Franchising is based on a marketing concept which can be adopted by an organization as a strategy for business expansion. Where implemented, a franchisor licenses some or all of its know-how, procedures, intellectual property, use of its business model, brand, and rights to sell its branded products and services to a franchisee. In return, the franchisee pays certain fees and agrees to comply with certain obligations, typically set out in a franchise agreement.

The U.S. Securities and Exchange Commission (SEC) is an independent agency of the United States federal government, created in the aftermath of the Wall Street Crash of 1929. The primary purpose of the SEC is to enforce the law against market manipulation.

The Federal Trade Commission (FTC) is an independent agency of the United States government whose principal mission is the enforcement of civil (non-criminal) antitrust law and the promotion of consumer protection. The FTC shares jurisdiction over federal civil antitrust law enforcement with the Department of Justice Antitrust Division. The agency is headquartered in the Federal Trade Commission Building in Washington, DC.

The Securities Act of 1933, also known as the 1933 Act, the Securities Act, the Truth in Securities Act, the Federal Securities Act, and the '33 Act, was enacted by the United States Congress on May 27, 1933, during the Great Depression and after the stock market crash of 1929. It is an integral part of United States securities regulation. It is legislated pursuant to the Interstate Commerce Clause of the Constitution.

The list price, also known as the manufacturer's suggested retail price (MSRP), or the recommended retail price (RRP), or the suggested retail price (SRP) of a product is the price at which its manufacturer notionally recommends that a retailer sell the product.

A franchise agreement is a legal, binding contract between a franchisor and franchisee. In the United States franchise agreements are enforced at the State level.

A privacy policy is a statement or legal document that discloses some or all of the ways a party gathers, uses, discloses, and manages a customer or client's data. Personal information can be anything that can be used to identify an individual, not limited to the person's name, address, date of birth, marital status, contact information, ID issue, and expiry date, financial records, credit information, medical history, where one travels, and intentions to acquire goods and services. In the case of a business, it is often a statement that declares a party's policy on how it collects, stores, and releases personal information it collects. It informs the client what specific information is collected, and whether it is kept confidential, shared with partners, or sold to other firms or enterprises. Privacy policies typically represent a broader, more generalized treatment, as opposed to data use statements, which tend to be more detailed and specific.

A mortgage broker acts as an intermediary who brokers mortgage loans on behalf of individuals or businesses. Traditionally, banks and other lending institutions have sold their own products. As markets for mortgages have become more competitive, however, the role of the mortgage broker has become more popular. In many developed mortgage markets today,, mortgage brokers are the largest sellers of mortgage products for lenders. Mortgage brokers exist to find a bank or a direct lender that will be willing to make a specific loan an individual is seeking. Mortgage brokers in Canada are paid by the lender and do not charge fees for good credit applications. In the US, many mortgage brokers are regulated by their state and by the CFPB to assure compliance with banking and finance laws in the jurisdiction of the consumer. The extent of the regulation depends on the jurisdiction.

The Truth in Lending Act (TILA) of 1968 is a United States federal law designed to promote the informed use of consumer credit, by requiring disclosures about its terms and cost to standardize the manner in which costs associated with borrowing are calculated and disclosed.

The Fair and Accurate Credit Transactions Act of 2003 is a U.S. federal law, passed by the United States Congress on November 22, 2003, and signed by President George W. Bush on December 4, 2003, as an amendment to the Fair Credit Reporting Act. The act allows consumers to request and obtain a free credit report once every 12 months from each of the three nationwide consumer credit reporting companies. In cooperation with the Federal Trade Commission, the three major credit reporting agencies set up the web site AnnualCreditReport.com to provide free access to annual credit reports.

In contract law, a non-compete clause, restrictive covenant, or covenant not to compete (CNC), is a clause under which one party agrees not to enter into or start a similar profession or trade in competition against another party. In the labor market, these agreements prevent workers from freely moving across employers, and weaken the bargaining leverage of workers.

A franchise disclosure document (FDD) is a legal document which is presented to prospective buyers of franchises in the pre-sale disclosure process in the United States. It was originally known as the Uniform Franchise Offering Circular (UFOC), prior to revisions made by the Federal Trade Commission in July 2007. Franchisors were given until July 1, 2008 to comply with the changes.

'Franchise consulting' traditionally meant the same consultant-to-client relationship as any other industry wherein the consultant charges a 'fee for services'. But, as of the late 1990s the term 'consultant' has been adopted by many franchise salesmen and brokers who represent themselves as 'free' consultants to prospective franchise buyers. These franchise brokers provide introduction services for franchise sellers with whom they have worked out a pay-for-sale agreement.

A franchise fee is a fee or charge that one party, the franchisee, pays another party, the franchisor, for the right to enter in a franchise agreement. Generally by paying the franchise fee a franchisee receives the rights to sell goods or services, under the franchisor's trademarks, as well as access to the franchisor's business processes. Often, the franchisee fee includes some assistance from the franchisor in opening the franchised business.

Cramming is a form of fraud in which small charges are added to a bill by a third party without the subscriber's consent, approval, authorization or disclosure. These may be disguised as a tax, some other common fee or a bogus service, and may be several dollars or even just a few cents. The crammer's intent is that the subscriber will overlook and ultimately pay these small charges without challenging their legitimacy or inquiring further.

Franchise fraud is defined by the United States Federal Bureau of Investigation as a pyramid scheme.

The franchise rule defines acts or practices that are unfair or deceptive in the franchise industry in the United States. The franchise rule is published by the Federal Trade Commission. The franchise rule seeks to facilitate informed decisions and to prevent deception in the sale of franchises by requiring franchisors to provide prospective franchisees with essential information prior to the sale. It does not, however, regulate the substance of the terms that control the relationship between franchisors and franchisees. Also, while the franchise rule removed the regulation of the sale of franchises from the purview of state law, placing it under the authority of the FTC to regulate interstate commerce, the FTC franchise rule does not require franchisors to disclose the unit performance statistics of the franchised system to new buyers of franchises. The FTC franchise rule was originally adopted in 1978. This followed a lengthy FTC rulemaking proceeding that began in 1971. A substantial revision of the FTC franchise rule was adopted by the FTC in 2007.

Franchise termination is termination of a franchise business license by a franchisor or a franchisee.

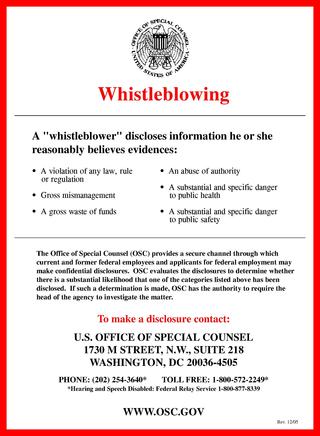

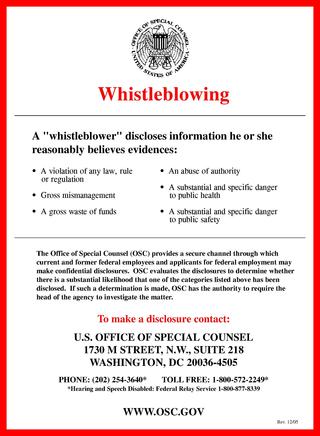

A whistleblower is a person who exposes any kind of information or activity that is deemed illegal, unethical, or not correct within an organization that is either private or public. The Whistleblower Protection Act was made into federal law in the United States in 1989.

Financial privacy laws regulate the manner in which financial institutions handle the nonpublic financial information of consumers. In the United States, financial privacy is regulated through laws enacted at the federal and state level. Federal regulations are primarily represented by the Bank Secrecy Act, Right to Financial Privacy Act, the Gramm-Leach-Bliley Act, and the Fair Credit Reporting Act. Provisions within other laws like the Credit and Debit Card Receipt Clarification Act of 2007 as well as the Electronic Funds Transfer Act also contribute to financial privacy in the United States. State regulations vary from state to state. While each state approaches financial privacy differently, they mostly draw from federal laws and provide more stringent outlines and definitions. Government agencies like the Consumer Financial Protection Bureau and the Federal Trade Commission provide enforcement for financial privacy regulations.