of all computer peripherals, compared to 5.1% for inkjet printers.

Pricing is the process whereby a business sets the price at which it will sell its products and services, and may be part of the business's marketing plan. In setting prices, the business will take into account the price at which it could acquire the goods, the manufacturing cost, the marketplace, competition, market condition, brand, and quality of product.

In economics and industrial design, planned obsolescence is a policy of planning or designing a product with an artificially limited useful life or a purposely frail design, so that it becomes obsolete after a certain pre-determined period of time upon which it decrementally functions or suddenly ceases to function, or might be perceived as unfashionable. The rationale behind this strategy is to generate long-term sales volume by reducing the time between repeat purchases. It is the deliberate shortening of a lifespan of a product to force people to purchase functional replacements.

In economics, a complementary good is a good whose appeal increases with the popularity of its complement. Technically, it displays a negative cross elasticity of demand and that demand for it increases when the price of another good decreases. If is a complement to , an increase in the price of will result in a negative movement along the demand curve of and cause the demand curve for to shift inward; less of each good will be demanded. Conversely, a decrease in the price of will result in a positive movement along the demand curve of and cause the demand curve of to shift outward; more of each good will be demanded. This is in contrast to a substitute good, whose demand decreases when its substitute's price decreases.

Lexmark International, Inc. is a privately held American company that manufactures laser printers and imaging products. The company is headquartered in Lexington, Kentucky. Since 2016 it has been jointly owned by a consortium of three multinational companies: Apex Technology, PAG Asia Capital, and Legend Capital.

Seiko Epson Corporation, commonly known as Epson, is a Japanese multinational electronics company and one of the world's largest manufacturers of printers and information- and imaging-related equipment. Headquartered in Suwa, Nagano, Japan, the company has numerous subsidiaries worldwide and manufactures inkjet, dot matrix, thermal and laser printers for consumer, business and industrial use, scanners, laptop and desktop computers, video projectors, watches, point of sale systems, robots and industrial automation equipment, semiconductor devices, crystal oscillators, sensing systems and other associated electronic components.

Consumables are goods that are intended to be consumed. People have, for example, always consumed food and water. Consumables are in contrast to durable goods. Disposable products are a particular, extreme case of consumables, because their end-of-life is reached after a single use.

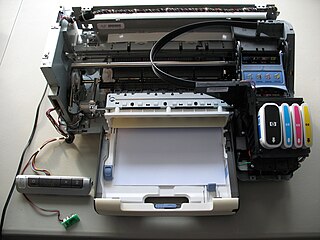

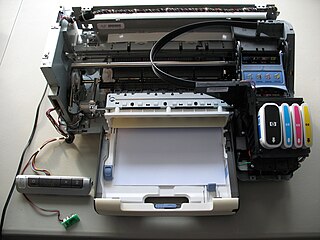

A continuous ink system (CIS), also known as a continuous ink supply system (CISS), a continuous flow system (CFS), an automatic ink refill system (AIRS), a bulk feed ink system (BFIS), or an off-axis ink delivery system (OIDS) is a method for delivering a large volume of liquid ink to a comparatively small inkjet printhead. Many business and professional grade printers incorporate a continuous ink system in their design to increase printing capacity.

An ink cartridge or inkjet cartridge is a component of an inkjet printer that contains the ink that is deposited onto paper during printing.

In competition law, before deciding whether companies have significant market power which would justify government intervention, the test of small but significant and non-transitory increase in price (SSNIP) is used to define the relevant market in a consistent way. It is an alternative to ad hoc determination of the relevant market by arguments about product similarity.

In competition law, a relevant market is a market in which a particular product or service is sold. It is the intersection of a relevant product market and a relevant geographic market. The European Commission defines a relevant market and its product and geographic components as follows:

- A relevant product market comprises all those products and/or services which are regarded as interchangeable or substitutable by the consumer by reason of the products' characteristics, their prices and their intended use;

- A relevant geographic market comprises the area in which the firms concerned are involved in the supply of products or services and in which the conditions of competition are sufficiently homogeneous.

The razor and blades business model is a business model in which one item is sold at a low price in order to increase sales of a complementary good, such as consumable supplies. It is different from loss leader marketing and free sample marketing, which do not depend on complementary products or services. Common examples of the razor and blades model include inkjet printers whose ink cartridges are significantly marked up in price, coffee machines that use single-use coffee pods, electric toothbrushes, and video game consoles which require additional purchases to obtain accessories and software not included in the original package.

Dymo Corporation is an American manufacturing company of handheld label printers and thermal-transfer printing tape as accessory, embossing tape label makers, and other printers such as CD and DVD labelers and durable medical equipment.

A toner cartridge, also called laser toner, is the consumable component of a laser printer. Toner cartridges contain toner powder, a fine, dry mixture of plastic particles, carbon, and black or other coloring agents that make the actual image on the paper. The toner is transferred to paper via an electrostatically charged drum unit, and fused onto the paper by heated rollers during the printing process. It will not stain like ink cartridges, but it can get messy if handled improperly.

Customer cost refers not only to the price of a product, but it also encompasses the purchase costs, use costs and the post-use costs. Purchase costs consist of the cost of searching for a product, gathering information about the product and the cost of obtaining that information. Usually, the highest use costs arise for durable goods that have a high demand on resources, such as energy or water, or those with high maintenance costs. Post-use costs encompass the costs for collecting, storing and disposing of the product once the item has been discarded.

Eastman Kodak Co. v. Image Technical Servs., Inc., 504 U.S. 451 (1992), is a 1992 Supreme Court decision in which the Court held that even though an equipment manufacturer lacked significant market power in the primary market for its equipment—copier-duplicators and other imaging equipment—nonetheless, it could have sufficient market power in the secondary aftermarket for repair parts to be liable under the antitrust laws for its exclusionary conduct in the aftermarket. The reason was that it was possible that, once customers were committed to the particular brand by having purchased a unit, they were "locked in" and no longer had any realistic alternative to turn to for repair parts.

The RemaxWorld Expo is an annual trade show comprising vendors from within the print consumables industry. The event began in 2007, resulting from a joint venture between the China Council for the Promotion of International Trade (CCPIT) and Recycling Times Media Corporation. Centered in Zhuhai, widely recognized as being the print consumables capital of the world, the exhibition currently takes place in the newly constructed Zhuhai International Convention & Exhibition Center. In 2015, the show accommodated 463 exhibitors and 13,938 visitors from 83 countries.

LePage's Inc. v. 3M, 324 F.3d 141, is a 2003 en banc decision of the United States Court of Appeals for the Third Circuit upholding a jury verdict against bundling. Bundling is the setting of the total price of a purchase of several products or services over a period from one seller at a lower level than the sum of the prices of the products or services purchased separately from several sellers over the period. Typically, one of the bundled items is available only from the seller engaging in the bundling, while the other item or items can be obtained from several sellers. The effect of the bundling is to divert purchasers who need the primary product to the bundling seller and away from other sellers of only the secondary product. For that reason, the practice may be held an antitrust violation as it was in the LePage's case, in which the Third Circuit held that 3M engaged in monopolization in violation of Sherman Act § 2 by (1) offering rebates to customers conditioned on purchases spanning six of 3M's different product lines, and (2) entering into contracts that expressly or effectively required dealing exclusively with 3M.

Right to repair is a legal right for owners of devices and equipment to freely modify and repair products such as automobiles, electronics, and farm equipment. This right is framed in opposition to restrictions such as requirements to use only the manufacturer's maintenance services, restrictions on access to tools and components, and software barriers.